Comments

Commented by Stefan Feulner on October 8th, 2021 | 11:28 CEST

Nordex, Desert Gold, TUI - The wind is changing

The DAX is back on top after a brief but painful correction and the slide below the psychologically important 15,000 mark. Was that it, and is the German stock market barometer preparing for a year-end rally and a renewed jump above the 16,000 mark, or will further price losses follow? A long consolidation phase could also be over for certain individual stocks, just like in the precious metals markets.

ReadCommented by André Will-Laudien on October 8th, 2021 | 10:25 CEST

BioNTech, Defence Therapeutics, Valneva, Formycon - Close to the bio-revolution!

Portugal is one of the countries with the highest vaccination rate, with 86% of the population already vaccinated. Approximately 98% of those eligible for vaccination - including everyone over the age of 12 - have been vaccinated. Germany, with about 64%, is one of the more vaccine-weary nations. What is the secret of the Portuguese? The government relied on an opinion maker from within its ranks, Admiral Gouveia e Melo. An expert in complicated logistical tasks in the military, he was appointed in February as the top leader of the national vaccination campaign. He is never seen without his military combat uniform in numerous public television appearances - and when asked how other countries can move their own vaccination effort forward, the admiral did not hesitate to offer his best advice: "You have to find people who are not politicians." Where are the current opportunities in the vaccination sector?

ReadCommented by André Will-Laudien on October 7th, 2021 | 14:03 CEST

Alibaba, Aspermont, Facebook - Cyberattacks or data leaks?

The stock markets are shaking, and the flood of data is increasing daily. As a result, the traffic on all social media channels is also increasing. Some of them get performance problems or have to shut down because of server problems. There have now been several outages lasting several hours in quick succession in the Facebook empire, costing investors over USD 50 billion in market value in Facebook shares. Information is the name of the game on the stock market today, and social platforms like Reddit have a big stake in the market. When something does not work, investors often react in panic and stock markets swing wildly. We take a look at some of the protagonists.

ReadCommented by André Will-Laudien on October 7th, 2021 | 13:38 CEST

Deutsche Telekom, Troilus Gold, Barrick Gold - Time for the safe haven

The world's stock markets are reeling. With inflation on the rise and investors fearing a turnaround in interest rates, the crash prophets are again coming out of their holes. Kiyosaki, Mr.DAX and Co. see themselves confirmed by an impending real-estate bankruptcy rolling towards us from China, triggered by the real estate Company Evergrande. Indeed, stock market barometers are in correction mode, at least in the short term, with the DAX tearing through the psychologically important 15,000-point mark. Meanwhile, another market is in the starting blocks to make a comeback.

ReadCommented by Fabian Lorenz on October 7th, 2021 | 12:54 CEST

Tembo Gold, Gazprom, Standard Lithium - Annual high or downward trend?

Developments in commodities could hardly be more different at the moment. While gas, oil and also lithium are in strong demand, precious metals are a tragedy. The development of the shares of the companies active in the respective sectors is corresponding. The Gazprom share is at a multi-year high, and energy prices will be a topic at the next EU summit. After the all-time high at the end of September, Standard Lithium is in a sharp correction. Debt-free Tembo Gold is currently interesting for anti-cyclical investors and has published positive news.

ReadCommented by Stefan Feulner on October 7th, 2021 | 12:00 CEST

Palantir, wallstreet:online, Commerzbank - Significant steps

Stock market trading experienced a real boom last year as a result of the Corona lockdowns. New shareholders, primarily from Generation Z, took a liking to trading in companies. Online brokers' revenue and profit numbers shot through the roof. During the second quarter of 2021, growth now stagnated. The wheat is separating from the chaff. Companies with unique selling points, such as wallstreet:online AG, will continue to grow. Many others will disappear from the playing field.

ReadCommented by Carsten Mainitz on October 7th, 2021 | 11:15 CEST

JinkoSolar, Meta Materials, Encavis - Here comes the sun!

Climate is the dominant topic of our time. Not only has the population understood this and given the Greens a record result in the last federal election, but many companies from traditional sectors such as the automotive industry or heavy industry have now accepted that only green, sustainable technology promises lasting growth. Climate-neutral energy sources are the central element. Associated with this are energy storage challenges and increasing efficiency, which is currently still far from completely replacing fossil fuels. These three stocks will benefit from the upheavals.

ReadCommented by Nico Popp on October 7th, 2021 | 10:33 CEST

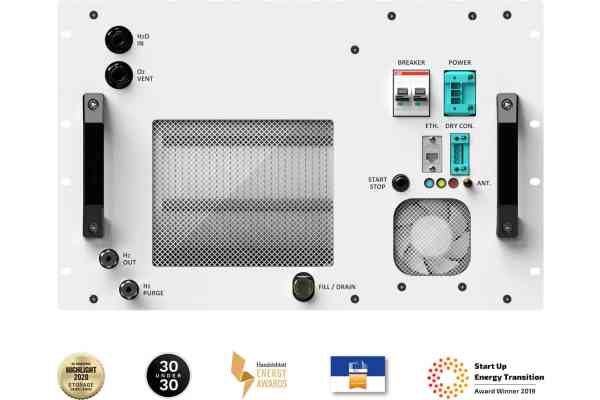

Varta, Enapter, NEL: Where hydrogen pays off directly

It is turnaround time! Never before in history will so much be changing as in the next five years. The energy turnaround is switching our supply to renewable energy sources and new storage options, and the mobility turnaround will ensure that electric motors will soon dominate the roads. Although it is clear where the journey is headed, shares based on the new technology offer highly diverse opportunities. We take a look at three stocks.

ReadCommented by André Will-Laudien on October 6th, 2021 | 13:25 CEST

Siemens Energy, Memiontec, Bayer - GreenTech is making the rounds!

For many people, water is as valuable as gold. Most of the water on our planet, more than 97%, is saltwater. And humans and animals cannot drink that because salt extracts water from the body, you would inevitably dehydrate. Freshwater is distributed unevenly on earth because it is predominantly found in forests and high mountains, and corresponding rainfall is the order of the day. The little freshwater there would be enough for all people - if it were evenly distributed on earth. Developing countries often lack the money to build sewage treatment plants to purify dirty or bacteria-contaminated water. Worldwide, about 4,000 children die every day because they drink contaminated water and become very sick. A reason to act as soon as possible!

ReadCommented by Stefan Feulner on October 6th, 2021 | 12:56 CEST

BYD, Saturn Oil + Gas, Royal Dutch Shell - Explosion on the oil market

The Organization of Petroleum Exporting Countries OPEC and its alliance partners led by Russia (OPEC+) have decided to increase production only gradually, despite tight supply. Demand is recovering strongly as the Delta variant of the coronavirus subsides. The result is skyrocketing oil prices, which are the highest they have been in seven years. In contrast, oil producer shares are still far from their highs.

Read