Comments

Commented by Nico Popp on September 16th, 2025 | 07:15 CEST

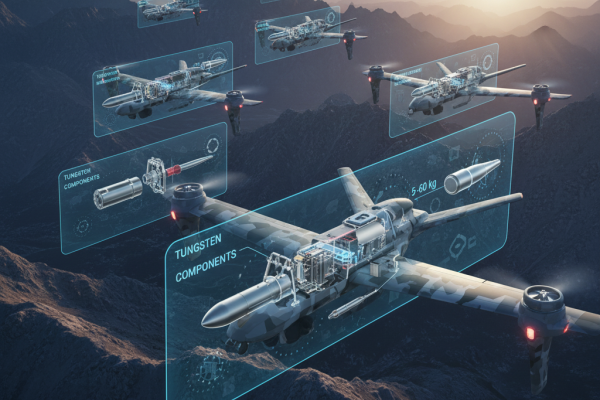

Defense industry expands – New growth drivers: Hensoldt, Almonty and Rheinmetall

An industry once largely overlooked by the public is now dominating the headlines. On Monday, it was announced that Rheinmetall will acquire the Marine Division of the Bremen-based Lürssen Group. This includes the Blohm + Voss shipyards, the Norderwerft shipyard in Hamburg, the Peene shipyard, and the Neue Jadewerft shipyard in Wilhelmshaven. This move underscores how the defense industry is venturing into new domains. Meanwhile, tensions between Russia and NATO continue to escalate. The drones that flew over Poland last week are considered by experts to be a serious provocation. In this context, we take a closer look at three high-flyers in the defense industry and highlight where investors may find the greatest opportunities.

ReadCommented by Fabian Lorenz on September 16th, 2025 | 07:10 CEST

OPPORTUNITY for 100% returns and a short squeeze! D-Wave Quantum, Zalando and Rio Tinto partner Aspermont

While traditional AI stocks like Nvidia, Palantir and Oracle are becoming increasingly overheated, investors are now turning their attention to second- and third-tier companies. These are companies that are poised to benefit from the adoption of AI technologies. One example is the hot stock Aspermont. The Australian company holds a massive trove of data on the global resources industry. The latest bombshell: a partnership with mining giant Rio Tinto, which is paying for access to and processing of Aspermont's valuable data. The stock has not yet reacted. At Zalando, analysts see upside potential of up to 100%. The e-commerce group could also benefit from AI advancements. And then, of course, there is quantum computing, seen as a potential challenger to AI. Could investor favorite D-Wave be on the verge of a short squeeze?

ReadCommented by André Will-Laudien on September 16th, 2025 | 07:05 CEST

Stock market with explosive potential – Where are the winners? Daimler Truck, dynaCERT and Plug Power

The stock market is currently developing very selectively. In addition to the megatrends of artificial intelligence, high-tech, and defense, investor interest is gradually shifting to future-focused sectors that have not yet felt much of the general bull market. The hydrogen sector in particular has hardly benefited from the general bullish mood so far. In addition to industrial applications within the energy transition, hydrogen technologies offer significant potential in heavy-duty transport, local transport and mining. The goal is to significantly reduce diesel consumption and thus contribute to emissions reduction. This is particularly true in cases where battery-powered trucks reach their limits in terms of range, weight, or charging times. The market for fuel cell infrastructure is growing rapidly. The EU plans to invest around EUR 5 billion in this area by 2030. Pilot projects and government subsidies are driving development forward, and private investors are now starting to take notice. Where do the opportunities for investors lie?

ReadCommented by Fabian Lorenz on September 16th, 2025 | 07:00 CEST

Hot Stock shakes up Big Pharma! BioNxt Solutions aims to replace Ozempic weight loss injection!

BioNxt is currently shaking up Big Pharma. The announcement that it plans to replace the Ozempic weight loss injection with an oral dissolvable film is once again fueling speculation about the share price. Just like in the multiple sclerosis space, the Company aims to disrupt a billion-dollar obesity market. Further exciting operational news is expected in the coming months. Key patents are already in place. With a market capitalization of around CAD 100 million, the Canadian-German life sciences company is far from expensive – even for Big Pharma. The major corporations will undoubtedly be watching BioNxt's development very closely in the coming months. Until then, the stock is likely to trade significantly higher.

