Comments

Commented by André Will-Laudien on March 29th, 2022 | 12:18 CEST

TUI, ThyssenKrupp, Desert Gold, Barrick Gold - Shares with 100% turnaround potential!

The armed conflict in Ukraine continues to drive inflation. In the US, inflation was recently reported at plus 7.9%, and the yield on the 30-year government bond rose above the magic 2.5% mark last week. For market experts, this heralds the long-term turnaround in interest rates. The Federal Reserve also sees the need for further interest rate steps to ensure monetary stability. These are conceivably bad conditions for the economy because the supply chain issue has already caused growth rates to plummet. Some economists see a slump in the western industrial nations of 4-6% as possible. For precious metals, this recession scenario could be the turning point. We select some promising stocks.

ReadCommented by Stefan Feulner on March 29th, 2022 | 11:25 CEST

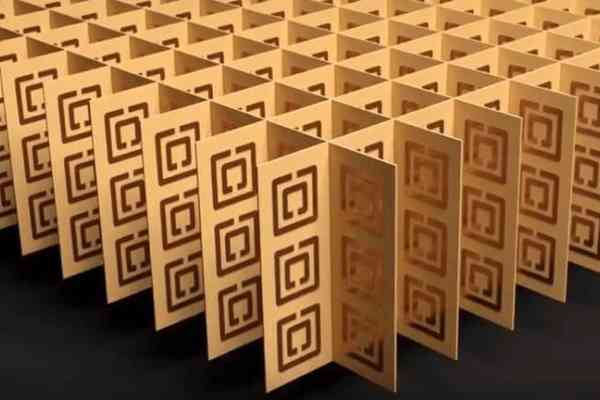

BYD, Meta Materials, Salzgitter AG - Unabated rise

Inflation is rising relentlessly and is likely to last far longer than predicted by the monetary authorities at the beginning of the year. The Russian war of aggression in Ukraine and the resulting sanctions have caused extreme price increases for energy and raw materials. Trade flows and supply chain relationships have also been severely impaired. Uncertainty about further economic developments remains high, but the price increases due to the escalation of the Russia-Ukraine conflict are only partially reflected in the inflation rate to date. As a result, the industry can expect higher costs in the coming months. By contrast, producers of various materials are benefiting.

ReadCommented by Fabian Lorenz on March 29th, 2022 | 10:20 CEST

Alarm bells ringing: Shares of Nel ASA, K+S and Almonty Industries take off

There is a mood of alarm in German politics and business these days. The reason - prices for critical raw materials are going through the roof, and the security of supply is in question. BMW, Daimler, and Volkswagen have to shut down plants due to a shortage of nickel. And the stress factor is also high in medium-sized companies. Take tungsten, for example. "The sources are drying up at the moment, which is causing problems in procurement," says Johannes Schmidt in an interview with the FAZ. He is chairman of the board of the medium-sized holding Company Indus and thus has an overview of the situation in various industries. Although China is the largest tungsten producer, German companies have often ordered from Russia. On the other hand, commodity companies such as Almonty Industries, K+S and Nel are profiting. Their shares are taking off.

ReadCommented by Armin Schulz on March 28th, 2022 | 13:44 CEST

Infineon, Edison Lithium, BYD - Raw material shortage for electric cars

The shift from combustion engines to electric cars poses new challenges for production. An electric vehicle requires significantly more chips, more copper and more raw materials such as nickel and lithium for the batteries. Most recently, the nickel price climbed to over USD 100,000 per ton, partly due to the sanctions against Russia. But the price of lithium is rising. The demand for batteries is still significantly higher than the supply after the rethinking of the automotive industry. Today, we highlight two problem areas and look at an electric vehicle manufacturer.

ReadCommented by André Will-Laudien on March 28th, 2022 | 13:40 CEST

Rheinmetall, Hensoldt, Kleos Space - These stocks have the Ukraine perspective!

No one would have thought that the sense of peace and security that Europe has built over the past 75 years could dissolve in just 4 weeks. The war in Ukraine is taking on unimagined traits, with threats between East and West intensifying at what feels like 24-hour intervals. With each verbal attack by Joe Biden, communications become tighter and more threatening. What will our world look like after another 4 weeks? We do not know. At any rate, the capital markets are trying to price in the consequences of the war. They are still relatively optimistic, possibly even too positive, considering the enormous inflationary pushes and the still unclear economic effects. We look at some price outliers in this explosive environment.

ReadCommented by Stefan Feulner on March 28th, 2022 | 12:34 CEST

Deutsche Bank, Hong Lai Huat, Commerzbank - Strong comeback

Following Russia's invasion of Ukraine and the subsequent sanctions, banks, in particular, lost disproportionately in stock market value. Concerns about possible loan defaults in neighboring Eastern European countries caused the major European banks and domestic financial institutions such as Deutsche Bank and Commerzbank to plummet in the short term. In recent days, however, it is precisely these stocks that showed relative strength, driven above all by interest rate fantasies triggered by the US Federal Reserve.

ReadCommented by Nico Popp on March 28th, 2022 | 11:20 CEST

Who profits by it? Shares! Alibaba, wallstreet:online, Steinhoff

Buy, sell or hold? The stock market is sometimes turbulent. The war in Ukraine and its economic side effects, in particular, can cause events to spiral out of control. Investors have to react quickly to limit losses or seize opportunities. We highlight three stocks and explain how they are doing in the current unrest.

ReadCommented by Carsten Mainitz on March 28th, 2022 | 10:26 CEST

Aspermont, AUTO1, Delivery Hero - Digital business models put to the test

Digitalization has triggered profound changes in everyday life and the business world. The Corona pandemic has significantly accelerated this development. But how do you measure success? Sales expansion, market share, rising share price or profit? For a long time, the market conceded rising share prices and many advance praises to Delivery Hero's share certificates, then the reality check set in - do profit expectations and valuation fit together? Shareholders of Auto1 are asking themselves the same questions. But there are other examples: Australian Company Aspermont is the market leader in an exciting niche and, according to analysts, is dramatically undervalued.

ReadCommented by Carsten Mainitz on March 25th, 2022 | 13:13 CET

Defense Metals, Hensoldt, Rheinmetall - Special boom for the defense industry

The war in Ukraine is giving the defense industry more weight. But what is the focus? Defense, deterrence, or war of aggression? The shares of industry representatives have recently benefited significantly from higher defense budgets and orders. What one thinks of this from a moral point of view is another matter. On a more sober note, stronger demand and earnings growth lay the groundwork for higher share prices.

ReadCommented by Carsten Mainitz on March 25th, 2022 | 12:23 CET

K+S, Ximen Mining, BP - The trend continues

The commodity markets are bullish across the board. Sanctions, supply bottlenecks, and demand that is increasingly exceeding supply can be observed in many areas. Precious metals play a unique role as a crisis currency. What is negative for consumers and demanders is a profit booster for commodity producers - rising prices. These companies should be among the beneficiaries. Who will be ahead at the end of the year?

Read