August 5th, 2025 | 07:10 CEST

Palantir, Rheinmetall, RENK, and Dryden Gold: Winners in the crossfire of trade war and NATO agenda

Tariffs, defense, and infrastructure! No wonder there is a considerable gap of around EUR 172 billion in the German federal budget between 2027 and 2029. Although the federal government is attempting to counter this with spending cuts, tax increases will ultimately be necessary, as migration and climate costs are also taking their toll. Those in government who now have to juggle everything at once are in for a rough ride! Government revenues are expected to continue to decline due to the sluggish economy and high inflation, meaning the government will face higher refinancing costs due to rising interest rates. For investors, this means that the price of gold is likely to increase further, making selective investments in precious metals a sensible move. We will briefly analyze whether there is still room for growth in the well-performing defense and military stocks.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , RHEINMETALL AG | DE0007030009 , RENK AG O.N. | DE000RENK730 , DRYDEN GOLD CORP | CA26245V1013

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir – People rushed to buy, but now the numbers are in!

Palantir is currently the focus of investors after the Company announced a potential ten-year contract worth around USD 10 billion with the US Army. This deal would consolidate around 75 existing individual contracts and position the Company as a key partner for AI-powered data solutions in the defense sector. Analysts see this as strategic confirmation of Palantir's role as a beneficiary of the US government's massive AI investments, particularly in applications such as the Maven Smart System and Meta Constellation. Ahead of the upcoming quarterly figures, the stock has already climbed to over USD 160, driven by expectations of strong results. For the year as a whole, PLTR shares are now up 530%, and even including US military orders, the 2025 price-to-sales ratio is a staggering 100. For the second quarter of 2025, analyst consensus estimates revenue of around USD 939 million, which would represent growth of just under 39%. The excitement is mounting because if the outlook is positive and the pipeline in the government and industrial sectors continues to grow, the stock is likely to rise further. However, the most important factor is the whisper estimate of traders, which still has to be exceeded. Highly exciting!

Rheinmetall – Solid as a rock

Rheinmetall dominates the European defense sector, with its share price increasing twentyfold since the start of the war in Ukraine – in 2025 alone, it rose by over 250%. The figures justify this performance. Driven by the booming defense business, revenue rose by 46% to EUR 2.3 billion in Q1 2025, while EBIT increased by 49% to EUR 199 million. At EUR 63 billion, the order backlog remains at a record level and is almost six times the annual revenue for 2024. The strategy remains clearly focused on defense: two plants are being converted, Hagedorn-NC is being acquired for powder supply, supplier status for the F-35 has been secured, and a partnership with Anduril for modern drone technology has been established. A missile competence center is also being set up with Lockheed Martin. Rheinmetall expects revenue to increase by up to 30% in 2025, with an EBIT margin of 15.5%. Analysts see the Company as the main beneficiary of rising NATO spending, but at EUR 1,940, the share price has almost reached the current average target of EUR 2,025 set by LSEG analysts. A possible stock split could bring new momentum and attract small investors. The Düsseldorf-based company will report on August 7, with consensus earnings per share expected to be EUR 3.88.

Gold boom ahead: Why Dryden Gold is a favorite for investors

Far removed from armaments and defense, but suitable for portfolio hedging, are gold investments. In addition to the quality of the deposit, the time to gold production, the existing infrastructure, and the jurisdiction are important factors for investors. With good fundamentals, Dryden Gold is increasingly coming into focus with the Elora Gold System in Ontario's Gold Rock Camp. The Company has already completed a fully funded 15,000-meter drill program and discovered several high-grade gold intersections and visible gold. Particularly in the Jubilee target area and the Pearl Zone, parallel, superimposed structures extending for approximately one kilometer are evident, a feature reminiscent of legendary deposits such as Red Lake. Drill hole KW-25-003 returned a spectacular 301.67 g/t gold over 3.90 meters, with new hits such as 15.30 g/t over 1.45 meters in the hanging wall, highlighting the potential. The broad, near-surface zones in Pearl also indicate an expanding system.

