Comments

Commented by André Will-Laudien on September 30th, 2025 | 07:10 CEST

Gold boom boosts critical metals! Another 100% with Power Metallic, BYD, Hensoldt and RENK

The geopolitical situation continues to escalate, but the stock markets continue to boom! Trade conflicts, sanctions, and military tensions dominate the headlines, but behind the front lines of a new Cold War, another competition has long been raging: the battle for access to critical metals. Without copper, lithium, nickel, cobalt, or rare earths, not only would the e-mobility revolution come to a standstill, but defense technologies, digitalization, and the energy transition would also grind to a halt. Supply chains are coming under increasing pressure from geopolitical power games, and the battle for resources is becoming a key strategic factor in a multipolar world order. For Western industrialized nations, security of supply is becoming a matter of survival, and for investors, this is creating new opportunities. Anyone looking for tomorrow's winners today should keep a close eye on the global raw materials poker game.

ReadCommented by Nico Popp on September 30th, 2025 | 07:05 CEST

Suriname set to become a growth champion! Sranan Gold, Newmont, TotalEnergies

There are many emerging economies. However, Suriname has some decisive advantages: the Guiana Shield rock formation runs through the country and offers ideal conditions, especially for companies in the gold sector. At the same time, Suriname is synonymous with oil – a giant oil field developed by TotalEnergies in collaboration with a local partner is set to go into production in 2028. The International Monetary Fund (IMF) predicts that Suriname's economy will grow by around 55% in the year production begins – reason enough to take a closer look at the country from an investor's perspective and highlight the opportunities it offers.

ReadCommented by Armin Schulz on September 30th, 2025 | 07:00 CEST

What is happening at Gerresheimer? Almonty Industries and Rheinmetall are booming again!

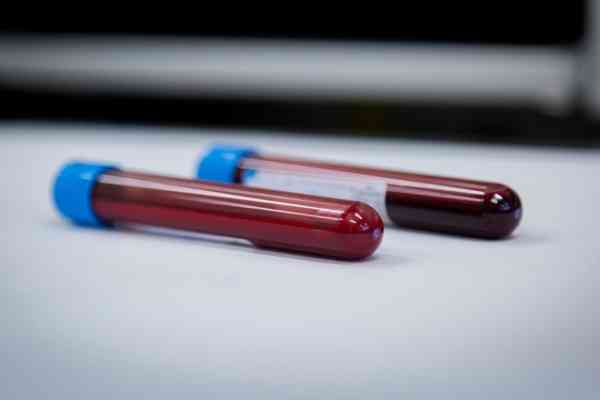

In uncertain times, the focus shifts to companies that form the backbone of our critical infrastructure. Their ability to build resilient and transparent supply chains for essential goods determines our collective resilience to geopolitical and economic upheavals. Where the highest quality and safety standards prevail in areas such as pharmaceuticals, high tech, and defense, sustainable and ethical conduct becomes a decisive competitive advantage, while strict traceability along the value chain becomes the new benchmark. This development makes values such as those of Gerresheimer, Almonty Industries, and Rheinmetall particularly interesting.

ReadCommented by André Will-Laudien on September 29th, 2025 | 07:20 CEST

Attention: Acquisitions! Biotechs like Evotec, PanGenomic Health, Pfizer, and BioNTech in focus

The biotech industry is in turmoil! With the expiration of blockbuster patents, there is a threat of sharp declines in revenue, which must be strategically compensated for. Driven by economic pressure and a growing focus on innovation and technology, the industry is increasingly turning to acquisitions of biotech companies with promising drug candidates, new technologies, and digital expertise. Not only are entire pipelines being acquired, but key players from the fastest-growing segments are also being targeted, particularly in the field of obesity therapies, where billions are being paid for drug candidates. Several examples illustrate this wave of transformation. Companies are restructuring, focusing their activities, and rapidly preparing for a phase of sustainable growth. The pace is picking up! Here are some promising investment ideas!

