Comments

Commented by André Will-Laudien on April 1st, 2022 | 12:43 CEST

BioNTech, Defence Therapeutics, Valneva, CureVac - Stocks with blockbuster potential!

With the Ukraine crisis, international vaccination activity has taken a back seat. The world's northern hemisphere is gearing up for next summer, so flu diseases are also slowly taking a back seat. However, the COVID virus will likely continue to mutate over the summer and will reappear in a new guise in the fall. Germany's maximum vaccination rate of 76% has been reached, with just under a quarter of the population ultimately foregoing vaccination after lengthy public measures. For the major biotech companies, it is now a case of - The country needs new products! There are still many areas of application in the field of mRNA. Which stocks stand out with their pipeline?

ReadCommented by Fabian Lorenz on March 31st, 2022 | 12:31 CEST

Is the gas dispute escalating? What are Nel, RWE and First Hydrogen doing?

Germany is preparing for a possible gas shortage with an "early warning" phase. Yesterday, Economics Minister Robert Habeck activated the early warning phase of the so-called Gas Emergency Plan due to a possible deterioration in the supply situation and put together a crisis team. Habeck: "There are currently no supply bottlenecks. Nevertheless, we must increase preventative measures to be prepared in the event of an escalation by Russia." The background to this is Russia's announcement that it will only accept rubles for gas deliveries in the future. Once again, this highlights the urgent need for Germany to become independent of Russian gas supplies. Companies such as the utility RWE and the hydrogen specialists Nel and First Hydrogen are providing support on this path. The shares offer interesting opportunities.

ReadCommented by André Will-Laudien on March 31st, 2022 | 11:57 CEST

Varta, Phoenix Copper, JinkoSolar, Nordex: Numbers upon numbers, where is the explosive?

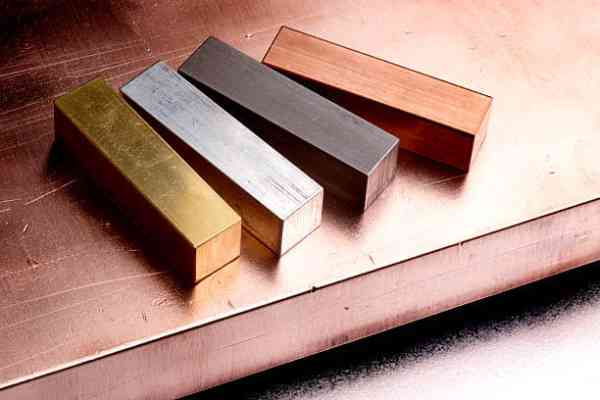

The copper price reached its preliminary high on March 7, 2022, at around USD 10,730. Since then, we have seen a standard consolidation of 3-4%, which is not an unusual occurrence in the present uptrend. Thus, the coveted metal has exploded by over 100% since the beginning of 2020. Large mining groups and copper mines have often been able to post a multiple of this performance for themselves in the same period. For many market participants, the medium-term upward scenario for the industrial metal remains set. Since the political closing of ranks on e-mobility, demand for copper and battery metals has shot through the roof. Mine operators and governments worldwide are alarmed because the current recoverable capacities cover just 85% of the current year's demand. Who can close the gap?

ReadCommented by Juliane Zielonka on March 31st, 2022 | 11:21 CEST

Kodiak Copper, Plug Power, BYD - Copper, copper and more copper

Carmaker BYD is finally showing itself without a mask: the brand-new Ocean X model is giving rival Tesla a run for its money. The Chinese electric carmaker is thus tapping into the design-savvy target group in the upper-middle class, which is climate-neutral and cost-conscious and relies on timeless elegance. Powered by electric motors with 203 hp, anyone will then be able to overtake the plug-powered MAN trucks in the left lane from 2023. But only if explorers like Kodiak Copper continue to successfully discover copper areas to meet market demand for the popular metal. 'Teamwork makes the dream work' is especially true for the Canadian Company's top executives.

