July 28th, 2025 | 07:15 CEST

Better than Nvidia and without AI – 185% with Veganz, Bayer, Novo Nordisk, and Nestlé in focus

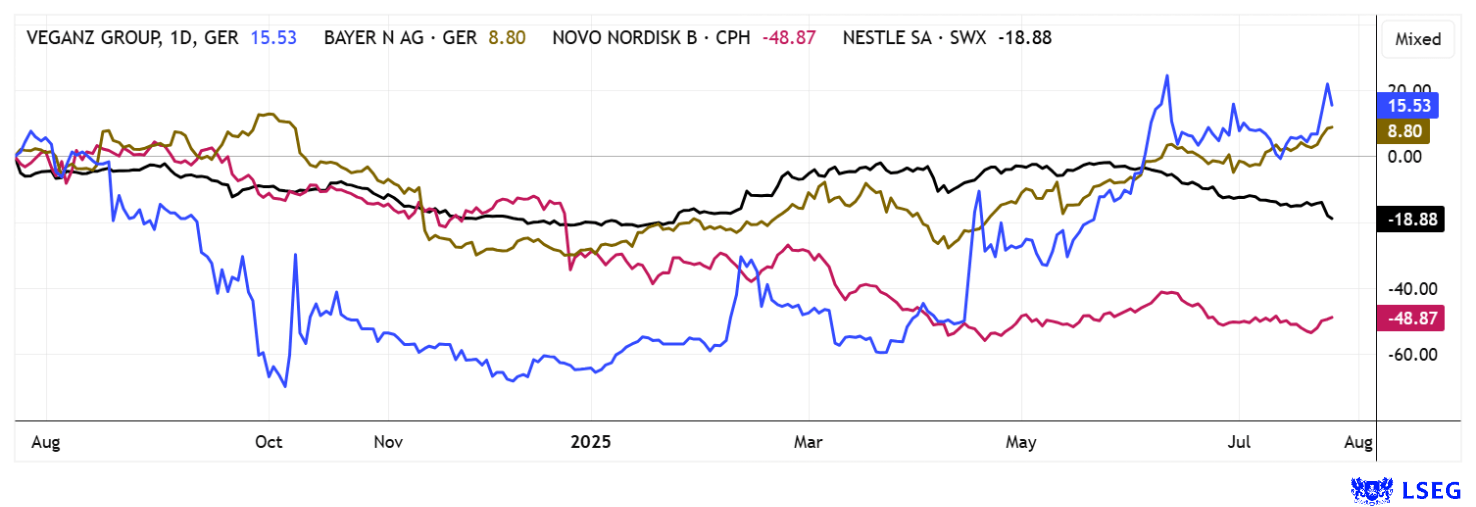

It does not always have to be NVIDIA. German stocks are also performing well. Those who took advantage of Trump's tariff panic in April to buy in have since earned 75% with NVIDIA, but a whopping 185% with German plant-based nutrition expert, Veganz Group. Even the long-sidelined pharmaceutical giant Bayer has made an astonishing comeback with 50% growth, while Nestlé, supposedly an anchor in many portfolios, has lost 15%. Some call it selection luck, while others refer to it as sector rotation. It is currently apparent that the long, strong rally on international stock markets is benefiting only a few stocks. It remains fascinating that the stock market always celebrates when Donald Trump's tariff threats ultimately turn out to be less severe than initially expected. What remains for the economy, however, is less growth and high prices at the checkout. The new US policy stands for many things, but first and foremost, for less trade and economic downturn. How can investors still profit?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VEGANZ GROUP AG | DE000A3E5ED2 , BAYER AG NA O.N. | DE000BAY0017 , NOVO NORDISK A/S | DK0062498333 , NESTLE NAM. SF-_10 | CH0038863350

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nestlé – Not on the list of favorites for three years

For years, Nestlé shares were a guaranteed source of profit for conservative portfolios. The stock was synonymous with stability, but since the beginning of 2022, it has declined by approximately 40%, while global indices have risen by around 50%. For a long time, Nestlé was a prime example of stable margins and global growth, but those days are over. The combination of higher raw material and energy prices, geopolitical tensions, and changing consumer behavior has had a noticeable impact on the Swiss food giant's business model. Margin development, in particular, lags behind the industry average. While competitors such as Mondelez and Unilever have been able to defend their profitability through consistent portfolio streamlining and pricing, Nestlé is struggling with a highly diversified brand portfolio. And price adjustments can only be implemented to a limited extent in this area. The operating margin has been declining since 2021 and is now well below the historical average of around 17.5%.