ReadCommented by Armin Schulz on September 15th, 2025 | 07:25 CEST

Beyond FAANG, German tech companies such as SAP, Finexity and TeamViewer also offer potential for your portfolio

While US tech giants like Meta and Google dominate the headlines, other technology companies in Germany receive little attention. But here too, on the other side of the Atlantic, innovative companies with disruptive technologies and robust business models are shaping the future and offering unique opportunities for capital growth. Reason enough to take a closer look at three German companies: SAP, Finexity and TeamViewer. We analyze the strategic decisions and innovations that will shape the next investment success story.

ReadCommented by Fabian Lorenz on September 15th, 2025 | 07:20 CEST

Gold mining stocks in takeover fever! Barrick Mining and Newmont are selling! B2Gold neighbor Desert Gold in the crosshairs?

Takeover fever is sweeping through the gold sector. The typical cycle of the industry appears to be repeating itself once again: with the rising price of gold, which remains solidly above USD 3,600, the appetite for takeovers is also growing. Gold producers are earning more, and banks and private equity firms are opening their coffers for mergers and acquisitions. For large and small mining companies alike, the current market phase offers an opportunity to expand their portfolios, optimize projects, or reposition themselves through strategic sales and purchases. Barrick and Newmont are currently raising billions through asset sales, boosting their war chests. In contrast, Desert Gold - a neighbor of B2Gold - could soon see a partner come on board or even become an acquisition target. Analysts see significant upside potential for the share.

ReadCommented by Nico Popp on September 15th, 2025 | 07:15 CEST

No more diet injections! Innovations in weight loss drugs: BioNxt Solutions, Merck & Co., Novo Nordisk

As recently reported by the United Nations Children's Fund (UNICEF), for the first time, more children worldwide are obese than underweight. While this is a great success in the fight against hunger, it also poses new risks. Severe overweight in childhood leads to obesity and associated diseases in adulthood, such as cardiovascular problems and diabetes. The treatment of overweight and diabetes in children is therefore likely to play an even more significant role in the future. GLP-1 receptor agonists have been popular for several years now in the form of modern weight loss injections. With patents expiring soon, experts anticipate substantial further growth and development in this rapidly expanding market. We explain who could benefit and what the future holds for modern diet medications.

ReadCommented by Stefan Feulner on September 15th, 2025 | 07:10 CEST

Equinox Gold, AJN Resources, K92 Mining – Gold boom with clear signals

The price of gold is currently only moving in one direction: Steeply upwards! After jumping above the previous record high of USD 3,500 per ounce, the USD 4,000 mark is now within reach. Central banks are buying massively, and investors are seeking security amid geopolitical crises, thereby driving up prices. Gold mining stocks are now benefiting enormously from this development. We present three stocks that are particularly in focus and are being carried by the current momentum.

ReadCommented by Fabian Lorenz on September 15th, 2025 | 07:05 CEST

NATO without drone defense! Opportunity for Rheinmetall, DroneShield and Volatus Aerospace!

Is a new rally starting for drone stocks? The shooting down and crash of Russian drones in Poland has painfully highlighted NATO's vulnerability in this area. Recent years have shown how unmanned aerial vehicles are revolutionizing warfare. However, NATO appears to have a lot of catching up to do in terms of its drone inventory, detection and defense. Volatus Aerospace—which trains pilots and monitors borders, among other things—and drone defense specialist DroneShield should benefit from this. Both stocks had multiplied in value at the beginning of the summer. After the setback, prices could now rise again. Rheinmetall is also becoming increasingly involved in this area. What does Germany's largest defense contractor have to offer?

ReadCommented by André Will-Laudien on September 15th, 2025 | 07:00 CEST

Security is key – Acquisitions continue to drive growth! 100% bull market possible with Almonty, Steyr, Mutares and Deutz

The stock markets are looking for direction! While the Russia-Ukraine conflict enters the next round with the drone incident in Poland, prices for strategic metals continue to rise. Western industries are under pressure from NATO rearmament and are looking for secure jurisdictions to be able to process highly sensitive orders. Supplies of critical raw materials from China have fallen by 90% since March 2025, with only long-term contracts still being fulfilled. But what about the current boom in orders? The price of the critical metal tungsten has doubled within 12 months. The primary beneficiary is Almonty Industries, as it already has active mines in Europe and is about to launch a mega-project in South Korea. Highly exciting, but also a challenge for investors. What happens next?

Read