Comments

Commented by Carsten Mainitz on October 14th, 2021 | 13:30 CEST

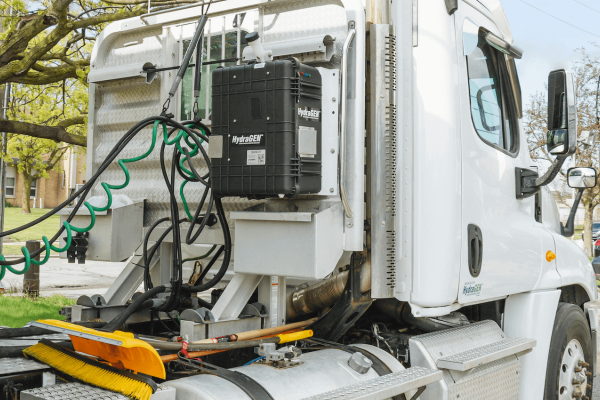

SMA Solar, dynaCERT, TotalEnergies - Good for the climate, good for your portfolio!

The signs of the times are climate protection: In America, Joe Biden is trying to push his Green New Deal through the legislature, China is phasing out the construction of coal-fired power plants, and in Germany, the Greens will most likely be part of the next government. Industry is also rethinking its position. Recently, an alliance of 69 leading German companies called for an "implementation offensive for climate neutrality" within the first 100 days of a new government. Signatories included heavyweights such as SAP, E.ON and Bayer. The following three stocks should get a tailwind from the new climate awareness.

ReadCommented by André Will-Laudien on October 14th, 2021 | 11:27 CEST

BioNTech, Cardiol Therapeutics, CureVac: A decade's worth of ideas!

Biotechnology remains a hotly contested industry. In the fight against a wide range of diseases, biopharmaceuticals are the first port of call. It studies the relationship between drugs and excipients' chemical and physical properties and their form of administration in a living organism. By directly applying findings from biology and biochemistry, technically functional elements are identified. The central objectives are to research, improve and develop processes for the production of relevant substances. Often research goes nowhere; we take a look at the sector.

ReadCommented by Carsten Mainitz on October 14th, 2021 | 08:20 CEST

Square, BIGG Digital Assets, Advanced Micro Devices - Profiteers of the FinTech and crypto boom

FinTech and crypto are defining investment themes of today. Even though there are now efforts by politicians to curb or regulate cryptocurrencies, they will remain part of our everyday lives in the long run. For cryptos to be usable by the broad population, it is essential to make them easy and safe to trade and use as a means of payment. That requires certified trading platforms and reliable payment service providers. These are not the only ones who will benefit from the development; hardware manufacturers are also in great demand.

ReadCommented by Stefan Feulner on October 14th, 2021 | 07:46 CEST

SAP, Kleos Space, Ballard Power - Igniting like a rocket

The storage and processing of data will be one of the themes of our society for the coming years. Big Data will create scientific advances and innovations, increasing the competitiveness of both science and companies across industries. Already today, innovative startups are working on the processing of larger amounts of data using artificial intelligence. The potential is enormous, the predicted growth rates gigantic.

ReadCommented by André Will-Laudien on October 13th, 2021 | 13:23 CEST

BASF, Almonty Industries, Millennial Lithium, BYD - All sold out?

Anyone who can offer scarce raw materials today is in a fortunate position as far as business prospects are concerned. In particular, metals and battery raw materials are in high demand and have become a bone of contention in globalization. That is because many critical metals are majority-owned by China, meaning that the regime decides on potential allocations to foreign countries. Admittedly, the Middle Kingdom wants to stay in business with the West, so long-term contracts exist. Nevertheless, the domestic industry is naturally given preferential treatment; we can only hope for political stability and incremental improvements in the West. Who are the interesting players in the tight commodity market?

ReadCommented by Stefan Feulner on October 13th, 2021 | 12:19 CEST

XPeng, Central African Gold, Volkswagen - It will not work without metals

Decarbonization is the magic word when it comes to achieving the ever-tighter climate targets. The phase-out of coal and the move away from fossil fuels, oil and natural gas is a done deal. However, considerable quantities of copper, lithium, cobalt and nickel are needed to ensure the energy turnaround, whether for electromobility, solar or wind technology. A limited supply is already matching the enormous demand. A stalling of ambitious plans is already preprogrammed.

ReadCommented by Armin Schulz on October 13th, 2021 | 11:09 CEST

Alibaba, AdTiger, ProSiebenSat.1 Media - Christmas business makes the cash register ring in the advertising market

Even before Corona, more and more people were shopping online, and the pandemic has further boosted this trend. Christmas is fast approaching, and this festival of gifts traditionally brings retailers the highest sales. Sitecore has learned from a survey that Christmas shopping will start earlier this year. When talking to local retailers, it is often heard that customers are nowhere near as abundant as they were before the pandemic. Corona rules or mask-wearing obviously bothers some consumers, and so they continue to turn to online shopping. The advertising market will grow significantly in the next two months, both online and offline. So today, we analyze three companies that are involved in advertising and e-commerce.

ReadCommented by Nico Popp on October 13th, 2021 | 10:16 CEST

Rock Tech Lithium, Manganese X Energy, Daimler: E-mobility takes off on the stock market

The bull market is here to stay. Although standard stocks are still bobbing along, speculative stocks are picking up speed. That suggests that the risk appetite of investors has not yet been satisfied. In addition, events in future-oriented sectors, such as electromobility, are coming thick and fast. Most recently, both Millennial Lithium and Neo Lithium were taken over. The Canadian-German Company Rock Tech Lithium is becoming a neighbor of Tesla in Brandenburg. Which stocks are the next winners?

ReadCommented by Nico Popp on October 12th, 2021 | 13:32 CEST

RWE, Desert Gold, Deutsche Bank: Opportunities from conservative to speculative

How to invest when prices are galloping and disruptive fires are increasing? Many investors will opt for blue chips. Indeed, large corporations with steady and stable cash flows offer an opportunity, especially in times of inflation. But which stocks are specifically suitable? Using three shares as examples, we explain how investments can succeed today.

ReadCommented by André Will-Laudien on October 12th, 2021 | 13:09 CEST

Infineon, BrainChip, Palantir - Spoiled for choice!

The chip shortage is having an increasingly negative impact on supply chains. In Mecklenburg-Vorpommern, short-time work has now been declared at some suppliers to the automotive industry. First, the pandemic and the associated uncertainties among consumers caused less demand. Now, demand is suddenly back, but it cannot be satisfied because the supply chains from Asia are not yet functioning properly. Market observers expect these constraints to continue into next year. The chip crisis has now existed since the Evergreen disaster in the Suez Canal and seems to be with us for longer. We take a look at some tech stocks in the near vicinity.

Read