Consumers are becoming more price-conscious, particularly in Europe and North America, the most important sales markets, and are increasingly turning to private labels at the expense of established Nestlé brands such as Maggi, Nescafé, and KitKat. The focus on functional nutrition and health is also not yielding results as quickly as expected. Internal challenges, such as an overly broad brand structure and high advertising expenses, are additional burdens. While smaller competitors are responding more agilely, Nestlé appears to be moving very slowly in its restructuring process. CEO Mark Schneider is sticking to his medium-term margin improvement target, but analysts on the LSEG platform are increasingly skeptical. They now only give the long-established company an average price target of CHF 89, just 20% above its battered share price. With a 2025 P/E ratio of 17.8, investors can at least hope for a stable dividend of 4.1%.

Veganz Group – From vegan pioneer to innovative food tech player

The Berlin-based experts in plant-based nutrition, the Veganz Group, are moving in a smarter, faster, and more innovative direction. Fully in tune with nature, the two founders, Jan Bredack and Juliane Kindler, conjured up vegan ideas out of thin air in 2011. When the branch operation proved unprofitable in 2017, the Company made a strategic shift from loading areas to its own brands and production. Today, Veganz operates several of its own production facilities, including a cashew-based Camembert plant in Berlin, a cheese alternative facility in Austria, and a site dedicated to algae-based smoked salmon. At the heart of its current innovation strategy is Mililk® technology - a 2D-printed milk alternative. This proprietary and exclusively licensed product represents a key strategic growth area.

The Veganz Group now supplies over 28,000 outlets in more than 26 countries, from discounters to the organic segment. Following several restructuring measures, the AG achieved revenue of EUR 10.8 million in 2024, with EBIT remaining at a loss of EUR 3.9 million. Analysts at mwb Research have evaluated the Berlin-based company following the latest capital measure and assigned a rating of "Speculative Buy." Based on the new number of shares, which is approximately 2.03 million, the fair value is calculated to be EUR 21.50. The large cash inflow of EUR 7.1 million significantly reduces Veganz's operating risk and will be used to finance growth initiatives. These include, in particular, the expansion of production capacities and the rollout of Mililk® in strategic partnerships. A plant with a capacity of 60 million litres is planned in the US by 2026. Assuming the sale of its stake in OrbiFarm for EUR 30 million plus an earn-out is finalized, the outlook for Veganz improves significantly once again. In this case, mwb Research calculates an additional value per share of EUR 10.80.

Growth drivers for the coming years clearly lie in the expansion of in-house production, patent exploitation, and internationalization. Veganz plans to market Mililk® through food service channels and acquire licensees. Additionally, a significant increase in production at the new factory in Ludwigsfelde and in cheese production in Austria is expected to contribute to an expanded sales base. If Veganz successfully licenses its product innovations and significantly increases output, there is considerable potential for an EBIT turnaround. The Company's clear focus on niche products with growth potential, coupled with its B Corp certification and credible commitment to sustainability, sets it apart from its competitors. The Mililk® technology, in particular, could establish itself as a scalable export product. Veganz now offers not only plant-based nutrition but also a growth-oriented food tech model that is ideal for forward-looking investors and risk-conscious portfolio structures.

Novo Nordisk – Signs of stabilization

Obesity would likely be preventable with a vegan diet. The Novo Nordisk Group has already earned billions with weight loss products such as Ozempic, but the stock has gone through tough times. Competitive products and weaker sales figures have sent the pharmaceutical company into a downward spiral, and expectations have already had to be lowered three times. The market value of what was once Europe's second-heaviest company has thus fallen by a full 50% to just EUR 268 million. However, the chart is now showing initial signs of stabilization, allowing long speculators to jump back on the bandwagon. The Q2 figures, which will be presented on August 6, are likely to be pivotal. Analysts are expecting earnings of 6.01 Danish kroner per share. The 2025 P/E ratio has risen to 17.3 due to the poor earnings forecasts. It is advisable to wait for the news, as the risk remains very high.

Bayer – Are all problems now off the table?

After bottoming out at around EUR 19, Bayer shares have recovered dynamically to over EUR 29. Positive news about the pipeline is currently providing additional momentum: The prostate cancer drug Nubeqa (darolutamide) has received a recommendation from the EMA for approval in a third indication, the treatment of metastatic hormone-sensitive prostate cancer (mHSPC) in combination with ADT. The final decision by the EU Commission is considered a formality, especially since approval has already been granted in the US. This puts Bayer's pharmaceuticals division back in the spotlight, while the glyphosate issue is slowly losing importance. Analysts agree on a 2025 P/E ratio of just 6.6, while the book value currently stands at over EUR 34 per share, despite the Company's high debt. An operational update for Q2 is due on August 6. From a technical perspective, there is now room for the share price to rise to around EUR 35. Exciting!

Global stock markets have recently suffered little from the tariff debates. New highs were reached across the board. The pharmaceutical stocks of Bayer and Novo Nordisk are now in focus, while in the food sector, investors should look to the opportunities offered by the innovative Veganz Group, as traditional business models, such as those of Nestlé, appear to be outdated.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.