Comments

Commented by André Will-Laudien on October 21st, 2021 | 13:26 CEST

Palantir Technologies, Kleos Space, Airbus, Boeing - Profits from air and space travel

Regardless of the discussion about who has now crossed the border into space, all tourist space flights have one thing in common - climate neutrality probably does not play a sustainable role for the initiators, given the manageable demand and horrendous ticket prices. After all, the wealthy travelers are in the minority, so an "anti-climate flight" can also be justified with the service to progress. Even the operation of a V8 engine in a Ford Mustang surely teases out a suitable justification for the operator's action. How about this one: permanently maintaining a classic car saves thousands of tons of CO2 compared to buying a new battery-powered vehicle. That is probably correct, so hopefully, the Mustang in question will last the next 30 years. We turn our attention to flying business models.

ReadCommented by Stefan Feulner on October 21st, 2021 | 12:17 CEST

Sartorius, Defence Therapeutics, QIAGEN - Still long potential

Since the outbreak of the Corona pandemic, biotech and pharmaceutical shares have been among the top performers on the stock market. In addition to vaccine producers such as BioNTech and Pfizer, the share price of the US pharmaceutical Company Moderna also multiplied. Other winners included diagnostics companies and laboratory equipment suppliers, process technology specialists and manufacturers of biopharmaceuticals. Biopharmaceuticals promise enormous growth potential even after Corona, especially the market such as gene and cell therapies is growing dynamically at the moment.

ReadCommented by Fabian Lorenz on October 21st, 2021 | 11:22 CEST

HelloFresh, SAP, TalkPool: Tech stocks make a comeback

The frustration among tech investors seems to be over for the time being. After difficult weeks and months, shares from the technology sector are in demand again. This demand applies to tech giants from the US such as Apple, Alphabet as well as SAP. The DAX heavyweight was even able to shine with a forecast increase. Cooking box supplier HelloFresh can also convince investors and analysts with its foreign expansion. And the technology Company TalkPool reported a reference order. With the future topics SmartHome and IoT, the Swiss want to double sales in a few years.

ReadCommented by Carsten Mainitz on October 21st, 2021 | 10:11 CEST

Gazprom, Saturn Oil + Gas, TotalEnergies - Rising prices continue to create a party atmosphere

Europe is currently experiencing an energy crisis. Drivers are noticing it clearly at the gas pumps and users of gas heating systems in their bills. The reasons are manifold: the recovery of the economy after Corona, the curbing of coal-fired power generation for climate protection reasons, the growing hunger for energy of emerging economies and, last but not least, weather effects. In Germany, there is an additional reason: the phase-out of nuclear energy is currently causing a strong expansion of gas-fired power generation to secure the baseload. The beneficiaries of this development are the oil and gas producers - and thus their investors.

ReadCommented by André Will-Laudien on October 20th, 2021 | 13:52 CEST

SAP, wallstreet:online, Baidu - This is where the action is!

Anyone who wants to secure a piece of the market share in today's online business must develop good digital concepts and exceptional customer service. However, many of these models have simply been transformed from the old economy to the digital world and have significant breaking points in the day-to-day operational processing. Currently, the online world is at a standstill because the transfer of goods has to be confirmed manually at a warehouse exit. Many companies are working on a perfect digital flow. We take a look at some of them today.

ReadCommented by André Will-Laudien on October 20th, 2021 | 12:56 CEST

Varta, Graphano Energy, Nel ASA - Who will deliver the super battery?

The race for the most powerful battery stops at many stations. On the one hand, it is about battery efficiency as a basic fact of the climate discussion. On the other hand, many producers wonder where all the battery metals should come from if every second EU citizen switches to e-mobility in the next few years. Neither the charging infrastructure nor resilient batteries are available at the moment, so the whole planning is actually still fraught with a lot of dreaming - nevertheless, the necessary metals are going through the roof in terms of price. The reason is that those sitting on the metals are turning the price screw, even if the actual excess demand will probably only arise in 2-3 years. We are looking at values that are in the middle of the typhoon.

ReadCommented by Nico Popp on October 20th, 2021 | 12:17 CEST

TUI, Diamcor Mining, Varta: Luxury that pays off

A luxurious trip? A sporty electric coupé or perhaps timelessly beautiful jewelry? There are many ways to indulge in luxury. Some are enduring, and some are rather clumsy consumption. But even when it comes to luxury, there is no arguing about matters of taste. However, it is easier to argue when it comes to investments in companies that benefit to a greater or lesser extent from the penchant for luxury. We discuss three shares.

ReadCommented by Carsten Mainitz on October 20th, 2021 | 12:10 CEST

Formycon, Memiontec, Synlab - Act before it is too late!

When an unpredictable event occurs, humanity sees how powerless it is in the face of it. We saw this in the spring of last year with the outbreak of the Corona pandemic. Only since the approval of various vaccines has a normalization taken place. However, further, foreseeable problems are coming our way. According to expert forecasts, water demand will exceed supply by 40% as early as 2030. Some companies sense an opportunity to profit from the water shortage through novel technologies.

ReadCommented by Stefan Feulner on October 20th, 2021 | 11:26 CEST

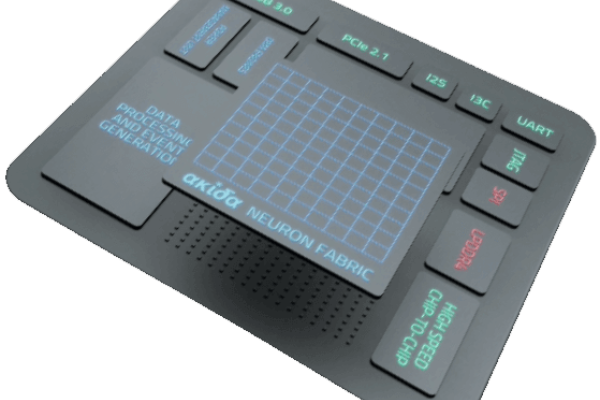

Plug Power, BrainChip, Software AG - Crisis and no end

The global economy is suffering from a chip shortage. One reason for this is blown-up supply chains due to the Corona pandemic, leading to production downtime and short-time working, especially in the automotive industry. In addition, with future technologies such as the Internet of Things, autonomous driving and artificial intelligence, there is a higher demand for semiconductors in addition to more powerful processors. An end to this dilemma is far from imminent, according to industry insiders.

ReadCommented by Armin Schulz on October 20th, 2021 | 11:04 CEST

Bayer, Sativa Wellness Group, MorphoSys - Can the pharmaceutical industry benefit from the new German government?

The federal election is over, and the pharmaceutical industry has to adjust to the new political constellation. The industry is facing change. Digitization is an important topic. To not lose even more researchers to foreign countries, approval processes must be accelerated and bureaucracy reduced. If we always acted as decisively as we did during the pandemic, much more could be achieved. The new federal government is flirting with the legalization of cannabis. If this were to happen, the market would probably be huge. The next four years promise to be exciting.

Read