Comments

Commented by Juliane Zielonka on April 7th, 2022 | 14:30 CEST

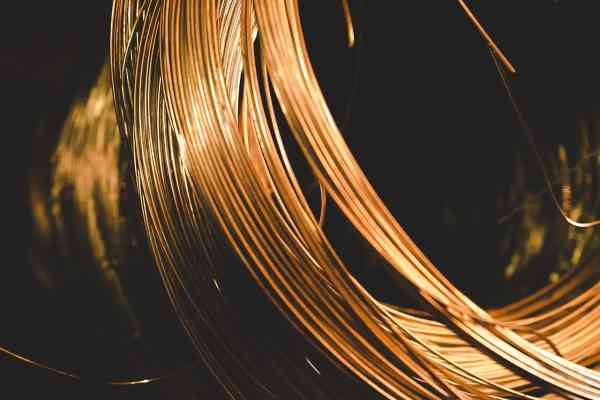

Phoenix Copper, Nordex, Tesla - Gold rush mood at the beginning of the supply chain

If the EU turns off the gas tap from Russia, alternatives are needed quickly to keep Germany running as a business location. With its wind turbines, Nordex SE is facing cybersecurity challenges, and Tesla shareholders are looking anxiously at the antics of their CEO, who is putting on yet another corporate hat. Producers are reeling from supply chain disruptions and other unreliabilities these days. So it is good to know there are reliable companies at the top of the supply chain: Phoenix Copper, with its raw material deposits of copper, gold and zinc, is not only an explorer on the hunt for the best mineral resources but also a collector.

ReadCommented by Nico Popp on April 7th, 2022 | 14:25 CEST

The alternative to concrete gold: Vonovia, Hong Lai Huat, HeidelbergCement

Concrete gold and tangible assets - these two terms have probably been used the most in the past ten years or more. The run on real estate began as early as after the great financial crisis. In retrospect, it is almost amusing that the first warnings of a bursting real estate bubble were sounded as early as the mid-10s. But the trend continued, on and on. Most recently, residential real estate prices have risen by around 12% in a single quarter. Once again, warnings of an end to the upswing are being voiced, such as by Deutsche Bank. But how strongly can real estate correct? Or will the real estate boom continue? Today, we present three shares as an alternative to apartments and highlight the particular advantages of real estate shares.

ReadCommented by Fabian Lorenz on April 7th, 2022 | 14:20 CEST

Varta, BYD, Nevada Copper: Shares under power

With the "Easter Package", Economics and Climate Protection Minister Robert Habeck wants to accelerate the expansion of renewable energies once again. The central goal is to double the share of electricity from renewable sources to 80% by 2030. In order to achieve this, approval procedures for new projects are to be shortened, among other things. In addition, new areas are to be made available for wind and photovoltaics, and remuneration is to be increased. Electromobility should also benefit because the environment is only really protected if the electricity comes from renewable sources. Companies across the entire value chain should benefit. The Chinese car manufacturer BYD is currently shining with several positive reports. Raw materials producer Nevada Copper also impressed with its quarterly update and is on the verge of a revaluation. At battery pioneer Varta, analysts are having their say after the figures.

ReadCommented by André Will-Laudien on April 6th, 2022 | 10:46 CEST

Siemens Healthineers, Perimeter Medical, Siemens, SAP - After BioNTech, now the push for MedTech shares!

The most significant positive share price developments in the last 12 months occurred in the biotech sector, especially among vaccine manufacturers such as BioNTech and Moderna. The stock market overlooked that pandemics, and the fight against them, offer short-term profit opportunities. The great battle against widespread diseases such as cardiovascular disease, cancer or other previously incurable indications progresses steadily. Their diagnosis and treatment require many types of technology, devices, processes, analysis tools, and intelligent software. Some methods certainly deserve the attribute "disruptive technology". We take a look at some blockbusters in the MedTech segment.

ReadCommented by Carsten Mainitz on April 6th, 2022 | 10:28 CEST

BASF, First Hydrogen, Nel - These developments are crucial!

A functioning energy supply influences the prosperity of society and our everyday lives. Security of supply and "affordable" energy prices currently present major challenges. Renewable energies are expected to provide most electricity and energy consumption within the next decades. Green hydrogen is also likely to play an important role. However, high oil and gas prices are placing an enormous burden on consumers and industry in the short term. Inflation continues to grow. How can investors position themselves?

ReadCommented by Nico Popp on April 6th, 2022 | 10:24 CEST

Making the best of the situation: Deutsche Bank, Aspermont, Deutsche Telekom

The importance of independent information is particularly evident these days. It is not without reason that the truth is considered the first casualty of every war. Later, disinformation and propaganda usually follow. Thanks to online access, also in Ukraine, information from various sources is available and can thus be verified or refuted. Decisions on sanctions also depend on this, and many sectors in this country are also affected. We highlight three stocks that, only at a second glance, play a role in the current situation.

ReadCommented by Stefan Feulner on April 6th, 2022 | 10:19 CEST

Ballard Power, dynaCERT, Plug Power - Hydrogen more important than ever before

The consequences are already apparent, at the latest when you stand at the gas pump and look at the horrendous increases of the last weeks. Germany is paying the price because of its overdependence on one customer, in this case, Russia. It is also a fact that Germany is moving too slowly concerning the energy transition. Acceleration is now imperative. Hydrogen fuel cell technology has already been identified as the missing piece of the puzzle and is becoming all the more important due to the current geopolitical tensions.

ReadCommented by Armin Schulz on April 6th, 2022 | 10:08 CEST

K+S, Barsele Minerals, Shell - Which commodity stocks belong in the portfolio?

Commodity prices are rising in almost all areas. To blame everything on the Ukraine conflict is too short-sighted. Fertilizer prices have significantly increased in the past year due to crop failures caused by natural disasters. Oil prices also began to rise last year. However, the sanctions against Russia gave the oil price a further significant tailwind. Gold has only been able to increase with the outbreak of the Ukraine war and is currently quoted at between USD 1,900 and 2,000. The high inflation should further increase the demand for gold. Today we look at three companies from the three sectors and analyze their potential.

ReadCommented by André Will-Laudien on April 5th, 2022 | 12:16 CEST

Baidu, mm2 Asia, GameStop, AMC - Entertainment shares: After Corona, time to party!

In 2021, no stocks were under as much pressure as the Asian tech giants. E-commerce giant Alibaba, for example, lost a full 50% year-on-year, while other stocks such as Baidu and Tencent suffered high double-digit losses in some cases. The situation has calmed down somewhat in recent weeks. The Chinese regulator is also gradually realizing that the heavy monitoring of its industry is significantly slowing down the growth prospects of its economy. The mood of the American SEC also seems to be brightening again. A delisting of Chinese stocks is probably off the table. We have selected the best stocks.

ReadCommented by Nico Popp on April 5th, 2022 | 12:10 CEST

New major trend determines share prices: BASF, Saturn Oil + Gas, Nordex

Those who invest along major trends ride the waves of the market with a tailwind. Trends such as population growth or digitization are here to stay and have far-reaching consequences - even if there is another slight dip in economic development. A new major trend is emerging that is something like the answer to globalization. We remember: For decades, people celebrated economic networking and the division of labor. Many economies, as well as companies, became specialized. But with the pandemic and the war in Ukraine, the golden age of globalization is over: regionalization and autarky are on the agenda instead. We explain what this means using three companies as examples.

Read