October 29th, 2025 | 07:35 CET

Record prices and takeover rumors confirmed! Almonty, D-Wave, and Oklo in the spotlight

What could be better than takeover rumors? For weeks, there have been persistent discussions about state participation in companies that support the Western supply chain for critical metals or can secure it in the medium term. Hopes are pinned on the latest developments at rare earth specialist MP Materials. But there is another way! Almonty Industries took the plunge and secured a tungsten project in the US to drive forward its geographical diversification towards the West. Investors are enthusiastic. D-Wave and Oklo are also speculating in the same vein. We provide a little more clarity.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , D-WAVE QUANTUM INC | US26740W1099 , OKLO INC | US02156V1098

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries – Acquisition in Montana apparently sealed

After a 25% correction, things got back on track yesterday for tungsten specialist Almonty Industries. While almost all other "critical minerals" players continue to lose ground, news of a successful project acquisition in the US is pushing Almonty's share price back up. It is becoming increasingly clear that Almonty Industries is becoming a cornerstone for investors who are focusing on critical raw materials and geopolitical independence.

According to agency reports, the Company is on the verge of reviving the first commercial US tungsten mine in a decade with the acquisition of the Gentung Browns Lake tungsten project in Montana (USA). This move is likely to not only find political support but also strengthen the confidence of the industry, which wants to reduce its dependence on Chinese supply chains. CEO Lewis Black is purposefully driving the expansion forward, positioning Almonty as one of the few Western producers capable of supplying tungsten in significant quantities. The acquisition in Montana underscores the Company's claim to become a "domestic, conflict-free supplier" that operates transparently and reliably. Expanding capacity in the US also strengthens the Company's plans to relocate its headquarters to Delaware. Market observers expect Almonty to further expand its role in the wake of possible industry consolidation or even act as a buyer of additional projects.

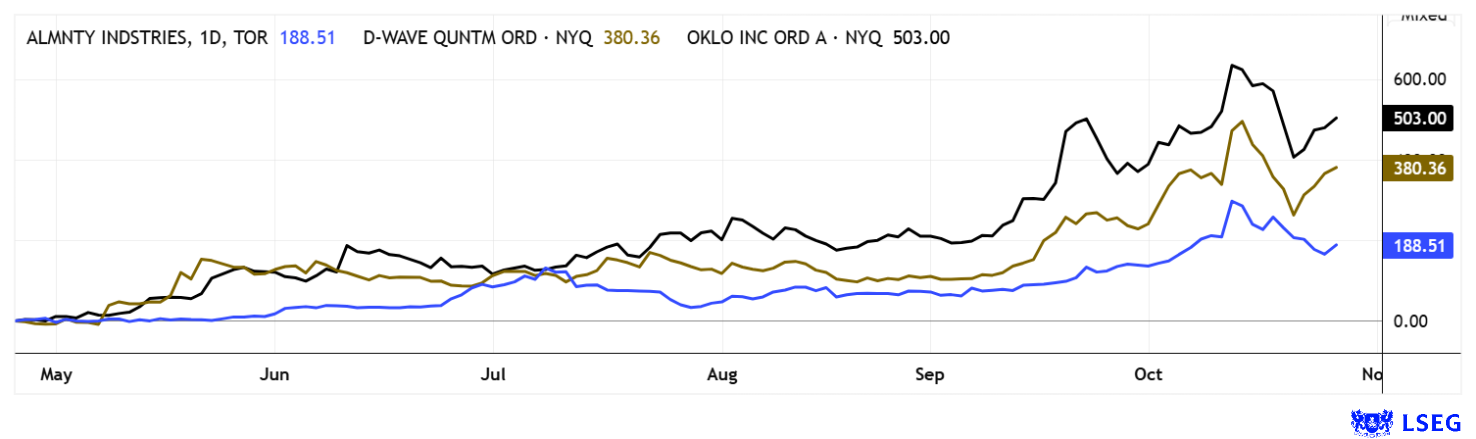

It has been known for weeks that Almonty is already in talks with the US Department of Defense and several American customers, such as Kennametal and Buffalo Tungsten. In order to maintain the political independence of producers, CEO Lewis Black recommends that government institutions purchase the necessary tungsten directly from the mines at market prices. This creates clear and transparent conditions! Analyst firms such as DA Davidson confirm the high upside potential with price targets of USD 11.00 and see Almonty as a key future producer outside China and Russia. From a purely technical perspective, the stock underwent a textbook consolidation with a 40% correction to around USD 6.40. With yesterday's rebound to USD 7.45, the path is now technically clear again to the old highs. With a return of over 700% since the beginning of the year, Almonty is one of the most dynamic players in the commodities sector. Long-term investors see the price swings as an opportunity to enter a market that is just beginning to unfold its strategic importance.

GBC analyst Matthias Greiffenberger provides the latest analytical insights on Almonty in an interview with Lyndsay Malchuk.

Oklo – After the correction comes the upturn

Up and down, over and over again – Carnival is approaching! Things are just as fast-paced for the shares of SMR start-up Oklo. The Company is positioning itself as a pioneer of a new generation of clean energy through compact, modular microreactors, offering significantly lower costs than conventional large-scale reactors. With its Aurora Powerhouse, Oklo aims to provide safe, scalable, and off-grid energy solutions that are particularly attractive for military applications. As part of the US Army's Janus program, Oklo could equip military bases with independent energy supplies in the future. Investors are jubilant about this promising combination of defense and nuclear technology. Nevertheless, the Company is under considerable pressure due to its enormous valuation of around USD 20 billion without any previous revenues or operating licenses. The stock, which had risen by more than 500% by October, recently lost around 30% within a week as doubts emerged about the sustainability of the price increase. Critics highlight Oklo's heavy dependence on regulatory support and its continued lack of economic substance. In addition, political observers accuse Oklo of being too closely linked to former government officials. It will be exciting to see how this story unfolds. The stock feels like going all-in at the poker table with just a pair of 7s in hand!

D-Wave – Quantum megatrend or bubble?

The US administration was also suspected of being an investor in the field of quantum computing. When this turned out to be a press hoax, quantum stocks reacted with a temporary 30% decline. As if nothing had happened, however, the journey is already back on track midweek. The main focus is still on D-Wave (QBTS) shares, which have seen a phenomenal 3,500% increase over the last 12 months. Despite the incomprehensibly high valuation, there is also tailwind from prominent investors such as Paul Tudor Jones, Ken Griffin, and Israel Englander. These self-made billionaires are considered "smart money," whose involvement is usually based on thorough analysis and long-term conviction, which lends D-Wave additional credibility. With projects already completed, such as the Advantage2 system, and growing international partnerships, the Company, which has had virtually no revenue to date, is showing its first commercial successes. Fundamental analysts expect the Q3 report on November 6 to provide more insight into the miracle technology of "quantum computing." Strong price swings in the stock and across the sector should be expected in the days following.

The super bull market on the growth exchanges is showing no signs of slowing down. This suggests that the consolidation phase in the "critical metals" sector may already be behind us. There were strong counter-movements yesterday at Almonty Industries and the technology stocks Oklo and D-Wave. If the upward momentum continues, new highs could be reached very quickly.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.