August 28th, 2024 | 07:00 CEST

Starting signal for a rally? BioNTech, Pfizer, and Bayer under scrutiny, Major news expected from Cardiol Therapeutics and Evotec

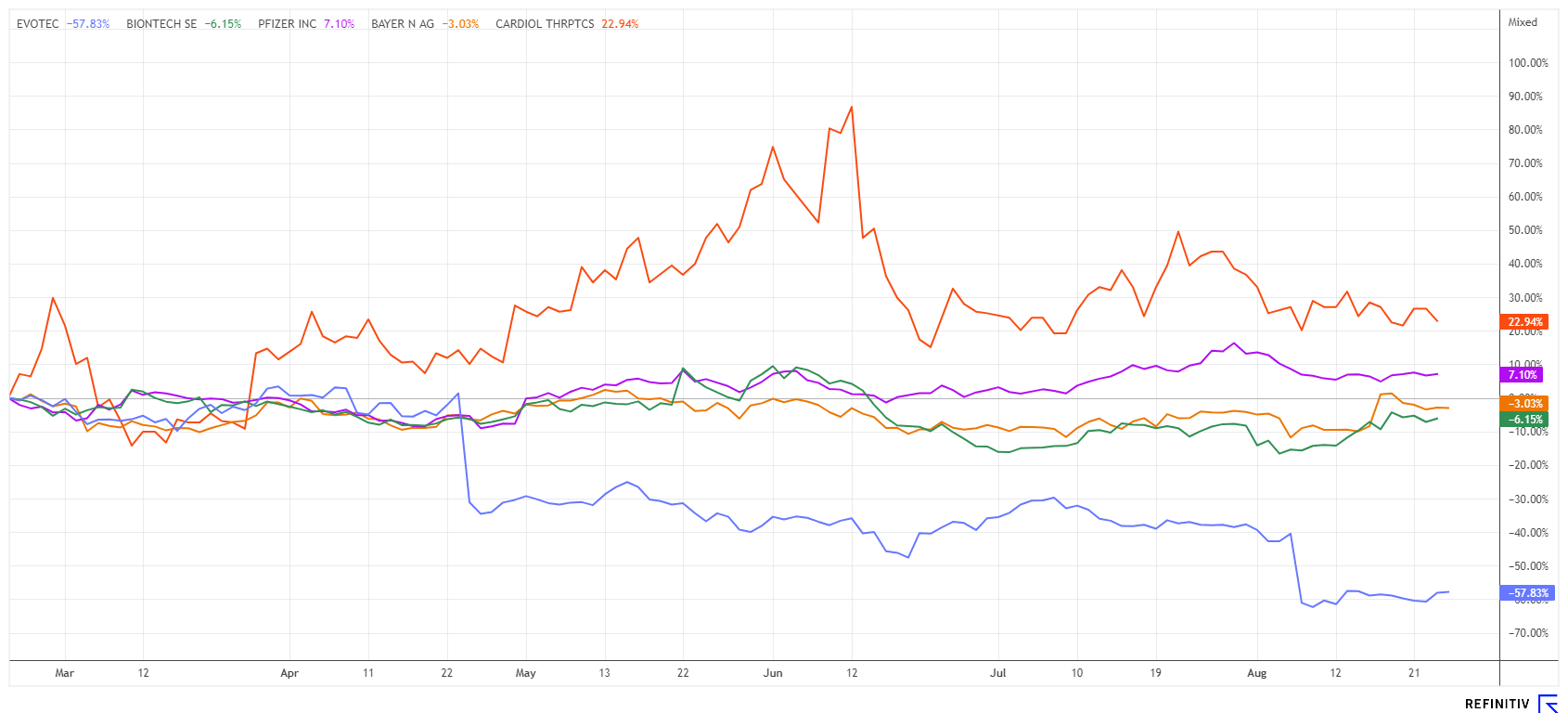

Despite all the prophecies of doom, life goes on in the biotech sector. With a medium-term focus, it makes sense to bet on management qualities, as the recent price drops were partially too severe, but the research approaches promise a better future. BioNTech and Pfizer still have to deal with the COVID-19 issue, while Bayer has now taken all measures to achieve a turnaround. The situation at Cardiol Therapeutics and Evotec is particularly interesting, as the members of the Management Board continue to buy shares regularly.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , PFIZER INC. DL-_05 | US7170811035 , BAYER AG NA O.N. | DE000BAY0017 , CARDIOL THERAPEUTICS | CA14161Y2006 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec - Now even the Management Board is buying in

Despite strong sell-offs and a historically high short ratio, the share price of the Hamburg-based life sciences company Evotec is struggling to get back on its feet. Currently, opinions regarding fundamental expectations are divided. Analysts estimate a figure of EUR 829 million for 2024, which is clearly below the range recently published by management. With a market capitalization of EUR 1.04 billion and prices below EUR 6, the Company is currently highly undervalued.

