Comments

Commented by Armin Schulz on October 29th, 2021 | 11:25 CEST

Steinhoff, Triumph Gold, TUI - Which stock will jump first?

Inflation is in full swing, and it isn't easy to protect yourself and your money from it. Real estate in Germany is often far too expensive, and as a small investor, such an investment is out of the question. Gold has always been used to protect against inflation, but even there, you can only buy anonymously for less than EUR 2,000. Otherwise, the identity must be deposited. Government bonds no longer yield interest, so the only option left is stocks. As an investor, one is always on the lookout for securities that have upside potential. That is where shares with an interesting story or turnaround candidates come in. We analyze three companies today.

ReadCommented by André Will-Laudien on October 29th, 2021 | 10:23 CEST

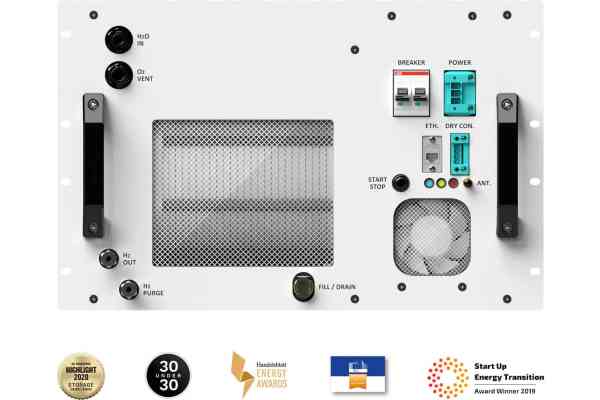

NEL, Plug Power, Royal Helium - Hydrogen rally, now it's rolling!

Only months ago, the comparatively expensive production of green hydrogen was put side by side with cheap Russian gas. Things can move that fast! The gas price has risen by 500% within 3 months, and the calculations are being recalculated. The explosive development of prices in the last 12 months shows how strongly shortages can affect the raw materials market. On average, known commodities increased by at least 25%, metals by 60-80% and energy doubled just like that. However, gas takes the cake with plus 600% in just 6 months, which gets the hydrogen industry buzzing. We take a closer look.

ReadCommented by Nico Popp on October 28th, 2021 | 13:20 CEST

BASF, Memiontec, JinkoSolar: Rich returns with green shares

Chemistry is everything. It is not just since the bestseller "Chemistry for Breakfast" by scientist and YouTuber Mai Thi Nguyen-Kim that people have known how comprehensively chemistry can explain our world. There is also a lot of chemistry involved in future technology, such as filter systems for water or solar panels. We present three stocks and assess their values. We start with one of the best-known chemical stocks, followed by smaller shares with no less interesting business models.

ReadCommented by Fabian Lorenz on October 28th, 2021 | 12:52 CEST

Nordex, Standard Lithium, Central African Gold: Raw materials for the energy transition

The energy turnaround is supposed to save the climate and significantly reduce the consumption of fossil fuels. But what is often overlooked: In practice, this means that demand for other raw materials is rising massively. In the EU alone, demand for cobalt is expected to increase more than tenfold by 2030. Copper and lithium are also in hot demand. Nordex, for example, needs rare earths for the production of wind turbines. Standard Lithium benefits from the exploding demand for batteries and Central African Gold's raw materials are included in practically every future technology.

ReadCommented by André Will-Laudien on October 28th, 2021 | 12:04 CEST

Canopy, Tilray, Sativa Wellness, Formycon - Finding the next cannabis rocket!

The big bull market in cannabis ran through 2018 and 2019, and then in 2020, the reality set in that only a fraction of states around the world will implement general licensing for hemp. The newly elected federal parliament has its first constituent session these days. Climate change and investments in digital infrastructure are two of the most important topics in the coalition negotiations to form a new federal government. One topic that is not quite so high on the list of priorities, but is already causing a lot of excitement in the run-up, is the possible legalization of cannabis. The Greens and FDP have been advocating legal, regulated trade for some time. Of course, nothing has been decided yet, but the outgoing federal government's drug commissioner, Daniela Ludwig of the CSU, already warns of the consequences. We take a look at important industry representatives.

ReadCommented by Carsten Mainitz on October 28th, 2021 | 11:26 CEST

MAS Gold, Barrick Gold, Yamana Gold - Go for gold!

If you look at the big picture, several aspects favor a medium-term increase in the price of gold. It is a combination of a low-interest rate environment, rising inflation and crisis currency in volatile stock market times. In addition, the global economic recovery is increasing the demand for gold. As the past has shown, the gold price can perform strongly even when nominal yields rise if inflation rates climb faster than interest rates. We believe this scenario is very realistic. Thus, these stocks should benefit.

ReadCommented by Stefan Feulner on October 28th, 2021 | 10:44 CEST

Deutsche Bank, Silver Viper, Hypoport - Back on track

The flood of figures continues unabated. The technology giant Microsoft exceeded all expectations and outperformed sales by 22% compared to the same period last year due to the trend towards hybrid working. Google's parent Company Alphabet also posted a substantial increase in profits. The figures of various financial companies were also surprisingly strong. Due to the underperformance in recent years, there is clear rebound potential for many.

ReadCommented by Carsten Mainitz on October 27th, 2021 | 14:53 CEST

Enapter, Plug Power, Ballard Power - This is the future!

In 1875, Jules Verne wrote in his book "The Mysterious Island": "Water is the coal of the future. Tomorrow's energy is water that has been broken down by electric current. The elements of water thus decomposed, hydrogen and oxygen, will secure the earth's energy supply for the unforeseeable time." The visionary was right. For a successful energy transition, we need hydrogen solutions. Mass production is increasingly within reach for many companies, but most companies are still in the red. Who will be ahead in the future?

ReadCommented by Carsten Mainitz on October 27th, 2021 | 14:38 CEST

Sierra Grande, Sibanye Stillwater, First Majestic - New developments!

High inflation argues in favor of investing in tangible assets such as equities, real estate and commodities. The traffic light is green for price increases in precious metals and energy metals in the medium term. Ultimately, investors must decide whether producers or exploration companies are of interest. Or perhaps a little of each?

ReadCommented by Stefan Feulner on October 27th, 2021 | 13:05 CEST

BYD, Manganese X Energy, Sixt - Do it again, Elon!

Tesla parks in the exclusive club of trillion-dollar companies, the share price of the pioneer of electric automobility exceeded the mark of USD 1000 for the first time. Congratulations, Elon Musk! Once again, the serial founder demonstrated foresight and was miles ahead of the competition. Musk also takes a pioneering role in the sourcing of materials for his cutting-edge technologies. He openly advocated replacing the controversial metal cobalt with manganese - a clear sign of the growing industry. Here, too, as with other materials, there is already an extreme shortage.

Read