August 21st, 2025 | 07:20 CEST

Defense sell-off – New doublers are emerging with thyssenkrupp, Almonty, and Heidelberger Druck

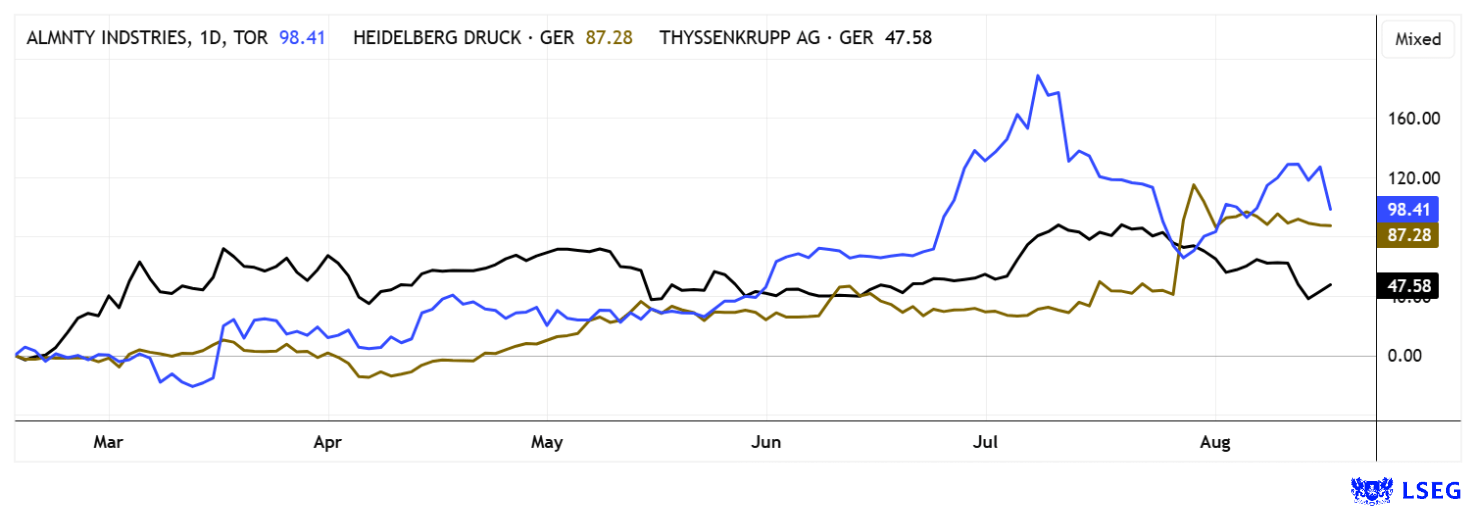

What defense speculators always feared as a looming threat is now happening within just one week: Peace negotiations between Russia and Ukraine! Even though nothing concrete has happened yet, the sentiment is clear: If only half of the numerous geopolitical conflicts calm down or even disappear entirely, the pressure to rearm will ease, and potential orders, which were already reflected extensively in share prices, could be reduced or canceled altogether. Public budgets resemble a pressure cooker at 120 degrees, so any relief is welcome. It will be interesting to see how far defense stocks might fall, especially after rising by up to 2000% in the case of Rheinmetall. Almonty remains interesting because, even with reduced defense demand, critical metals remain the bottleneck of Western industries. It is worth taking a closer look.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP AG O.N. | DE0007500001 , ALMONTY INDUSTRIES INC. | CA0203987072 , HEIDELBERG.DRUCKMA.O.N. | DE0007314007

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp – Spin-off of the TKMS marine business

Industrial groups such as thyssenkrupp play an important strategic role in securing key sources of technology in Europe. Long-awaited, the spin-off of the TKMS marine business is finally happening, paving the way for an IPO in the fall. TKMS will operate as an independent provider in the maritime defense sector, with thyssenkrupp retaining 51% of the shares and 49% going to the new shareholders. The listing on the Prime Standard of the Frankfurt Stock Exchange is scheduled for 2025, and demand is already huge in the media. The new structure will give TKMS greater entrepreneurial freedom and direct access to the capital market, enabling it to finance innovation and expansion independently. This strengthens Germany's security policy position within a rearming Europe. For the approximately 8,300 employees, this means additional growth prospects and stability as demand for complex maritime defense systems increases. The figures look good. The order backlog currently stands at over EUR 18 billion and includes international submarine orders and projects such as the research vessel "Polarstern II." Through targeted investments in digitalization and autonomous systems, TKMS has recently significantly improved its operational performance and margins.

