Comments

Commented by Nico Popp on October 27th, 2021 | 12:34 CEST

B2Gold, Tembo Gold, Newmont: Gold from small amounts? Here is how!

Gold has become mainstream. Even the German newspaper Handelsblatt quotes experts saying that the precious metal currently offers more opportunities than risks. The reasons for this are the rising inflation and the growing uncertainty in the financial system. But how can investors get a foot in the door with gold without having to put up too much capital or, as is usual with physical holdings, having to rent the already scarce lockers?

ReadCommented by Armin Schulz on October 27th, 2021 | 11:43 CEST

Defense Metals, Nordex, Xiaomi - Battle for raw materials intensifies

China is scaling back its magnesium production due to electricity problems. The Chinese government is aiming to reduce energy consumption and thus emissions. It will inevitably lead to supply bottlenecks worldwide, and in Germany, it will initially affect the metal industry. However, since China produces 90% of the world's magnesium, there are, in fact, no alternatives. Similar problems exist with tungsten and rare earths, needed for almost all new technologies, from renewable energies to consumer electronics and e-cars. If you want to reduce this dependence, you have to look for alternatives.

ReadCommented by André Will-Laudien on October 27th, 2021 | 11:03 CEST

NEL, Clean Logistics, Ballard Power, FuelCell Energy - Hydrogen in the third wave!

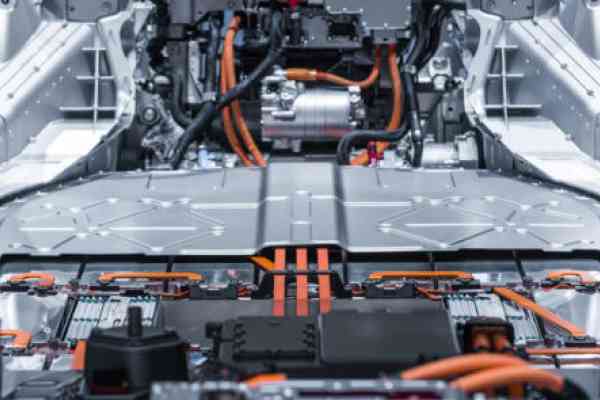

The hydrogen hype is entering its third wave. The price increase of fossil fuels increases the pressure to switch to alternative energies and new propulsion concepts. Governments around the world have therefore decided on rapid decarbonization. For the EU, the resolutions were already passed in 2020. In the USA, Joe Biden has now extended his environmental package to USD 1.5 billion. The market will decide whether battery or hydrogen technology will play a greater role here; the only important thing is quickly releasing the funds to finance the upcoming research projects. Time is pressing because the pandemic has put many industries on the sidelines. The transport industry, in particular, depends on the sale of goods, and in the future, this should occur without any negative environmental impact.

ReadCommented by Stefan Feulner on October 27th, 2021 | 10:23 CEST

Deutsche Telekom, Barsele Minerals, Symrise - Positive surprises

The reporting season for the third quarter is in full swing. Positive surprises already outweighed the negative ones last week. As a result, the leading indices in the USA, the Dow Jones and S&P 500, reached new highs, and the DAX is also likely to start its year-end rally with the first target of 16,000 points after breaking through the crucial 15,500 mark. Even outside the quarterly figures, there are important events that should positively affect the respective share prices.

ReadCommented by Fabian Lorenz on October 26th, 2021 | 13:56 CEST

Nel, BYD, BrainChip: This looks good

While shares from the technology sector have been very volatile in recent weeks, the knot has burst at BYD, and the share has risen to a new record high. Rumors about Tesla and Apple have contributed to this. Both are said to be in talks with the Chinese specialist around electric mobility. The shares of Nel and BrainChip have also developed very positively recently. Both have invested heavily and could now reap the rewards of these investments. All three shares have further room for improvement. You can read why here.

ReadCommented by Nico Popp on October 26th, 2021 | 13:26 CEST

Desert Gold, B2Gold, Barrick Gold: This news changes everything

When a simple plot of land turns into a mine, a veritable windfall beckons for early investors - after all, a lucrative commodity project justifies high valuations. But betting on the right stock in commodity developers requires experience and, ultimately, a little luck. However, there are market phases where the facts are apparent, and investors can still get in at favorable prices. Such a phase may currently be evident in Desert Gold. The Company made a new discovery yesterday that significantly expands the previous Gourbassi West zone. Gold grades are high, and the Company continues to see excellent exploration potential at its SMSZ project in Mali. Only the stock has not responded so far. Is this an opportunity for countercyclical investors?

ReadCommented by André Will-Laudien on October 26th, 2021 | 12:27 CEST

LVMH, Diamcor Mining, TUI, Carnival - Another lockdown or profit explosion?

The poor are getting poorer, and the rich are getting richer. Demographic studies suggest that in Europe, especially Germany, large sections of the population will be affected by poverty in old age. The reason: falling income in real terms due to high inflation, especially for everyday goods. The official inflation rate of the central banks is window dressing because the hedonically calculated indices include, for example, increases in the performance of mobile devices and thus compensate for the exploding prices of energy and food. Luxury is a particular area of consumption that tends to be attributed to the privileged tiers of the population. Here, the increase in prosperity is supported by inflation on the income side and enables the suppliers of luxury goods to achieve sustained high growth rates.

ReadCommented by Nico Popp on October 26th, 2021 | 12:05 CEST

SAP, wallstreet:online, Alibaba: Sentiment Check for Digital Shares

More and more business models are shifting to the Internet. Even traditional industries, such as trades, are benefiting from digital processes. Elsewhere, this transformation is already in full swing, such as in the financial sector. Investors have long since been trading online and only speak to their broker by phone in exceptional cases. We present three digitization stocks and examine their price potential.

ReadCommented by Stefan Feulner on October 26th, 2021 | 11:37 CEST

Tilray, Ayurcann, Aurora Cannabis, Canopy Growth - Sow first, then reap

After the hype around cannabis companies like Aurora Cannabis, Tilray and Canopy Growth in 2018, consolidation followed, and it continues. But the industry is moving mightily. Smaller companies disappeared from the price list, while big players expanded their market power through mergers and acquisitions for the next few years. The cannabis industry is predicted to grow tremendously in the future. The fantasy is fueled by government legalization plans in several states, including Germany.

ReadCommented by Stefan Feulner on October 26th, 2021 | 10:31 CEST

Nel ASA, First Hydrogen, Nikola - Fully on schedule

Time is pressing. From 2025, stricter emission targets issued by the European Union will apply, which gasoline and diesel engines will not meet. Due to the energy transition and decarbonization, carmakers globally are turning to battery-powered electric cars. However, electric mobility is unsuitable for transportation due to its short-range and long charging time. Here, the advantage currently lies very clearly with fuel cell technology.

Read