Comments

Commented by Nico Popp on September 23rd, 2025 | 07:00 CEST

What MASH could do for your portfolio: BioNxt, Roche, Novo Nordisk

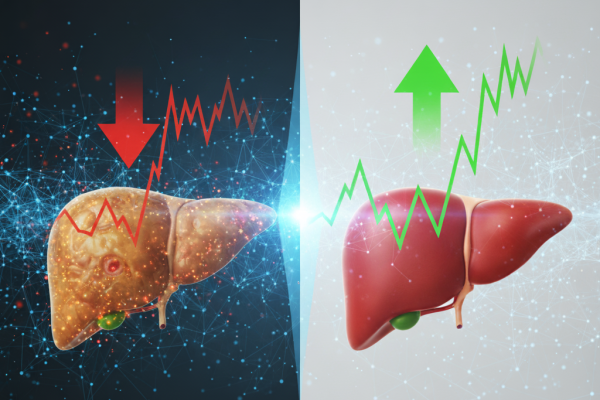

Have you heard of MASH? The acronym stands for metabolic-associated steatohepatitis, which was previously simply called "fatty liver." Medications targeting this disease, which studies suggest affects around 6% of Americans, are being hailed as the next big trend in the biotech market. Overall, one in three overweight individuals is affected. Since many patients initially show no symptoms, MASH is considered particularly insidious. The growing discussion around the condition could turn many at-risk individuals into patients who take medication, which is excellent news for certain companies in the sector. For a small-cap stock, the hype surrounding MASH could even be transformative.

ReadCommented by Carsten Mainitz on September 22nd, 2025 | 07:55 CEST

AJN Resources, TUI, Evotec: Fresh capital and insider purchases!

Fresh capital, insider purchases, or significant changes in the shareholder base can be important signals regarding future share price performance. The leverage effect of fresh capital is particularly high for smaller companies. This is because projects can be launched with manageable amounts of capital, bringing important milestones closer. However, the stock market sometimes reacts late because small or micro-caps fly under the radar of the investor community. However, it is precisely this constellation that creates good opportunities for active and vigilant investors.

ReadCommented by Stefan Feulner on September 22nd, 2025 | 07:45 CEST

Almonty Industries, Rheinmetall, D-Wave Quantum – Alarm bells are ringing

Tungsten is one of the most strategically critical raw materials in the global economy. With its extremely high melting point, exceptional density, and hardness, the metal is indispensable, especially in the defense industry and semiconductor technology. Tungsten is also essential in toolmaking, aviation, and medical technology. The problem: over 80% of global production comes from China, a massive dependency that is increasingly viewed critically in times of geopolitical uncertainty. With the global expansion of defense and high-tech, demand is rising rapidly, but secure Western supply chains are virtually non-existent.

ReadCommented by Armin Schulz on September 22nd, 2025 | 07:40 CEST

BioNxt Solutions: Your chance to get in early on the next biotech blockbuster

Imagine a cancer treatment that doesn't affect the whole body, but instead acts only at the tumor site. Or a treatment for multiple sclerosis that no longer needs to be swallowed, but simply dissolves under the tongue. What sounds like a dream of the future is already being pursued with full force by the German-Canadian biotech company BioNxt Solutions. The Company is developing two innovative platform technologies that aim to solve some of the biggest challenges in modern medicine. For investors, this opens up extraordinary opportunities.

ReadCommented by Fabian Lorenz on September 22nd, 2025 | 07:35 CEST

Defense fantasy and takeover buzz! Daimler Truck, thyssenkrupp, Pasinex Resources!

Defense, takeovers, and raw materials moved the stock market last week. After a period of weakness until April, the price of zinc has risen significantly again, benefiting Pasinex Resources. The Company focuses on high-grade zinc deposits in Turkey and the US, and it has now acquired 100% of a key project. Revenue and earnings are set to increase from 2026 onwards, with net margins of up to 50% on the horizon. This makes the stock appear undervalued. Will defense fantasies boost Daimler Truck's stock? The stock has been one of the underperformers in the DAX so far. In the future, the Company plans to collaborate more closely with a US defense contractor. Meanwhile, thyssenkrupp's stock is at a multi-year high. But is the Company effectively winding itself down? The latest takeover bid points in that direction.