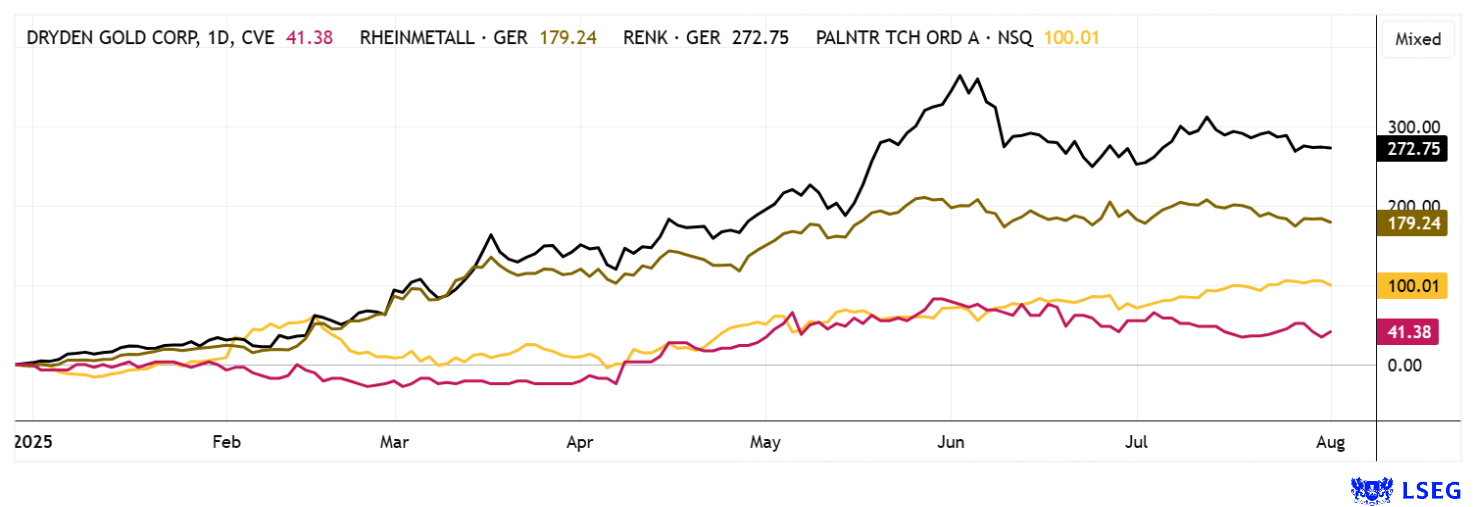

With approximately 70,000 hectares of land, strategic acquisitions, and partners such as Centerra Gold and Alamos Gold, Dryden Gold is well-positioned. The environment is ideal: stable jurisdiction, low-cost energy, excellent infrastructure, and good relations with indigenous communities. Historical mines in the region, such as Musselwhite with 1.5 million ounces produced, demonstrate the potential of the area. CAD 5.8 million has been earmarked for further drilling in 2025, with the aim of not only defining resources but also making new discoveries. The combination of high-grade hits, an expanding target area, and strategic financing could make Dryden Gold one of the most exciting growth stories in the North American gold sector. Anyone looking to bet on the next big find should keep an eye on this company. With a gain of over 40% since the beginning of the year, Dryden shares can even hold their own in a comparison chart with popular defense stocks.

RENK – Rumors drive the share price

Let's return to defense stocks. Many investors are surely wondering why RENK shares are still trading at just under EUR 70. The mystery is easily solved: In July, tank manufacturer KNDS exercised an option agreement and acquired 9.17 million RENK shares from financial investor Triton. This increased KNDS's stake in the transmission manufacturer from 6.7% to 15.84%, making it the largest single shareholder. KNDS is a joint venture between Krauss-Maffei Wegmann and Nexter Defense Systems, important partners of RENK in the defense sector. The agreement ends lengthy negotiations and disputes over the purchase price and antitrust concerns. Triton continues to hold approximately 9.2% of the shares. At the same time, rumors are circulating about talks regarding a potential takeover in which RENK could play an important role as a technology supplier. This would lead to greater integration in the defense industry and enable synergies in technology and production. For investors, the high valuation of the transmission expert in these negotiations is justified; from a purely analytical perspective, RENK is clearly overvalued compared to Rheinmetall.

After a sharp correction, the stock market is once again showing its sunny side. Global trends such as artificial intelligence and security policy tensions are fueling investors' imaginations, particularly in the technology and defense sectors. However, it remains uncertain whether classic defense stocks can still generate above-average returns. The potential appears much more realistic for precious metals, which are considered a proven hedge against geopolitical risks and economic uncertainty. Dryden Gold could benefit here, as the Company holds a first-class project in the heart of Ontario's Gold Belt, a location with rare value and exciting prospects.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.