July 28th, 2025 | 07:10 CEST

Hensoldt, Almonty Industries, MTU Aero Engines – Profit-taking after milestone

The signs of a correction on global stock markets are growing. In addition to the historically high Shiller P/E ratio, call options reached their highest share since the meme stock euphoria of 2021 last week, accounting for almost 70% of total option volume. Market sentiment is extremely bullish, which could indicate an imminent consolidation. One of the most promising commodity companies of the future consolidated last week. Following outstanding news, investors cashed in, which could offer long-term entry opportunities.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , HENSOLDT AG INH O.N. | DE000HAG0005 , MTU AERO ENGINES NA O.N. | DE000A0D9PT0

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

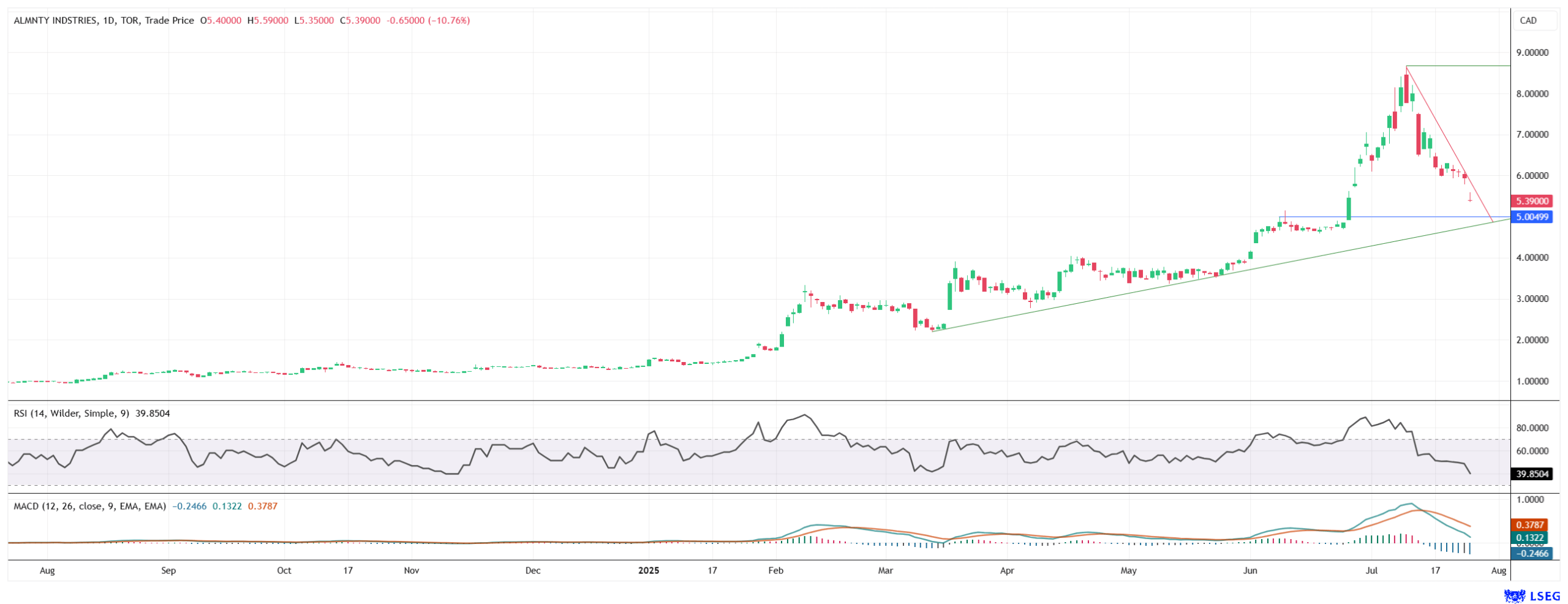

Almonty Industries – Sell on good news

The fact that both stock indices and individual stocks move in waves, even during extreme upward movements, is nothing new on the stock market. Consolidations reduce overbought situations and the market looks for "refueling stations" to find new entry opportunities. This was also the case last week with the up-and-coming tungsten producer Almonty Industry, which is becoming a beacon of hope for Western raw material supplies thanks to the construction of its mine in South Korea.

Following its successful Nasdaq listing in mid-July and the completion of an issue of 20,000,000 common shares at an issue price of USD 4.50 per share, which generated gross proceeds of USD 90 million for the Canadian company and strategically set the course for further expansion, Almonty's share price began to decline. However, long-term investors should bear one thing in mind. With its cash reserves, Almonty is not only expanding its own tungsten oxide production but also creating a unique selling point with its own smelting operation, making it the only fully integrated Western tungsten source, thereby securing its independence from the Chinese refining market.

Several analyst firms have recognized this clever move. In their latest study, analysts at GBC AG set the target price as of December 31, 2026, at EUR 5.28, equivalent to CAD 8.50. Compared to similar companies, such as MP Materials, a leading US producer of rare earth elements, there is a significant discrepancy in the valuation of the two companies based on their future EBITDA figures.

Almonty currently has a market capitalization of CAD 1.20 billion, significantly less than MP Materials, which is valued at CAD 15.05 billion. However, a look at the EBITDA forecasts paints a very different picture in terms of growth. Almonty is expected to generate EBITDA of CAD 105.18 million in 2026, which is expected to more than triple to CAD 384.55 million by 2028. MP Materials' growth over the same period is significantly more moderate, from USD 125.20 million to just USD 190.92 million.

Hensoldt – Chart picture looking shaky

Defense stocks also showed signs of correction in recent trading sessions. Hensoldt, a specialist in sensor and electronics solutions for defense, security, and aviation applications, which already had a price-to-earnings ratio of over 70, lost over 6% to close the week at EUR 96.95, further clouding the chart picture. A fall below the EUR 95 mark could accelerate a further sell-off, which could only find support at the significant support level in the EUR 76 zone.

Investors ignored the announcement of a major order worth more than EUR 340 million to supply state-of-the-art radar systems to Ukraine. According to the Taufkirchen-based company, the current delivery package includes high-performance TRML-4D radars and short-range systems from the SPEXER-2000-3D-MkIII series. The aim of this delivery is to specifically improve Ukraine's air defense capabilities.

According to Hensoldt, the TRML-4D radar is capable of detecting up to 1,500 targets simultaneously within a 250 km radius. It detects, tracks, and classifies air targets, such as drones, aircraft, helicopters, and cruise missiles, in real-time. The system is supplemented by the SPEXER radar series, which is designed for shorter ranges. These sensors enable the automatic detection of ground and sea targets as well as low-flying objects.

MTU Aero Engines on a rollercoaster ride

First, analysts and investors alike applauded the Company's better-than-expected forecasts for the second quarter of 2025. However, after reaching a new all-time high, investors cashed in. Within two trading days, MTU shares lost around 11.50% to a price of EUR 361.

In the second quarter, the Company, one of the leading engine manufacturers for Airbus and Boeing, significantly exceeded analysts' expectations and at the same time sent a strong signal for the rest of the year by raising its annual forecast.

Revenue increased by 21% to EUR 4.1 billion, while operating profit (EBIT) reached EUR 657 million, marking a positive surprise for the market. Adjusted net profit climbed by 40% year-on-year to EUR 479 million.

CEO Lars Wagner confirmed that the Company is clearly on track to achieve its increased annual targets. These targets include a revenue range of between EUR 8.6 and 8.8 billion and an adjusted EBIT growth rate of 21 to 25%.

The overall market is reeling, but global indices have managed to remain close to their highs. Defense stocks were particularly hard hit. Almonty Industries' milestone announcements point to attractive long-term entry opportunities.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.