December 30th, 2025 | 09:10 CET

Silver boom racing towards USD 100, or not? Focus on critical metals with Antimony Resources, Airbus, Rheinmetall, and Plug Power

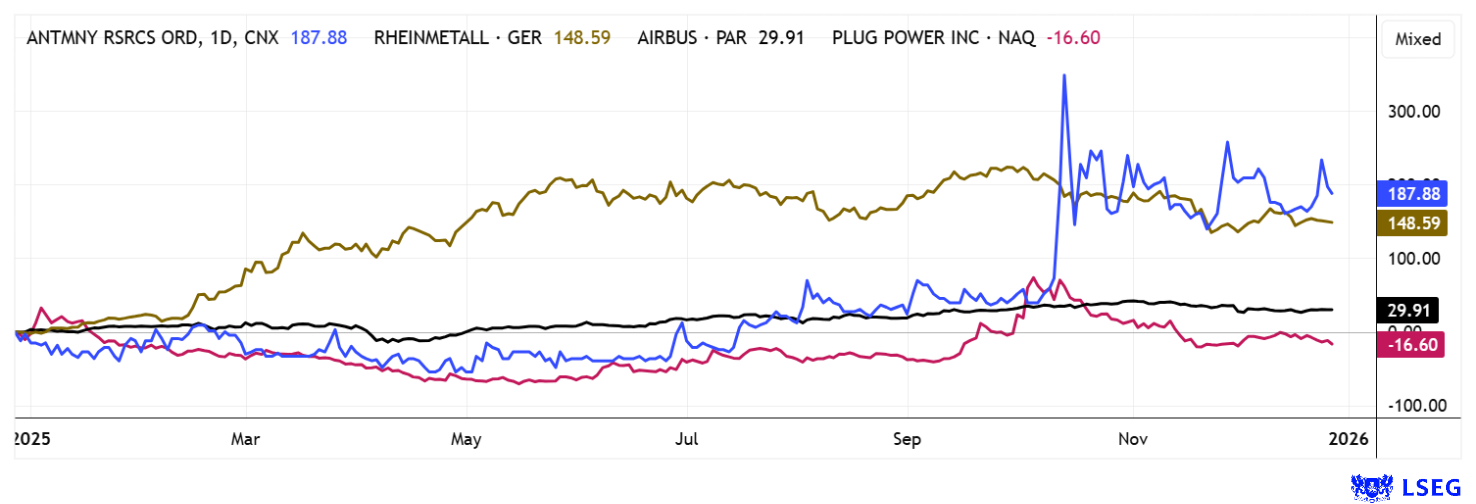

No peace in Ukraine after all? Defense stocks are being passed around like hot potatoes; no one seems to want to be invested when the flag of peace is raised. Yesterday, the defense sector fell by 4% at times, with Rheinmetall even dropping below the EUR 1,500 mark. When disappointing interviews with Donald Trump arrived from Florida, the stocks turned upward again. The fact remains that the defense sector needs critical metals. Industrial giant Airbus has secured several new orders, while Plug Power's targets are being pushed further and further back. Is another capital increase looming? Antimony Resources remains promising, as the Canadians have what Donald Trump would like to have. Judge for yourself!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

ANTIMONY RESOURCES CORP | CA0369271014 , RHEINMETALL AG | DE0007030009 , PLUG POWER INC. DL-_01 | US72919P2020 , AIRBUS | NL0000235190

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Airbus – In addition to defense, the civil sector is also booming

After a long upward trend, Airbus shares reached a high of around EUR 216 in the fall. This valued the aviation expert at more than EUR 200 billion at its peak. Based on the current level of EUR 196, 15 out of 20 analysts believe the target price will be around EUR 226. That is not much room for maneuver for 2026, for which growth leaders are currently still being sought. Airbus is currently strengthening its market position, particularly in China, where two airlines have ordered a total of 55 aircraft from the A320 family, triggering a list price volume of around USD 8 billion. This order shows that Airbus continues to enjoy confidence in the industry's most important growth market and that Boeing is increasingly falling behind there.

