Comments

Commented by André Will-Laudien on August 25th, 2025 | 07:00 CEST

100% with NATO contracts from the air! Airbus, Globex Mining, Boeing, and Lufthansa

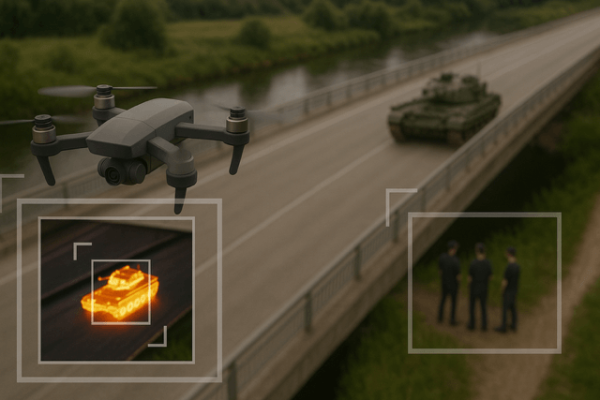

The craziness continues! NATO member states have agreed on new planning targets for armaments and capabilities and, according to Secretary General Mark Rutte, have increased the requirements for air and missile defense by about 30%. Rutte stated: "We need more resources, troops, and capabilities to be prepared for any threat." German Chancellor Friedrich Merz emphasised that Germany would provide all the necessary resources to expand the Bundeswehr into the strongest conventional army in Europe. According to experts, large-scale defense projects, particularly in the aerospace sector, will require enormous investments and far-reaching acquisitions. Across Europe, around EUR 300 billion is expected to be invested in air forces by 2030. Investors should now set the course to benefit from the flood of orders in the aerospace sector.

ReadCommented by Nico Popp on August 22nd, 2025 | 07:10 CEST

Gold story remains intact – Three good ideas for every portfolio: Dryden Gold, Kinross Gold, and Barrick Mining

"Gold is money. Everything else is credit" – banker JP Morgan recognized this long ago. The precious metal is currently in high demand again. ETF investors in particular, but also central banks, are betting on gold. In July, global holdings in ETFs climbed to 3,639 tons, the highest level since August 2022. Central banks have purchased around 1,000 tons of gold annually over the past three years – about twice the amount they bought per year in the previous decade. This shows that demand from both private and professional investors remains unbroken. We present three promising gold stocks and explain where even speculative investors can get their money's worth.

ReadCommented by Fabian Lorenz on August 22nd, 2025 | 07:05 CEST

EXCITEMENT at RENK and Power Metallic Mines! Sell SMA Solar shares now?

Power Metallic Mines shares have risen by around 30% in recent weeks. According to the CEO, however, this is likely to be just the beginning. Operational progress in developing the world-class multi-metal project discovered last year could lead to a dynamic turn by the end of the year. Perhaps last year's 200% gain will even be repeated? RENK shares have gained over 200% in the current year alone. To ensure long-term success, the gearbox specialist aims to expand its business model and offer smaller autonomous tanks, among other things, in the future. SMA Solar shares have performed surprisingly well this year. Can the rally continue, or will the skeptical analysts ultimately be proven right?

ReadCommented by Nico Popp on August 22nd, 2025 | 07:00 CEST

Raw materials as the key to greater value creation: SQM, Lynas Rare Earths, Almonty Industries

Equality is a social construct. Reality, however, is diverse. This also means that some companies are in a much better starting position than others. In free markets, companies compete for market leadership and thus spur each other on to become better. However, some companies are in pole position for a variety of reasons and also have a few extra horsepower than their competitors. We use the examples of lithium specialist SQM, rare earths company Lynas Rare Earths, and innovative tungsten specialist Almonty Industries to explain which characteristics promise long-term advantages for companies and how investors can benefit.

ReadCommented by André Will-Laudien on August 21st, 2025 | 07:20 CEST

Defense sell-off – New doublers are emerging with thyssenkrupp, Almonty, and Heidelberger Druck

What defense speculators always feared as a looming threat is now happening within just one week: Peace negotiations between Russia and Ukraine! Even though nothing concrete has happened yet, the sentiment is clear: If only half of the numerous geopolitical conflicts calm down or even disappear entirely, the pressure to rearm will ease, and potential orders, which were already reflected extensively in share prices, could be reduced or canceled altogether. Public budgets resemble a pressure cooker at 120 degrees, so any relief is welcome. It will be interesting to see how far defense stocks might fall, especially after rising by up to 2000% in the case of Rheinmetall. Almonty remains interesting because, even with reduced defense demand, critical metals remain the bottleneck of Western industries. It is worth taking a closer look.