ReadCommented by Stefan Feulner on March 31st, 2022 | 10:30 CEST

K+S, Saturn Oil + Gas, Salzgitter AG - Growth market for raw materials

The specter of inflation has been growing since the outbreak of the Corona pandemic and the unlimited money printing by central banks. According to the minutes of the monetary authorities, inflation was only temporary. But far from it, inflation will remain permanent and hit even harder than feared. Support is also coming from the sanctions imposed against Russia. As a result, the supply of oil, gas and many other commodities is becoming tighter, and prices are skyrocketing. And do not take the word of a central banker again who wants to explain to you that this time inflation is only temporary.

ReadCommented by Armin Schulz on March 30th, 2022 | 13:58 CEST

Alibaba, mm2 Asia, Tencent - Profits with entertainment shares from Asia

Ever since the Internet entered our everyday lives, companies that produce content and make it available to customers have been making profits. It does not matter whether it is web content, movies, music or computer games. In recent months, companies from China have suffered from the Chinese government's regulations. But that could now come to an end. In mid-March, the Chinese government declared that it supports listings on foreign stock exchanges. Therefore, today we look at three companies that offer entertainment to their customers with their content and analyze their potential.

ReadCommented by Carsten Mainitz on March 30th, 2022 | 12:50 CEST

Nordex, Altech Advanced Materials, Varta - Winners of the energy turnaround!

Renewable energy generation and energy storage are taking on an increasingly important role. The challenges for the infrastructure with decentralized energy sources are also increasing. Given the explosively rising lithium prices, which are essential for the production of batteries, innovations are gaining importance. Some solutions have the potential to powerfully shake up the industry. Long-term investors can profit from the megatrends in various ways.

ReadCommented by André Will-Laudien on March 30th, 2022 | 11:36 CEST

Attention: BYD, Edgemont Gold, Delivery Hero, MorphoSys - Shares with the highest dynamics!

The intensity of fluctuation on the capital markets remains high. It is measured by volatility indices such as the EU Vola Index or the VIX on the S&P 500. Both indices had risen well above 30 at the beginning of the crisis, with the EU Vola Index even reaching a peak of 43.3% on March 7. At the beginning of the Corona Lockdown in February 2020, this index rose overnight to values of over 70%. Although these volatility coefficients are slowly trending downwards due to political easing tendencies, hedgers on the derivatives markets are pricing volatility into their products at a higher price. So those who are currently trading options may experience their blue miracle with Vola changes overnight. Some stocks have recently jumped in this environment; where are the opportunities?

ReadCommented by Nico Popp on March 30th, 2022 | 10:09 CEST

Turn of the times! Stock winners and losers: Rheinmetall, Ximen Mining, ThyssenKrupp

Disputes surrounding the Ukraine war are taking on various dimensions drawing wide international circles. After China, India's role in the conflict could now also increase. According to reports by Deutsche Welle, there have been lively exchanges between Russia and India in recent weeks. India is seeking a permanent seat on the UN Security Council and has recently begun to buy Russian oil. Cooperation between the two financial systems is also conceivable. That would give Russia access to the capital markets again.

ReadCommented by Juliane Zielonka on March 29th, 2022 | 13:34 CEST

Valneva, Triumph Gold, BioNTech - Gold rush mood in the pipeline

While the Corona measures are eased in Spain, and the government lets symptom-free positive tested persons out of quarantine, Germany tightens again and extends the measures. This could create a gold-rush mood among BioNTech investors, as figures from the Mainz-based biotech Company will be announced on Wednesday. Valneva is also looking ahead with confidence to the first shipment of its liquid gold in the form of the COVID-19 inactivated vaccine. For investors with a more earthy disposition, it is a good idea to look at the real precious metals and gold deposits these days. For example, an investment in Canada's Triumph Gold Corporation offers copper and diamond deposits in addition to gold. The Company specializes in the discovery and development of gold and other valuable commodity deposits.

Read