The final assembly line in Tianjin is particularly significant, as it sends a political and industrial signal to Chinese airlines. Although large orders traditionally come with high discounts, the symbolic significance of the deal remains unbroken. Airbus is also benefiting from an already very high order backlog, which will keep production running at full capacity for years to come. The China deal now increases planning security and underscores the manufacturer's strategic dominance in the Asian region. At the same time, Airbus is working to get supply chain problems and quality checks under control in order to secure delivery targets. Despite these operational challenges, demand for medium-range jets remains very high, and the defense sector is also booming. **Investors should use setbacks as an opportunity to buy, as the order pipeline will push revenue above the EUR 100 billion mark by 2028. This makes the projected 2025 valuation of 2.3 times sales appear quite low compared to the sector average.

Antimony Resources – US security agenda drives demand

Investors should take note here! Antimony, a brittle semi-metal with the element symbol Sb, is now one of the most strategically important raw materials worldwide, as global mine production has been hovering at only around 150,000 to 160,000 tons per year for years. China clearly dominates production, while Western industrialized countries are heavily dependent on imports. This concentration poses considerable risks, as export controls and geopolitical tensions are increasingly being used as political leverage.

The rare metal antimony is used in batteries, electronics, flame retardants, alloys, semiconductors, and in special military technology such as night vision devices and armor-piercing ammunition, and is currently considered virtually irreplaceable. This creates a structural supply deficit, which is further exacerbated by aging mines and a lack of new projects. Investors are therefore focusing particularly on secure, politically stable production sites in North America.

This is precisely where Antimony Resources, a Canadian exploration company with the Bald Hill project in New Brunswick, comes in. Initial drilling results have already yielded high-grade stibnite mineralization with peak values of nearly 15% antimony. An NI 43-101-compliant report confirms substantial tonnage potential and indicates grades of approximately three to four percent in around 2.7 million tons of rock. This corresponds to 81,000 to 108,000 tons of pure antimony and could measurably reduce US import dependency. Historically, Bald Hill was already the largest antimony deposit in North America, which further supports its geological validity. Now the excavators must return to the site. When this will happen depends on a few intermediate steps.

The basis for a scarcity analysis is the US's efforts to radically overhaul its raw materials policy, as a significant portion of the Trump administration's tariff revenues goes toward the defense budget of nearly USD 1 trillion. A three-digit million-dollar amount is explicitly earmarked for the procurement and development of antimony projects. The development of new refining and smelting capacities, such as the joint venture between Korea Zinc and the US government in Tennessee, also demonstrates the political will to achieve supply chain sovereignty. However, this infrastructure will not be fully operational until 2029 at the earliest, so the market will remain tight in the short term. This presents Antimony Resources with an attractive window of opportunity to tackle the next stage of exploration. To date, 71.8 million shares have been issued, resulting in a market capitalization of CAD 36 million. It is inconceivable what could happen if the US were to open its pockets and make a strategic entry here. Collect now!

Plug Power – Super sale at the end of the year

Frustration is spreading among the US market leader for PEM electrolysers. While there was still justified hope in 2021/22 that green-red politicians would get the hydrogen flywheel going, the Trump administration, with its motto "Drill Baby Drill," is showing the other side of the coin. Despite a 90% price correction and three consecutive capital increases, the PLUG price is not really getting off the ground. The USD 2.00 mark is currently fiercely contested, with temporary order announcements only briefly helping to fuel euphoric daily jumps. At least 6 out of 25 analysts on the LSEG platform are still giving it a thumbs up, resulting in an average price target of USD 2.71 – around 35% above yesterday's price. As the share price has not fallen further recently, speculators will certainly revisit the stock at the start of the year. At present, tax-induced loss realizations are likely to predominate.

The stock market is currently taking no prisoners. The silver sector is currently experiencing a vivid short-selling squeeze that could end in a major squeeze. There are also worrying shortages of the raw material antimony. Geopolitical tensions have made secure access to critical raw materials a core component of modern investment strategies. While traditional defense stocks come under sudden valuation pressure whenever there are signs of détente, the strategic commodities sector offers additional return opportunities. Antimony Resources is ideally positioned here and valued at only CAD 36 million. Dynamic investors should diversify broadly across the entire security and commodities complex while paying disciplined attention to predefined stop-loss levels.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.