Comments

Commented by Carsten Mainitz on November 1st, 2021 | 13:56 CET

wallstreet:online, Deutsche Bank, GFT Technologies - It should continue to improve here!

Low-interest rates, high inflation and economic growth, form the framework conditions that continue to speak for a positive stock market environment and rising share prices. The three following companies benefit from this in different ways and should also perform well in the coming year. Who is your favorite?

ReadCommented by Stefan Feulner on November 1st, 2021 | 13:20 CET

Bayer, MAS Gold, Salzgitter - Positive turnaround

At chemical and pharmaceutical giant Bayer, the mood continues to brighten following the important decision of the European Patent Office. Also, the number season, which has been running for weeks, gives the markets an additional boost with solid figures and forecast increases. New highs in the most critical global stock indices are the result. On the other hand, the high inflation rates are a cause for concern, although they continue to be underestimated by the monetary watchdogs. The still weak precious metals markets could therefore experience a boom in the coming months.

ReadCommented by André Will-Laudien on November 1st, 2021 | 12:50 CET

Barrick Gold, Central African Gold, Gazprom - Gold becomes a fireball!

The development of gold follows the inflation trend in our economies in the last 25 years. Before the turn of the millennium, the ounce was still below USD 200. Due to the real estate bubble after the dot-com boom and the devastating effects of the US subprime crisis, the precious metal reached its temporary peak in 2011 at USD 1,950. At that time, the ECB tried to prevent the collapse of Greece with emergency loans. With the deployment of EUR 336 billion, this European rescue experiment succeeded for the time being, but the gold price then lost value again in the following years until 2015, down to USD 1,120. Last year, there was then a new attempt in the direction of north. In May, the precious metal reached USD 2,050 - a plus of USD 600 since the Corona Crisis. Where does the metal go from here?

ReadCommented by Stefan Feulner on November 1st, 2021 | 12:30 CET

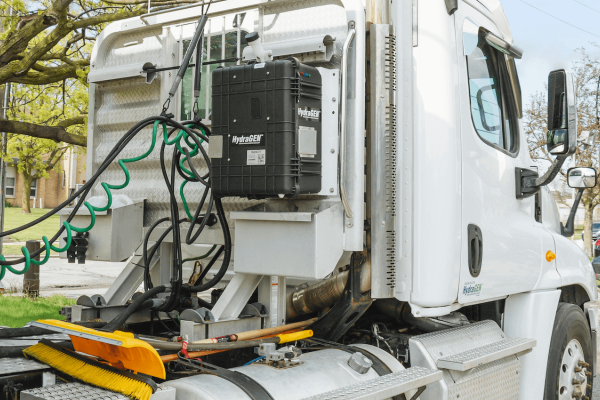

BASF, dynaCERT, Nikola - These shares will be exciting

From today until November 12, all eyes are on the UN Climate Change Conference COP26 in Glasgow. Nothing less than the future of our planet and a trend reversal towards a climate-neutral economy are at stake. At the top of the agenda is the commitment of countries to reduce emissions. A company that has received little attention in the recent past is waiting in the wings with its patented technology and could soon take off. Be prepared.

ReadCommented by Armin Schulz on November 1st, 2021 | 11:15 CET

BioNTech, Memiontec, TeamViewer - Which high flyers still have potential?

High flyers are companies that establish themselves very quickly in a market or shares that increase in value very quickly. As an investor, one dreams of such investments. A stock that gains more than 100% in value within months is often found in extreme situations and when hypes arise. At some point, the situation normalizes, or the hype ends because not enough investors jump on the bandwagon. A drastic consolidation often follows that. Today, we analyze three companies whose shares have gained at least 200% since the Corona pandemic and look at their future potential.

ReadCommented by Nico Popp on November 1st, 2021 | 10:29 CET

Shell, Sierra Grande Minerals, K+S: 4.1% inflation - here is how investors counteract it

Inflation in the eurozone climbed to a new record in October - at 4.1%, one can confidently speak of inflation. At the same time, the European Central Bank (ECB) continues to adopt a wait-and-see approach. Although the markets are pricing in an interest rate hike in the eurozone, analysts and the ECB believe these expectations are premature. Given the stuttering economic recovery, it might make sense from the central bank's point of view to delay the exit from the ultra-loose monetary policy a little longer - with all the risks.

ReadCommented by Stefan Feulner on October 29th, 2021 | 14:13 CEST

XPeng, Graphano Energy, K+S - The fear of emptiness

There are shortages in all sectors. In addition to the chip shortage, which is affecting the automotive industry, there are also shortages of metal, plastic, and even packaging material for Christmas presents. Even at technology giant Apple, there is concern about whether the all-important final quarter can be spared supply disruptions due to fragile global supply chains. There is no end to this problem in sight in the longer term; on the contrary, the shortage of raw materials due to the energy transition exacerbates this circumstance.

ReadCommented by Carsten Mainitz on October 29th, 2021 | 13:39 CEST

Kleos Space, Lufthansa, TeamViewer - Exciting developments!

The capital market thrives on diversity. The stock market trades in the future and is never a one-way street. The pendulum - as painful as it sometimes is - swings in both directions. Corporate growth is just as much fuel for share prices as euphoria and panic. The following companies have seen a lot of action in the recent past. Who will perform best by the end of the year?

ReadCommented by Nico Popp on October 29th, 2021 | 13:10 CEST

Gazprom, Osino Resources, Deutsche Telekom: Will 2022 be another crisis year?

The world is sliding from the Corona Crisis into the energy crisis. While climate change also threatens prosperity and stability, a conflict of goals is now emerging between sustainable action and safeguarding industry livelihood. What is at stake: Energy is becoming scarce in China. German industry is also urging the prospective coalition leaders in Berlin to reduce energy costs urgently. Saudi Aramco boss Amin Nasser stresses the importance of investing in new oil wells. And what happens? Oil companies are adorning themselves with wind farms that are, at best, fig leaves in the face of concrete energy needs. We present three stocks for turbulent times.

ReadCommented by Stefan Feulner on October 29th, 2021 | 12:07 CEST

United Internet, TalkPool, Visa - Smart businesses

Communication between people and machines will become one of the central themes of our society in the coming years. Technology and computer systems take over essential everyday life and industry tasks, visibly or unnoticed in the background. Sensors and interfaces enable their operation. These smart technologies can be used across all sectors, from medical or building technology and mobility to accelerating climate change.

Read