ReadCommented by André Will-Laudien on September 22nd, 2025 | 07:30 CEST

E-mobility poised for the next boost! Focus now on Mercedes-Benz, Geely, BASF, and Graphano Energy!

The market for electric vehicles is heavily influenced by current battery technology. Advances in high-performance materials and solid-state batteries are significantly improving range, performance, and safety. Faster charging times and longer battery life are leading to greater consumer acceptance. The development of silicon anodes and new cathode materials is enabling more efficient and cost-effective batteries. Sustainable recycling methods are also important, as they strengthen the circular economy and reduce environmental impact. With the expansion of charging infrastructure, range anxiety is decreasing, and EV usage is becoming more convenient. This highly innovative environment opens up opportunities for both manufacturers and investors alike. Those who understand the key players in the space can achieve substantial returns.

ReadCommented by Armin Schulz on September 22nd, 2025 | 07:25 CEST

How to profit from the arms race: Rheinmetall on the ground and Volatus Aerospace and DroneShield in the air

The global security landscape is undergoing a historic shift. Driven by geopolitical tensions, modern warfare is moving into the digital realm, with drones emerging as a crucial key technology. This paradigm shift is creating a billion-dollar market for defense systems and offering investors exceptional growth opportunities. While defense giant Rheinmetall strengthens the backbone of national defense with conventional technologies, specialists like Volatus Aerospace and DroneShield are positioning themselves at the forefront of this technological revolution.

ReadCommented by André Will-Laudien on September 22nd, 2025 | 07:20 CEST

SMR nuclear power on the rise! 100% with Oklo, First Hydrogen, E.ON, and Plug Power

Since Fukushima, nuclear power seemed to be on the decline, but with the energy transition, it is now experiencing a spectacular comeback, with small modular reactors (SMRs) taking center stage. Although this topic is only sporadically addressed in Europe, the US, under Donald Trump, recently approved a program to quadruple domestic nuclear power by 2050. While Brussels is still hesitating, the technology is advancing in Poland, France, Finland, and Czechia. These innovative countries are planning concrete SMR projects, while France even classifies the reactors as a pillar of future energy supply. Of course, large amounts of electricity are also supplied to Germany at high prices. Canada has already started approval processes for its first plants, and British energy giant Rolls-Royce is working on the series production of its own SMR technology. Even the International Atomic Energy Agency (IAEA) is now talking about a turning point. Which companies are currently at the forefront of this nuclear revolution?

ReadCommented by Nico Popp on September 22nd, 2025 | 07:15 CEST

Serbians don't want mines – Are Europe's battery supply chains at risk? BYD, BMW and European Lithium

A recent article in the Frankfurter Allgemeine Zeitung (FAZ) reveals that the vast majority of Serbians oppose lithium mining in the country. The Journal for International Politics and Society cites a survey according to which 55% of Serbians are against a lithium mine in the Jardar Valley – only 25% are in favor of it. The latest media report paints an even bleaker picture. According to the report, the various population groups in Serbia have rarely been as united as they are in their opposition to the mine. But what does this mean for European battery supply chains? Which companies will be penalized, and which will benefit? We analyze the situation.

ReadCommented by André Will-Laudien on September 22nd, 2025 | 07:10 CEST

Takeovers in the chip sector – Gold is unstoppable! Intel, AMD, Infineon, and Sranan Gold

The stock market is booming, and strategic partnerships are nothing unusual. Then last week came the bombshell: the world's largest chip designer, Nvidia, is investing billions in its rival Intel. The two semiconductor companies announced that Nvidia will acquire Intel shares worth USD 5 billion. They also plan to jointly develop chips for PCs and data centers in the field of artificial intelligence. That adds more fuel to the already overheated NASDAQ rally. A rate cut by the Fed on Wednesday also catapulted precious metals upwards. Gold touched the USD 3,700 mark, while silver broke through the next barrier at USD 43. The bull market continues, and as usual, it is high-tech stocks and gold stocks like Sranan Gold that are leading the way. Here is an important update.

Read