The new CEO, Christian Wojczewski, made a second share purchase in quick succession with a purchase price of EUR 5.66. This was only a short distance from the current 10-year low of EUR 5.08. On the Refinitiv Eikon platform, 8 out of 12 experts recommend the share as a "Buy". They expect a 12-month price target of an exalted EUR 15.20. This seems very high to us; a rebound to the 200-day moving average line, which currently stands at EUR 11.74 and is falling daily, should be targeted. We, therefore, collect up to EUR 5.95, with a strict STOP at EUR 5.05.

Bayer - A comprehensive package for the turnaround

The recent rebound to over EUR 29 last week felt like a promising step forward for German biotech flagship Bayer. There are currently increasing glimmers of hope that the reduction of up to 5,000 jobs will lower costs accordingly. In addition to the ongoing glyphosate lawsuits in the US, Bayer's main challenges are the expiring patents on blockbuster drugs, which will lead to a decline in margins in the medium term.

Solving the major glyphosate issue is a necessary but by no means sufficient step for the sustainable recovery of the Company. Many essential future investments have been neglected in recent years due to budget constraints, and the new management has so far shown too few forward-looking ideas. The figures Bayer released in early August fell short of expectations: high debt of EUR 33 billion, little revenue growth, and declining margins. At least the Leverkusen-based company is no longer burning through cash, and free cash flow could finally turn positive again this year. Although CEO Bill Anderson has made many promises in his first year, the share remains at a five-year low. Buy your target position only with upward momentum; however, those with a long-term view might consider dipping a toe in now. It likely will not go much lower.

Cardiol Therapeutics - There is turbo potential

Cardiol Therapeutics Inc. is one of the shooting stars in the biotech sector this year. CRDL shares achieved a 250% gain at its peak and are currently experiencing a minor consolidation. However, the positive overall picture has not changed, and the Company’s promising drug candidate CardiolRx™ is making its way through two Phase 2 clinical trials. The pharmaceutically manufactured oral formulation is being targeted at helping people suffering from myocarditis and pericarditis – conditions for which suitable therapies have been sought after for years.

At the beginning of 2024, the Canadian company was granted orphan drug designation from the USA FDA for CardiolRx™ for the treatment of pericarditis. Canaccord, First Berlin, ROTH, and H.C. Wainwright adjusted their price targets upwards as a result of the news and progress in Cardiol’s clinical trials. They are USD 8.00, USD 8.50, USD 10.00, and USD 9.00 respectively – with the median being USD 8.88. With CAD 24 million still in the bank at the end of the second quarter, the Company is well capitalized to achieve corporate milestones into 2026. Cardiol Therapeutics is currently valued at CAD 185 million with just under 69 million shares. From a technical analysis perspective, the CAD 2.50 to 2.70 range is a good entry point, as the high for the year was around CAD 4.30. The turbo could reignite quickly with significant announcements this fall.

BioNTech and Pfizer - No end to the COVID-19 debate in sight

Analysts are perplexed by the continuing pressure on BioNTech and Pfizer share prices. Full coffers are of little help when the pipeline is faltering. In addition, there are also special problems, such as the extensive lawsuits due to the exorbitant profits made during the COVID-19 pandemic. The Mainz-based company and its US partner had made a fortune here. But now trouble is looming. Moderna and CureVac have already filed patent lawsuits against BioNTech, and the University of Pennsylvania is also demanding money. What should we make of these lawsuits?

The messenger molecule mRNA has fascinated Hungarian researcher Katalin Kariko throughout her research career. However, her long-standing employer, the University of Pennsylvania, showed very little interest. She had to secure her own research funding and eventually moved to BioNTech. Last year, however, her efforts finally paid off when she was awarded the Nobel Prize for Medicine. Together with her partner Weissman, she succeeded in modifying RNA molecules in such a way that they are not destroyed by the immune defenses of human cells. This breakthrough was crucial for the success of vaccine giants BioNTech and Moderna. Since this discovery, the university has been demanding higher license fees from BioNTech because the success of the COVID-19 vaccines has also led to increased covetousness. Moderna and CureVac have now filed lawsuits against BioNTech/Pfizer, but the Mainz-based company has also filed lawsuits against its competitors.

In 2021 and 2022, BioNTech earned nearly EUR 19 billion and EUR 17 billion, respectively, from Comirnaty. However, the Mainz-based company has not yet launched any further drugs on the market; in H1-2024, BioNTech even posted a loss of more than EUR 500 million. Nevertheless, the Mainz-based company still has around EUR 18 billion in reserves, and Pfizer is also flush with cash. In chart terms, the breakout lines of EUR 88 to 92 are important for BioNTech, while for Pfizer, things could get more interesting above EUR 28. It is advisable to keep a close watch on both stocks and remain patient!

The stock market can also consolidate sometimes. Although many may have overlooked this, the economy is weakening, and the only relief seems to be the hope for interest rate cuts by the FED. Otherwise, we hear about financing issues and a pronounced investor strike. This makes it all the more important to focus on fundamental opportunities. A sensible diversification across sectors and currencies reduces the risk in the portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.