August 26th, 2025 | 07:20 CEST

Big moves! Buying frenzy at Novo Nordisk and PanGenomic Health, Valneva left behind

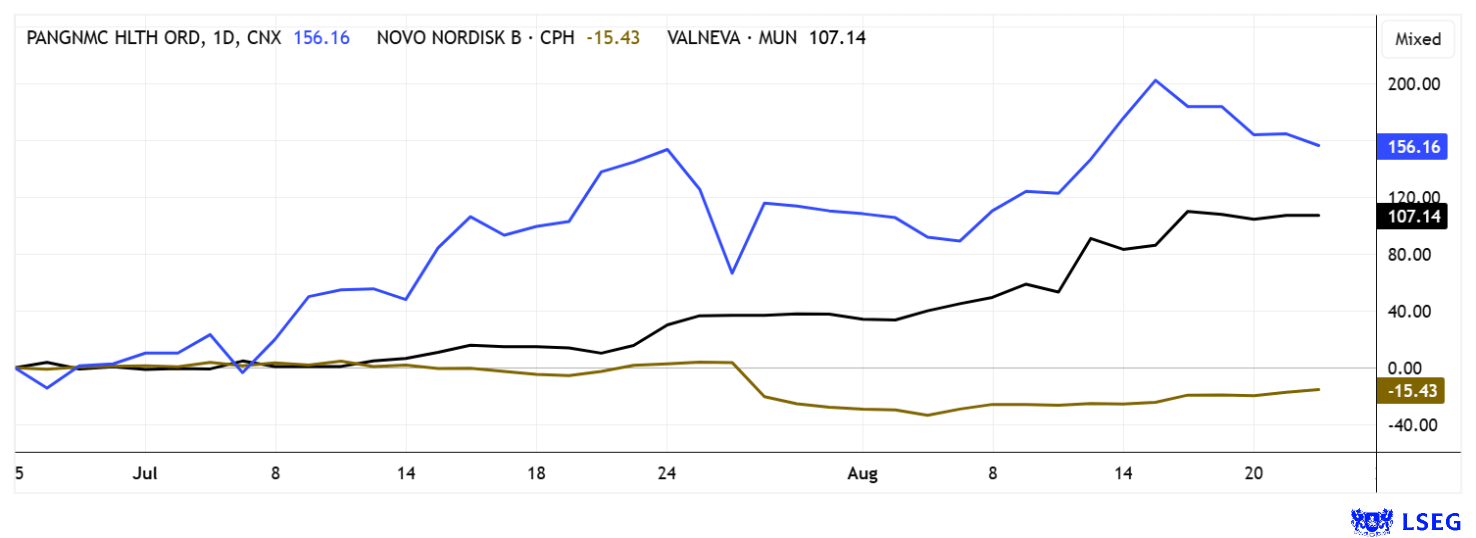

Things are moving again in the biotech sector! While Novo Nordisk appears to have finally found its footing after three profit warnings, PanGenomic Health continues its upward trend. Since launching its new business model in May, the stock has staged a phenomenal rally of over 1,000%. Meanwhile, Valneva faces a major setback as the US Food and Drug Administration (FDA) has halted approval of the chikungunya vaccine Ixchiq due to severe side effects. This comes as a shock to investors, who are now waiting for the Company to provide further explanations. The stock market has reacted with a sharp drop in the share price. How can investors benefit from the current situation?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NOVO NORDISK A/S | DK0062498333 , PANGENOMIC HEALTH INC | CA69842E4031 , VALNEVA SE EO -_15 | FR0004056851

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Novo Nordisk – Early signs of recovery could signal a turnaround

Novo Nordisk is back in the spotlight after a sharp drop in its share price at the end of July. The stock initially fell dramatically but is now showing signs of recovery. The drop was triggered by a significant reduction in the annual forecast and a change in management. The operational reasons lie primarily in growing competitive pressure, slower market access in the US, and increased price pressure from cheaper competing products, such as generic GLP-1 therapies. Wegovy and Ozempic, which have driven growth to date, are facing declining demand due to copycat products and potentially expiring patents.

