Comments

Commented by Armin Schulz on August 28th, 2025 | 07:15 CEST

The BioNxt Solutions formula: How a simple idea can turn into a billion-dollar business – Without high risk

In the pharmaceutical industry, promising active ingredients often fail due to a simple problem, such as administration. Canadian biotech company BioNxt Solutions has taken on precisely this challenge. With a smart platform for oral dissolvable films and patches, the Vancouver-based innovator could not only make life easier for patients but also open up a lucrative growth opportunity for investors. We took a closer look at the promising technology behind it.

ReadCommented by Fabian Lorenz on August 28th, 2025 | 07:10 CEST

DRUMROLLS for Hensoldt, SFC Energy, Argo Graphene Solutions shares!

Drumrolls for small and mid-cap stocks: Argo Graphene Solutions is causing a stir with an exciting partnership and is taking a big step closer to commercialization. A new material is poised to revolutionize the way we build. The potential for the Company and its shares is huge. The situation is different at Hensoldt. The Company appears to be stagnant in terms of growth and margins. Analysts, therefore, consider the valuation to be too high and recommend selling. The forecast adjustment at SFC Energy has shown that, here too, growth cannot quite keep pace with the recent euphoria. With the latest orders, the Company aims to regain lost investor confidence.

ReadCommented by André Will-Laudien on August 28th, 2025 | 07:05 CEST

Nvidia figures: Will the bull market continue? Rheinmetall, Almonty, and BYD also offer excitement!

Today, Nvidia's figures will dominate stock market activity. In the slipstream of the 3,000% stock, there are, of course, other key players such as Rheinmetall and BYD, which have also multiplied in value over the last three years. Both companies reported good figures, but even a stock split at BYD did not help to prevent the downward correction. Almonty Industries raised USD 90 million through a NASDAQ listing and then faced short sellers, who are now starting to tremble. This is because the consolidation appears to be over, and the start of mining operations in South Korea is within reach. The stock market is clearly not a one-way street, especially as AI algorithms increasingly determine trading activity and attempt to mislead inexperienced investors with short-term moves. It is beneficial to maintain a clear head. Here are a few ideas.

ReadCommented by Armin Schulz on August 28th, 2025 | 07:00 CEST

The silver boom: What investors need to know about Intel, Silver North Resources, and Xiaomi

Silver is experiencing a historic surge, driven by the megatrends of our time. Industrial demand is exploding, fueled by the tech revolution, the green energy transition, and the electrification of our everyday lives. This indispensable commodity, the best electrical conductor, is found in every smartphone, every electric vehicle, and every solar cell. Supply can barely keep up. Today, we are examining two electronics companies that face high silver prices and analyzing a silver company that is in an exciting phase.

ReadCommented by Fabian Lorenz on August 27th, 2025 | 07:20 CEST

Quick 30% return possible? Novo Nordisk, D-Wave, and NetraMark shares!

Three completely different companies, but all with return potential: AI specialist NetraMark is on the verge of a technical breakout. NetraAI has outperformed ChatGPT and DeepSeek and is gaining more customers. If the breakout occurs, the stock could quickly move toward the analyst price target, representing a potential gain of around 30%. At Novo Nordisk, last week's price gains have almost been lost again. Wegovy's strong market entry in South Korea caused only brief jubilation. Now, competition from Eli Lilly is dampening the mood. At D-Wave, the stock could soon be heading toward new highs again. The Company plans to accelerate its growth in Asia, and new momentum for the stock is expected in September.

