August 22nd, 2024 | 07:00 CEST

RWE, dynaCERT, Mercedes-Benz: Energy of the future - Hydrogen vs Electric

The energy transition is at the center of the strategies of RWE, dynaCERT, and Mercedes-Benz, each with different emphases. The energy company RWE is driving forward its hydrogen strategy with billions in investment and state subsidies. The Company plans to build electrolysers and hydrogen storage facilities, which, according to its IR Factbook, are the most promising components of its energy mix in the future. dynaCERT and its portfolio company Cipher Neutron are also focusing on innovative hydrogen solutions. Its AEM electrolysis technology, which is being researched in collaboration with Simon Fraser University, promises more efficient and cost-effective methods of hydrogen production. Mercedes-Benz, on the other hand, is struggling with the weaknesses of electric batteries. A severe fire involving an EV-Mercedes in an underground garage required over 8 hours of firefighting efforts, damaging 108 other vehicles and significantly damaging its reputation in one of its key markets...

time to read: 6 minutes

|

Author:

Juliane Zielonka

ISIN:

RWE AG INH O.N. | DE0007037129 , DYNACERT INC. | CA26780A1084 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

RWE presents strong half-year figures and pushes ahead with hydrogen strategy

The German energy group RWE has presented its half-year figures for 2024. Despite turbulence at the beginning of the year, the Company delivered a good financial performance, emphasized CEO Markus Krebber.

Adjusted EBITDA amounted to EUR 2.9 billion in the first half of the year, which means that more than 50% of the annual forecast has already been achieved. Adjusted net profit amounted to EUR 1.4 billion. Investments to date in wind, solar, and battery capacities have led to growth in renewable energy production. In total, RWE currently has over 10 GW of capacity under construction. According to Krebber, the returns on these projects are in line with the targets.

RWE's hydrogen strategy is particularly noteworthy. The Company recently received government funding of over EUR 600 million for two major hydrogen projects in Germany. These funds are to be used for the construction of a 300-megawatt electrolyser in Lingen (Lower Saxony) and a hydrogen storage facility at a nearby airport.

