Comments

Commented by Carsten Mainitz on October 25th, 2021 | 13:25 CEST

Desert Gold, Barrick Gold, K+S - Now or never?

With inflation of over 4% in Germany and the continued massive money printing of the central banks, every investor should think about protecting oneself against the loss of purchasing power. To dismiss this as a temporary phenomenon would be a mistake. In times of high inflation, a good strategy is to invest in tangible assets such as stocks, real estate, and commodities.

ReadCommented by Armin Schulz on October 25th, 2021 | 12:36 CEST

BP, Saturn Oil & Gas, Royal Dutch Shell - Oil stocks take off

Anyone who has to fill up their car at the moment will not be thrilled. Prices at gas stations rose in some cases to over EUR 2. The reason is the further rising oil price. An end to this trend is currently not in sight. Morgan Stanley analyst Martijn Rats raised his forecasts for the first quarter of 2022 to USD 95 and sees the oil price at USD 70 per barrel in the long term. Falling supply due to scaled-back investments is causing prices to rise. Due to climate protection and the targets set, investments in the development of new oil wells have been significantly reduced. In 2014 it was still USD 740 billion; 6 years later, it is only USD 350 billion. Oil producers are currently benefiting the most from this development, so we take a closer look at three companies.

ReadCommented by André Will-Laudien on October 25th, 2021 | 11:41 CEST

GSP Resource, Nordex, JinkoSolar - Alternative energies on the rise!

The political course set in Germany is also decisive for further progress in the EU's complex opinion-making process. Nordic countries want to promote alternative energies much more strongly, while more southern members are increasingly focusing on nuclear power. French Prime Minister Macron intends to invest a total EUR 30 billion in the expansion of nuclear energy, hydrogen technology and e-mobility as part of his "France 2030" plan for the future. Nuclear power is set to disappear from the German energy mix. The race is already evidently on in Europe to see who will be allowed to cover our electricity shortfall in the future.

ReadCommented by Stefan Feulner on October 25th, 2021 | 11:28 CEST

SAP, Meta Materials, Intel - Going above and beyond

The mastery of light, electricity and heat has played a vital role in technological advances throughout human history. Successes in electrical and electromagnetic technology, wireless communications, lasers and computers have been made possible as the behavior of light and other forms of energy has become better understood and how to manipulate it has been developed. Even the current burdensome chip crisis can be eliminated by changing the chemical properties of semiconductors using nanotechnology.

ReadCommented by Nico Popp on October 25th, 2021 | 10:37 CEST

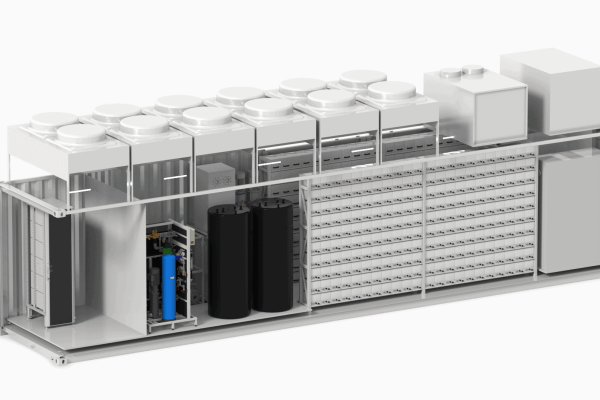

PayPal, BIGG Digital Assets, IBM: Crypto becomes a billion-dollar business

Invest, pay, transfer: The flow of money is becoming increasingly digital. The digitization of finance began more than a decade ago. Back then, we got tired of paying small amounts for transactions on eBay via bank transfer - and signed up for PayPal. Today, this development is much further along. Cryptocurrencies and the ongoing tokenization of tangible assets have changed the financial world. All other sectors, such as healthcare, are also becoming increasingly digital. Reason enough to take a closer look at three stocks.

ReadCommented by Stefan Feulner on October 22nd, 2021 | 13:23 CEST

Infineon, Sierra Grande Minerals, Xiaomi - New attack

2020 shows an extreme increase in government debt in the Eurozone. Due to the Corona Crisis, the ratio of public debt to gross domestic product increased to 90.7%, according to the Eurostat statistics agency. The situation worsened further in the crisis countries, especially in Greece. There, the debt-to-GDP ratio was 205.6%, followed by Italy with 155.8% and Portugal with 133.6%. There is no end in sight to this spiral. In the long term, however, investors can protect themselves by investing in the precious metals sector.

ReadCommented by Nico Popp on October 22nd, 2021 | 12:47 CEST

NEL, First Hydrogen, Rock Tech Lithium: Why investors must rethink now

For months, stocks related to innovative mobility concepts lived in the shadows. After the hype of last year and the first few months of this year, the former high-flyers seemed to have run out of steam. But the wind has changed. Investors' appetite for risk is high again. A few weeks ago, the market would have shrugged its shoulders at best, but now it is attracting buyers. For investors who think speculatively, this is excellent news!

ReadCommented by Carsten Mainitz on October 22nd, 2021 | 12:18 CEST

Clean Logistics, Plug Power, BYD - Huge upheavals in the transport industry fuel share prices

"Decarbonization" - this term could make it to "word of the year." That is because it describes what urgently needs to be implemented in all sectors to preserve the Earth's habitat: the switch from fossil, carbon-based energy sources to sustainably and climate-neutrally produced energy sources. The transport industry plays a significant role in global warming. In Germany alone, road freight transport is expected to increase by a further 19% by 2030. Innovative ideas and solutions that can be implemented quickly are therefore urgently needed. In doing so, manufacturers are relying on a variety of technologies.

ReadCommented by Armin Schulz on October 22nd, 2021 | 11:38 CEST

Bitcoin Group, BIGG Digital Assets, Coinbase - Profiting from the new crypto hype

Bitcoin has reached a new all-time high and has pulled many other coins up with it. Currently, the hype around cryptocurrencies is not as big as it was at the beginning of May, but due to the new highs, people are increasingly looking at the crypto market again. The first experts are already calling out price targets of USD 100,000 for Bitcoin. According to market observers, the high price gains in bitcoin could be due to the ProShares Bitcoin Futures ETF launch, which recorded more than USD 1 billion in turnover on the first day of trading. Today, we analyze three companies that can benefit from crypto hype.

ReadCommented by André Will-Laudien on October 22nd, 2021 | 10:32 CEST

Plug Power, Enapter, SFC Energy - The climate savior is hydrogen!

The strong increase in energy prices is driving the inflation rate in Germany to a high level. With an increase of 4.1% compared to the same month of the previous year, inflation accelerated again in September. Already in July, the ECB thought that a cyclical high might have been reached. It has reached its highest level in almost 28 years, only in December 1993, it was once briefly above the 4% mark. These are historic times into which Western society is now moving; unfortunately, no one knows when the end will be. The efficient production of hydrogen and its industrial utilization would make our energy supply affordable and environmentally compatible in the long term. Unfortunately, the current technologies are still costly and not suitable for mass production. However, hydrogen remains a hot topic on the stock market. We take a look at some of the protagonists in the H2 thriller.

Read