ReadCommented by Armin Schulz on August 27th, 2025 | 07:15 CEST

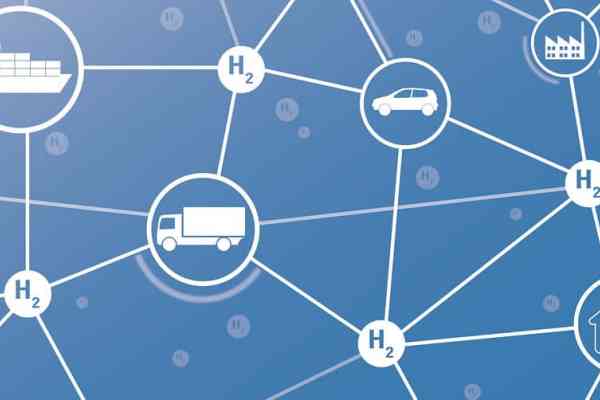

Benefit from the hydrogen boom: The most promising developments at Nel ASA, dynaCERT, and Daimler Truck

The hydrogen market is booming! A groundbreaking efficiency record in electrolysis is revolutionizing production costs. At the same time, the world's first commercial hydrogen flight connection is launching, proving the technology's suitability for everyday use. This boom is confirmed by a European hydrogen auction, which underscores the immense competitiveness of green hydrogen with record results. These three powerful impulses are now also driving the established players. The developments at Nel ASA, dynaCERT, and Daimler Truck are particularly noteworthy.

ReadCommented by André Will-Laudien on August 27th, 2025 | 07:10 CEST

Let off some steam! Caution advised for DroneShield, RENK, and Hensoldt - but opportunities at Pasinex

The stock market is entering a correction phase. For overheated stocks in the high-tech and defense sectors, this is a welcome opportunity to let off some steam. Now it is important to put the long-term prospects into perspective against the short-term hysteria. Doing so reveals where it may be worth buying after a correction. The charts are only just starting to rise, and a stronger correction should follow. In this context, the zinc projects of Pasinex Resources appear to be particularly attractive. As always, a balanced portfolio protects against unpleasant surprises. We present a few ideas.

ReadCommented by Armin Schulz on August 27th, 2025 | 07:05 CEST

China's leverage: Why Rheinmetall is struggling, European Lithium is benefiting, and BYD remains confident

The next wave of global conflicts will not be fought with weapons, but with export licenses. At the heart of this geopolitical struggle are critical metals without which no high-tech weapon, electric vehicle, or wind turbine can function. China's recent tightening of export restrictions has exposed the West's brutal dependency, forcing governments and corporations alike to rapidly rethink and realign their supply chains. While some companies are fighting to secure their supply chains, others are consolidating their sources or celebrating their monopolistic position. Three companies exemplify this dichotomy: the recently pressured defense giant Rheinmetall, the rare earth and lithium beneficiary European Lithium, and the Chinese giant BYD.

ReadCommented by Fabian Lorenz on August 27th, 2025 | 07:00 CEST

TAKEOVER rally and analyst reactions! Puma, CTS Eventim, AJN Resources!

Gold hopes, concert frustration, and takeover speculation—three exciting stories are currently moving the stock market. AJN Resources is starting the next phase of exploration and hopes to find millions of ounces of gold in Ethiopia. To this end, it has a strong partner on board. CTS Eventim shocks investors with weak figures, but analysts remain surprisingly calm. Is the stock now a buy? And at Puma, the possible exit of the Pinault family is causing the biggest jump in the share price in two decades. Is the cult brand facing a takeover from China? Analysts remain skeptical.

ReadCommented by André Will-Laudien on August 26th, 2025 | 07:20 CEST

Big moves! Buying frenzy at Novo Nordisk and PanGenomic Health, Valneva left behind

Things are moving again in the biotech sector! While Novo Nordisk appears to have finally found its footing after three profit warnings, PanGenomic Health continues its upward trend. Since launching its new business model in May, the stock has staged a phenomenal rally of over 1,000%. Meanwhile, Valneva faces a major setback as the US Food and Drug Administration (FDA) has halted approval of the chikungunya vaccine Ixchiq due to severe side effects. This comes as a shock to investors, who are now waiting for the Company to provide further explanations. The stock market has reacted with a sharp drop in the share price. How can investors benefit from the current situation?

Read