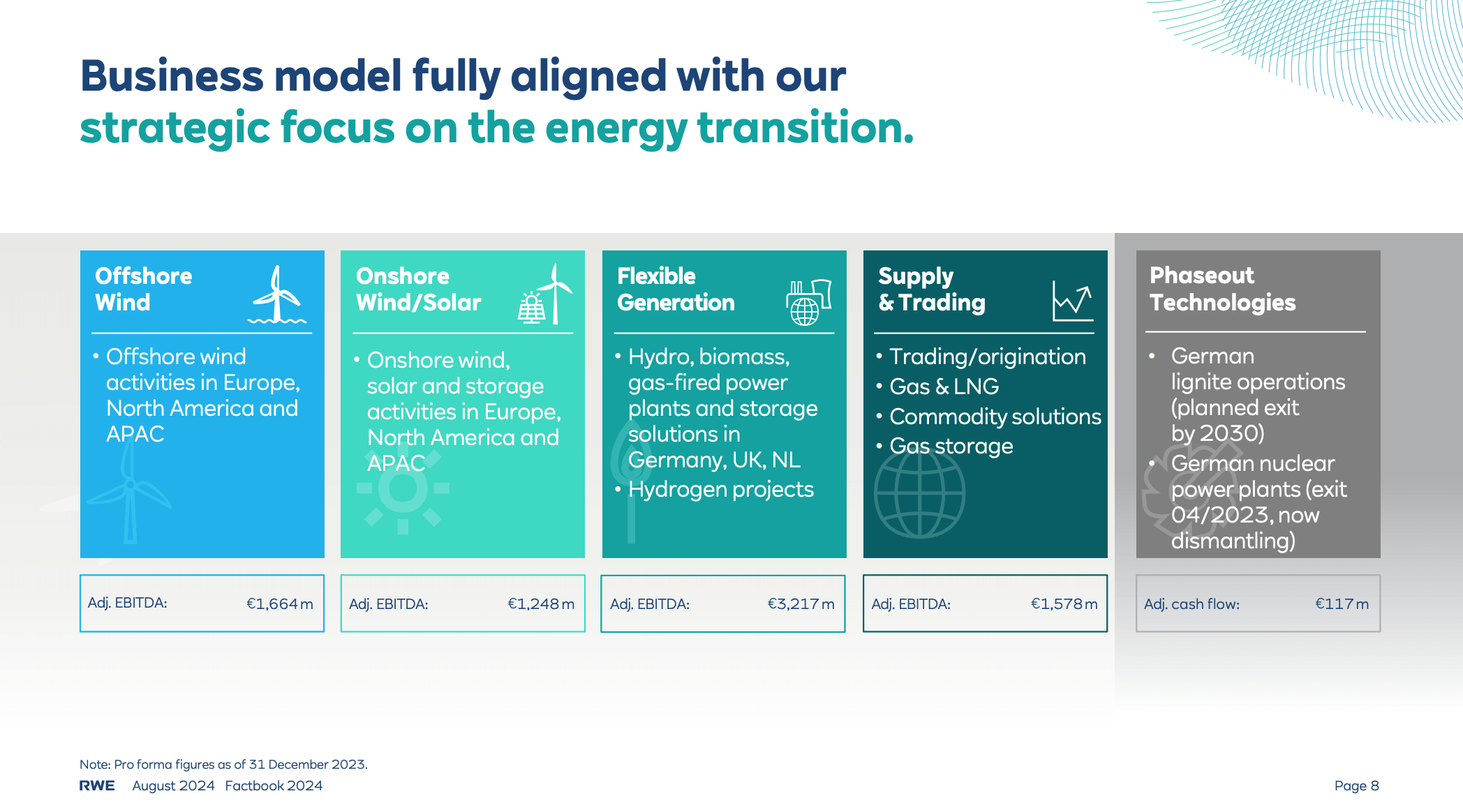

Additionally, RWE plans to build new gas power plants that are "H2-ready," meaning they will be prepared for future operation with hydrogen. **A look at the Company's Factbook (page 8, see graphic) illustrates the Company's growth in the hydrogen segment.

The management did not want to comment specifically on questions about possible acquisitions in the US, particularly in the area of flexible power generation. The election campaign is still underway in the land of opportunity, so it is unclear which government will come to power and how their plans will progress. Options are being 'examined', but a decision is still open. Overall, RWE is confident it will achieve the goals of the "Growing Green" strategy. This envisions attractive profit growth alongside rapid decarbonization. RWE aims to reduce its CO₂ emissions by nearly 60% by 2030.

RWE expects adjusted EBITDA of between EUR 5.2 billion and EUR 5.8 billion and adjusted net income of EUR 1.9 billion to EUR 2.4 billion for the remainder of the 2024 financial year. The Company assumes the results will be at the lower end of these ranges. For the current financial year, RWE plans to increase the dividend to EUR 1.10 per share.

dynaCERT's portfolio shines: Cipher Neutron in pioneering uni-hydrogen project

Cipher Neutron Inc, a portfolio company of the Canadian firm dynaCERT, has been awarded a pioneering contract by Simon Fraser University (SFU) in Canada.

The university's SFU Hydrogen Hub plans to build an AEM water electrolyser with fluorine-free polymer membranes. Cipher Neutron will provide the AEM technology. The aim is to reduce the risks associated with scalable next-generation hydrogen production.

The benefits of AEM electrolysers:

- They produce very pure hydrogen (99.9%)

- They operate at high pressure (up to 30 bar)

- They require no rare earth metals or harmful chemicals

- They achieve an efficiency of over 90%

These properties make them cheaper and more environmentally friendly than conventional methods. The research project is investigating Cipher Neutron's AEM technology in the 250 kW to 1 MW range. This power range is crucial to enable precisely these competition-critical cost savings when scaling up green hydrogen production.