Despite the challenges, Novo Nordisk increased its revenue by 16% to just under DKK 155 billion in the first half of 2025 and its operating profit by 25% to DKK 72.2 billion. The obesity business in particular remains dynamic, with revenue up 56% to DKK 38.8 billion. Diluted earnings per share climbed 23% to DKK 12.49. Surprisingly, the forecast for the full year was revised downward. Revenue is now expected to grow by only 8 to 14%, with operating profit rising by 10 to 16%. Strategically, Novo Nordisk is focusing on innovation, new formulations, and an expanded pipeline with a focus on Amycretin, CagriSema, and higher doses of Wegovy.

New CEO Mike Doustdar is tasked with guiding the Company through this challenging phase, while Novo Nordisk is pursuing patent strategies to secure the exclusivity of its products into the 2030s. Analysts are divided: while some highlight the strong portfolio, others urge caution in light of regulatory uncertainties. The median price target on the LSEG platform is DKK 502, well above the current level of DKK 366, signaling further upside potential.

PanGenomic Health – NaraCare.AI becomes an online blockbuster

Anxiety and depression are widespread today, but many sufferers still do not receive adequate support. PanGenomic Health (NARA) recognized this market gap during the COVID-19 pandemic and developed AI-based platforms aimed at promoting individual health. At the heart of the platform is the NARA app, which uses genetic characteristics and behavioral data to derive naturopathic recommendations. It also offers the Mindleap and MUJN platforms: Mindleap helps with stress management and provides online therapists, while MUJN focuses on diagnostics for cognitive disorders. The Company's proprietary Nustasis AI analyzes various data sources to deliver scientifically based, personalized therapy options. NaraCare.AI creates a holistic approach to health that combines features from multiple applications and uses modern AI models to provide alternative treatments along with evidence-based information. Users and therapists receive targeted support in selecting natural healing methods, including dosage and side effects. An integrated e-commerce store for alternative health products rounds out the offering.

With the launch of the Agenta Health e-commerce platform, PanGenomic is significantly expanding the reach of its health services. Agenta Health offers consumers a carefully curated selection of products to promote health and well-being, with all product information backed by scientific evidence. This platform is an important building block of the NaraCare.AI strategy, which is scheduled to be launched in the fourth quarter of 2025.

"The Agenta Health e-commerce website is the springboard for our NaraCare.AI platform," said Maryam Marissen, President and CEO of PanGenomic Health. "We believe that consumers are underserved when it comes to personalized online shopping for alternative health products. They are looking for better information about products that fit their individual health situations, lifestyles, and personal goals."

PanGenomic also announced recent progress in financing: Over 6.6 million stock call options have already been exercised, resulting in a cash inflow of nearly CAD 870,000. PanGenomic shares (ticker: NARA) continue to attract strong investor interest. Over the past four months, the share price jumped from CAD 0.18 to CAD 2.40, and yesterday the stock was trading at a slightly lower CAD 1.85. PanGenomic Health continues to demonstrate impressive momentum!

Valneva – Chikungunya vaccine pulled from shelves in the US

Valneva shares have been under massive pressure since yesterday after the US Food and Drug Administration (FDA) suspended approval for the Chikungunya vaccine Ixchiq with immediate effect following reports of four serious side effects. This means that Valneva must immediately stop shipping and selling the vaccine in the US, even though a suspension on its use for people over 60 was lifted just a few weeks ago. The reported cases occurred mostly in older people outside the US and, according to Valneva, are consistent with known risks, especially in patients with underlying medical conditions. The Company is investigating the incidents and emphasizes that it adheres to the highest safety standards.

Despite the setback, Valneva is sticking to its revenue forecast and continues to see opportunities in other markets such as Europe and Canada, where the vaccine was recently approved. In the first half of 2025, IXCHIQ generated revenue of approximately EUR 7.5 million, a large part of which came from a one-time delivery to La Réunion. The share price reacted immediately with a drop of over 23%, after having previously almost doubled. For Valneva, the permanent loss of US approval could have serious financial and strategic consequences. A further tightening of US vaccine policy would be particularly critical, especially with regard to the Lyme disease vaccine developed jointly with Pfizer, which is primarily intended for the US market. This uncertainty about the regulatory future is having a direct impact on the share price and overshadowing international approval successes. Analysts are urging caution, as reputation risks and additional regulatory hurdles could arise in addition to lost sales.

The biotech sector is back in the spotlight. While PanGenomic Health continues its triumphant advance, vaccine manufacturer Valneva is coming under heavy pressure. Novo Nordisk is at least showing signs of stabilization, which could be the start of a turnaround. Expected interest rate cuts in the US could give the entire sector a boost.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.