ReadCommented by Armin Schulz on September 29th, 2025 | 07:15 CEST

Identifying fintech winners: An analysis of the success factors of PayPal, Finexity and Coinbase

The financial world is undergoing historic change. Driven by digitalization and new technologies, lucrative opportunities are emerging beyond traditional investments. Innovative platforms are revolutionizing how we pay, invest, and manage assets. They are making markets more accessible, efficient, and transparent. Today, we focus on three pioneers who are driving this transformation and opening up new avenues for investors. The strategies of PayPal, Finexity, and Coinbase deserve special consideration.

ReadCommented by Nico Popp on September 29th, 2025 | 07:10 CEST

More than defense - How Almonty's tungsten makes AI chips from Intel and Micron possible

Tungsten is considered a critical metal worldwide—the defense industry in particular cannot do without it. But tungsten is also a high-tech metal. Without this element, which only melts at 3,400 degrees Celsius, has low resistance, and offers extremely high electrical conductivity, computer chips would not exist. The AI boom would be unthinkable without tungsten – the many data centers currently springing up around the world could not be built. We show how companies from the chip industry, such as Intel and Micron, are securing their supply and explain why Almonty is a blessing for the chip industry.

ReadCommented by Stefan Feulner on September 29th, 2025 | 07:05 CEST

SAP, Aspermont, AppLovin – AI models with powerful upward momentum

The combination of big data and artificial intelligence is considered one of the biggest growth drivers of the coming decade. Companies that manage to efficiently collect and evaluate vast amounts of data and make it usable in real time not only gain competitive advantages but also redefine entire industries. Whether in healthcare, finance, commodities, or industry, those who use data intelligently can optimize processes, reduce costs, and develop entirely new business models. Investors should not underestimate this dynamic.

ReadCommented by Fabian Lorenz on September 29th, 2025 | 07:00 CEST

Takeover in the Ozempic market! BioNxt Solutions next? Novo Nordisk, Eli Lilly, and Pfizer are fighting!

The battle against obesity is considered one of the biggest growth markets in the global pharmaceutical sector. According to estimates, the market for obesity therapies could reach a volume of up to USD 150 billion by 2030. So far, Novo Nordisk and Eli Lilly have dominated the market. But almost every major corporation and innovative challenger wants a piece of the pie. The latest example: Pfizer is planning a billion-dollar takeover of US-based Metsera, a company competing with novel drugs against obesity. BioNxt Solutions is also a hot takeover candidate. The Company aims to revolutionize the market and attract new customers with an oral dosage form, and the first prototypes have already been developed. That makes it an attractive prospect for virtually every pharmaceutical company.

ReadCommented by Armin Schulz on September 26th, 2025 | 08:25 CEST

Palantir, Aspermont, ProSiebenSat.1 Media – Data as a gold mine! Where can you profit?

In a world where data is the new gold, the ability to turn this data into competitive advantages and profit determines success or failure. While tech giants set the rules, established players must radically rethink their approach. Three companies exemplify how differently this transformation can be mastered. The sometimes controversial data analysis company Palantir, the niche publisher Aspermont, which monetizes specialist information, and the media giant ProSiebenSat.1 Media, which aims to link conventional television with the online world. Their strategies reveal where the greatest opportunities lie.

ReadCommented by André Will-Laudien on September 26th, 2025 | 08:20 CEST

Bitcoin at USD 250,000? Quantum computers conquer crypto – Favor D-Wave, Finexity and Alibaba now!

The financial markets are undergoing a profound transformation, with speed and computing power becoming decisive competitive advantages. High-performance computers have already revolutionized stock market trading by implementing complex strategies in milliseconds. At the same time, blockchain technology and crypto platforms are creating a new market that is benefiting massively from these technological developments. Whether in high-frequency trading, hedging digital assets, or building tokenized securities markets, the interplay of computing power and decentralized networks is opening up access to a whole new dimension of global financial flows. Which stocks offer opportunities?

Read