Once research in this area yields significant insights, the technology can be applied on a large scale. The work of the SFU Hydrogen Hub could drive the development of cost-effective and efficient methods to produce green hydrogen, paving the way for wider use of hydrogen as a clean energy carrier.

This makes the portfolio company, including dynaCERT, an exciting candidate for corporations like RWE, Plug Power, or NEL. dynaCERT covers various applications of hydrogen as a form of energy in future industries. dynaCERT offers a patented electrolysis technology that produces on-demand hydrogen and oxygen for combustion engines. This innovation improves combustion, reduces emissions, and increases fuel efficiency in various applications. Its technology is versatile and suitable for diesel engines in road vehicles, refrigerated trailers, construction machinery, power generators and in the mining and forestry industries.

Together, dynaCERT and Cipher Neutron cover both the production and use of hydrogen. Their in-depth experience in this field puts them miles ahead of other companies.

Electric car fire in South Korea causes a stir: Mercedes-Benz under pressure

A serious fire in an underground parking garage in Incheon, near Seoul in South Korea, has once again brought the safety of electric vehicles into focus. At the beginning of August, a Mercedes-Benz EQE caught fire due to a faulty battery, causing considerable damage to around 140 other vehicles. The fire, which took eight hours to extinguish, forced residents to evacuate to emergency shelters.

Extinguishing e-car fires is particularly difficult. The high energy storage in lithium-ion batteries, the risk of thermal runaway, and the possibility of reignition after hours or days pose particular challenges for emergency services.

Mercedes-Benz Korea initially only responded with a brief statement and remained largely silent for days. Particularly unsettling, given the extensive damage: the local CEO, Mathias Vaitl, did not cut short a business trip to return. It was not until a week later that the Company announced relief measures and donated the equivalent of USD 3.3 million.

The exact cause of the fire is still unclear. It is surprising that the battery was not supplied by the market leader CATL but by the smaller Chinese manufacturer Farasis Energy. Experts warn that Mercedes-Benz is jeopardizing its reputation in South Korea, its fourth most important market, with its hesitant reaction. The delayed response by the CEO is considered a major affront in South Korean culture.

In response to this fire, the South Korean government plans to encourage car manufacturers to voluntarily disclose information about the batteries used in their electric vehicles. The aim is to reduce public fears. The government hopes to restore confidence in electric vehicles and value consumers' safety concerns by increasing transparency. Some car companies have already started to name the manufacturers of their batteries. However, experts warn that the "EV phobia" could continue for some time and question the effectiveness of safety improvements without further action.

Contrary to public perception, statistics show that electric vehicles are less likely to catch fire than conventionally powered vehicles. In the US, 25 out of every 100,000 electric cars catch fire compared to 1530 petrol cars and 3475 hybrid vehicles. In South Korea, the rate is 1.3 fires per 10,000 e-cars compared to 1.9 for fuel-powered vehicles.

Professor Kim Jonghoon from Chungnam National University recommends that electric vehicle batteries should not be fully charged as a precautionary measure, as the risk of fire is increased if the charge exceeds 90%. This is certainly a well-intentioned suggestion for short distances.

RWE is showing a strong financial performance and is consistently pushing ahead with its hydrogen strategy. Major players such as RWE are proving that hydrogen energy will be an essential component of the future energy supply. By cooperating with Simon Fraser University on AEM electrolysis technology, the dynaCERT portfolio company Cipher Neutron is putting its expertise in green hydrogen production at the service of research. The technologies of both companies cover both the production and application of hydrogen, which makes them attractive for larger energy companies. dynaCERT's on-demand electrolysis for combustion engines and Cipher Neutron's efficient AEM electrolysers offer versatile solutions for various industries. The electric battery fire in a Mercedes in an underground parking garage in South Korea has caused the manufacturer a considerable loss of confidence in one of its key markets. The hesitant response from the Stuttgart-based company and, in particular, the local CEO has damaged the Company's image in the critical South Korean market. In summary, an investment in hydrogen companies offers good potential returns over the long term. Companies such as Mercedes-Benz, on the other hand, must be careful to handle the sensitivities of key markets with greater competence.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.