Market experts anticipate high demand for the new shares, as TKMS is benefiting from geopolitical uncertainty and rising defense budgets. The valuation is expected to be set at EUR 4 to 5 billion outside the stock market, which is roughly in line with the current market capitalization of thyssenkrupp AG. However, it is still unclear how the group's debts will be distributed between the parent company and the subsidiary. For the struggling thyssenkrupp Group, the deal could be a way out without having to give up TKMS's long-term opportunities. Buy!

Almonty Industries – Strategically positioned in the spider's web

What a rollercoaster ride! Almonty Industries' share price has now stabilized again after the sharp correction surrounding its Nasdaq listing and the significantly oversubscribed capital increase. Despite political uncertainties and market turbulence, such as intensified trade conflicts with China and Russia, it showed considerable strength and defended important technical support zones. It should not be forgotten that Almonty had gained a good 800% in just 12 months! The background to this is the strategic importance of tungsten, which NATO considers to be a critical raw material for defense, aviation, and high-tech. China dominates the market and has further restricted its export quotas for 2025, which is an advantage for Western alternatives such as Almonty.

CEO Lewis Black is strategically positioning his company as a key Western supplier of tungsten. The fresh capital is being used to expand its projects, particularly the flagship Sangdong project in South Korea, which is currently in the pre-production phase and expected to begin ramp-up in 2025. At the same time, Almonty has secured long-term supply contracts with US defense contractors and is strengthening its industrialization strategy by relocating its headquarters to the US and hiring an experienced CFO. In addition to tungsten, molybdenum is also emerging as a second growth pillar: a purchase agreement with South Korea's SeAH Group is already in place, offering enormous growth potential in the long term.

More about the tungsten business in the latest interview between GBC analyst Greiffenberger and Stockhouse: https://stockhouse.com/opinion/interviews/2025/07/28/building-assets-producing-critical-minerals-and-slashing-dependency-on-china

Rising commodity prices, particularly for tungsten (+40% in six months) and molybdenum (+30%), will strengthen the earnings base when the first concentrates are delivered from Korea. Analysts on the LSEG platform attest to the Company's clear valuation trend with price targets of up to CAD 9.00 and an expected average of approximately CAD 7.00. From yesterday's price of CAD 5.60, this represents a potential gain of just under 30%. The latest quarterly loss of CAD 58.2 million was impacted by special items and non-cash options, but cash reserves remain solid thanks to capital measures. Almonty could become a true beneficiary of the global market shift as the first fully integrated Western tungsten source. It also holds further upside potential due to ongoing takeover speculation. CEO Lewis Black just has to wait - like a spider in its web!

Heidelberger Druck – Up and down again

Heidelberger Druck has started the 2025/26 financial year with strong momentum and is entering a phase of clear realignment, which is generating enthusiasm on the stock markets. After years of declining revenues, the Company is increasingly turning away from its traditional printing business and focusing more on growth areas such as energy supply and, above all, defense technology. A strong signal in this regard is the new, long-term partnership with Vincorion, a specialist in military energy systems. This strategic shift was rewarded by the market with massive share price gains, even though the share price has calmed down again after a brief surge.

The figures for the first quarter, however, speak for themselves: Revenue rose by 15% to EUR 466 million, benefiting in particular from growth in Europe and Asia. Adjusted EBITDA improved significantly from EUR –9 million to EUR 20 million, while earnings after taxes improved from EUR –42 million to EUR –11 million. At EUR 559 million, order intake was solid at the upper end of expectations, even though it remained below the previous year's level. The measures taken in the areas of personnel and efficiency had a positive effect: Free cash flow improved significantly compared with the previous year and, at EUR –68 million, was better than expected.

CEO Jürgen Otto believes Heidelberg is well-positioned to benefit from emerging technology opportunities and its entry into the defense sector, thanks to its optimized cost structure and strong international presence. The Company is confirming its forecast for the full year: Assuming a stable global economy, it expects revenue of around EUR 2.35 billion and an EBITDA margin of up to 8%, signaling the ambitious outlook of this long-established company. From a technical perspective, an entry below EUR 1.90 appears attractive, as this would also mark the completion of the current consolidation phase from above.

The defense sector is currently prone to profit-taking. From a valuation perspective, this may continue for a few more days, but strong technical counter-movements are likely once the artificial euphoria premiums have been priced out. Almonty has already rebounded by 30%, but this is likely not the end of the road, as the pipeline is full to bursting. Heidelberger Druck is once again offering attractive entry prices at around EUR 1.85. Thyssenkrupp is clearly living off the IPO fantasy for TKMS.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.