October 16th, 2025 | 07:35 CEST

Gold continues to soar to USD 4,200, critical metals in a panic storm! MP Materials, AJN Resources and Standard Lithium

The US government has declared a state of emergency regarding critical metals. Due to disrupted trade policies with China, Beijing is threatening to halt the supply of key metals and rare earths completely. Will the tariff threats from the Trump administration help? It is doubtful, as China clearly holds the upper hand. Western industrial powers have long understood the stakes. Building domestic mining operations takes time and money, but it is urgently necessary. Investors can benefit from the panic scenarios of recent weeks because commodity markets have been lying in wait for years and are now being hit by an immeasurable flood of money. Where should investors position themselves now?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

MP MATERIALS CORP | US5533681012 , AJN RESOURCES INC. O.N. | CA00149L1058 , STANDARD LITHIUM LTD | CA8536061010

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

MP Materials – Tenfold increase and still too cheap?

Anyone looking at the stock prices of companies involved in critical metals will rub their eyes in disbelief. MP Materials inevitably stands out. The Company was the first US stock to secure a government deal focused on critical metals. As the only major producer of these strategically important raw materials in the Western Hemisphere, MP Materials benefits directly from US efforts to break away from Chinese dependencies. Thanks to the successful expansion of its processing facilities in California, the Company can now produce high-quality rare earths entirely domestically. However, the full ramp-up of production will still take some time.

The US Department of Defense has classified MP Materials as a strategic security asset and agreed on a long-term minimum purchase price for its main product, rare earth elements (REE). This largely protects the Company's revenues against price fluctuations. The partnership with Apple, which has invested over USD 500 million in a magnet supply contract, further highlights the Company's industrial significance. The elevated value of USD 16.3 billion reflects not only industrial worth, but also a so-called geopolitical premium - the market is granting the Company an additional valuation premium due to its strategic importance. The rating of the stock on the LSEG expert platform is notable: 9 out of 14 analysts recommend buying the stock, with an average 12-month price target of USD 72.45. The day before yesterday, the stock reached nearly USD 100, before a small correction set in yesterday. Could this be the beginning of a larger correction?

AJN Resources – Huge potential lies dormant here

In addition to critical metals, the price of gold has surged by another USD 1,000 in just six weeks, reaching an all-time high of USD 4,200. AJN Resources, a Canadian explorer focused on East Africa, stands to benefit from this rally. Under the experienced leadership of geologist Klaus Eckhof, the Company has shifted its focus from lithium to gold, with Ethiopia as its central location. AJN recently acquired a 70% stake in the promising Okote Gold project, located just 100 km from the important Lega-Dembi mine.

New geological mapping and sampling have identified several mineralized shear zones that indicate significant gold potential. In particular, the main target, the NNE-SSW trending Okote Central Shear Zone, shows thicknesses between 10 and 40 meters with a steep westward dip. Three additional parallel zones in the Okote East area, with a cumulative width of over 60 meters, have been identified over a length of 1 km and remain open to the north and south. These structures are characterized by intense quartz-carbonate alteration and disseminated pyrite and chalcopyrite mineralization. To date, a total of 43 rock samples and 34 channel samples have been collected, with results expected from ALS Global in Ireland.

In parallel, a 1,500-meter drill program has been prepared and is expected to commence shortly. CEO Eckhof emphasizes that the recent mapping provides a deeper insight into the geological structures and lays the foundation for targeted drilling. The region itself is benefiting from growing economic stability and extensive infrastructure investment, attracting increasing international attention to Ethiopia. With a current market capitalization of only CAD 6.5 million, AJN appears undervalued relative to the project's potential. AJN Resources combines geological expertise, a solid financial position, and regional growth opportunities in a promising overall package. Collect!

Standard Lithium – Now the lines are cast

Like a phoenix rising from the ashes, shares in US lithium specialist Standard Lithium have surged in the last three weeks. Completely swept up in the "critical metals" euphoria, sales increased tenfold, catapulting the value up by over 300%. However, specific reasons were certainly also the announcement of the DFS (Definitive Feasibility Study) for the South West Arkansas project, which provided reliable planning data for the first time. With an expected production capacity of 22,500 tons of lithium carbonate per year, this results in an internal rate of return of over 20%. Investors were enthusiastic about this progress and now see clear growth prospects. A previously agreed subsidy through the Smackover Lithium joint venture with Equinor gives the Company a strong strategic partnership and access to resources. In addition, there is USD 225 million in government funding to support phase 1 of the SWA project. At the same time, rising lithium prices and increasing supply risks have brought the market for North American metal and lithium projects into focus. Due to the high level of activity in the sector, there is naturally already speculation about takeovers or investments. The rally could therefore continue here.

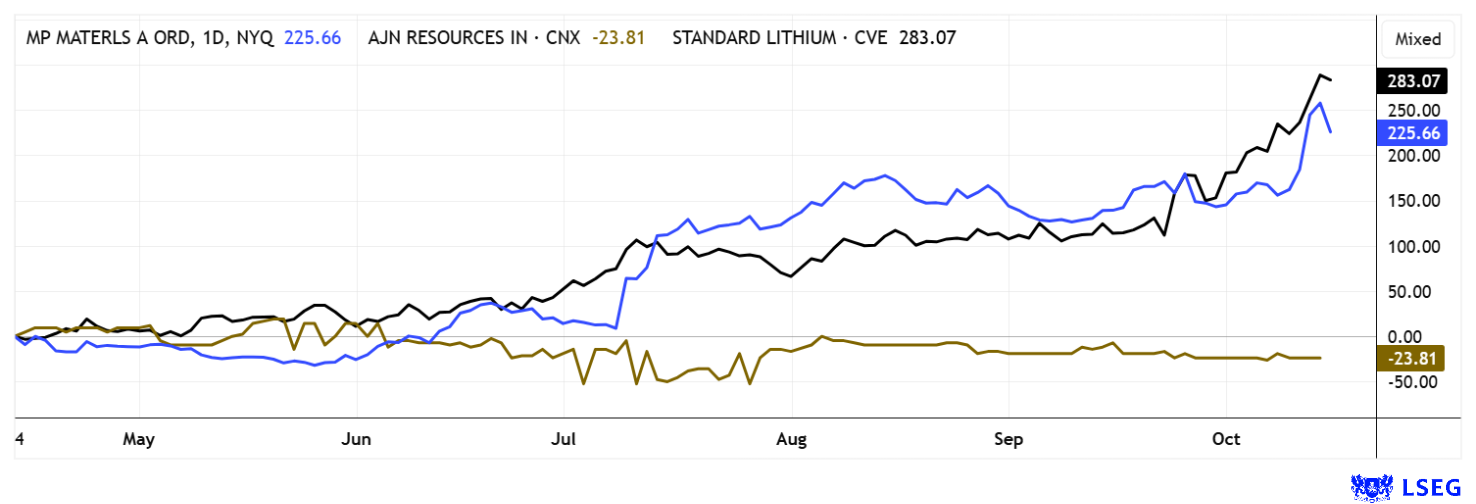

The stock market is prepared to pay exceptional prices for scarce commodities. Anyone jumping on MP Materials, which has seen a price gain of more than 700% since 2024, will need strong nerves. Standard Lithium was struggling with the USD 1.50 mark in May and climbed to over USD 5 at the start of the week. AJN Resources could experience similar moves if positive drilling results are announced. Good diversification is key to protecting against sharp portfolio fluctuations.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.