ReadCommented by André Will-Laudien on August 21st, 2025 | 07:15 CEST

High-tech correction! A brief pause, then the party continues at Palantir, Deutsche Telekom, MiMedia, and SAP

Oops – there it is. The first correction at Palantir was somewhat severe. But after a 1000% increase in 24 months – who cares? The blockbuster themes of artificial intelligence, cloud computing, and big data continue to dominate the stock market, leading to significant daily price gains. Investors seem to view the capital markets as an almost one-way success story in which valuations play hardly any role. Europe is increasingly taking the lead, with the EURO STOXX 50 rising by around 20% since the tariff dip in April. Despite apparent risks, many investors are sticking to the bull market, although the S&P 500's high Shiller P/E ratio of over 38 is sending out a clear warning signal. Deutsche Telekom is generating excitement with the announcement of another innovation push in the form of its first AI-based smartphone. The coming weeks therefore offer exciting opportunities for investors who, despite the warning signs, are betting on the continued momentum of the market. Where to invest?

ReadCommented by Armin Schulz on August 21st, 2025 | 07:10 CEST

Overvaluations in pharma and biotech reduced – Novo Nordisk, BioNxt Solutions, and Bayer are NOW in focus

Following the drastic market correction since the waning of the COVID-19 pandemic, the pharma and biotech sectors now offer more rationalized valuations and real opportunities. Instead of speculative hype, solid pipelines, clinical results, and disruptive technologies are what count today. Artificial intelligence is revolutionizing drug development, accelerating processes, and creating measurable competitive advantages. This new reality makes companies that are mastering their digital transformation particularly promising candidates. However, it is important to take a close look at each company. That is why we are examining three exciting companies today where there is a lot going on: Novo Nordisk, BioNxt Solutions, and Bayer.

ReadCommented by André Will-Laudien on August 21st, 2025 | 07:05 CEST

The AI revolution is turning biotech into a gold mine! BioNTech, Eli Lilly, NetraMark Holdings, and Pfizer know how!

Artificial intelligence (AI) is becoming increasingly important in drug research and is revolutionizing the development of new active ingredients. Machine learning and neural networks enable large amounts of data to be analyzed and potential drugs to be identified more quickly. AI also plays a central role in the planning and execution of clinical trials by recognizing data patterns, identifying suitable patients, and thus increasing the chances of success. The market for AI in drug development is growing rapidly. Experts estimate it will reach several billion US dollars by 2025, with projected annual growth of over 40%. Where are the opportunities and risks for agile investors?

ReadCommented by Fabian Lorenz on August 21st, 2025 | 07:00 CEST

Up to 300% with raw materials and defense! Standard Lithium, DroneShield, and zinc play Pasinex!

DroneShield's stock has plummeted by around 20% in recent days. However, with a performance of over 300% in 2025, the Australian company remains one of the top performers. The drone defense specialist recently reported on its performance in Q2. Revenue is at record levels, and the order book is full. Will that be enough? Pasinex Resources remains in rally mode. The chances of a continuation are high, as important milestones are coming up and the stock remains favorable. Standard Lithium has celebrated a comeback in recent months, recovering from its brutal crash at the turn of the year. What is next?

ReadCommented by André Will-Laudien on August 20th, 2025 | 07:05 CEST

Rethinking energy! Siemens Energy, First Hydrogen, VW, and BYD for the winning portfolio

For a long time, it seemed that nuclear energy was disappearing from the global energy mix, but now there are clear signs of a change of course. The US, in particular, is pushing for a restart. The government has adopted an ambitious plan to quadruple nuclear power capacity. The focus is on small modular reactors (SMRs) - compact reactors that can be used in decentralized locations, are considered efficient and safe, and can also be built more quickly than conventional large-scale power plants. In addition to their role in domestic energy supply, SMRs are considered an important export product for allied countries looking to reduce their dependence on fossil fuels. At the same time, they offer the possibility of being flexibly combined with renewable energy sources, such as supplementing solar and wind farms to ensure base load capability. E-mobility also depends on a secure power supply. Which companies are attracting the most investor interest?

Read