Comments

Commented by Nico Popp on March 23rd, 2022 | 10:47 CET

Stocks that change the world: TeamViewer, Perimeter Medical, Nordex

When new technology meets the right opportunity, things can go up quickly for companies. One example is the German company TeamViewer, which already had an established remote desktop solution that many users had heard of when the pandemic broke out. When we moved to the home office overnight but had to use software from the office, it made sense to install TeamViewer. Innovative solutions are also meeting with great demand in other industries. We analyze what this means for investors.

ReadCommented by Stefan Feulner on March 22nd, 2022 | 15:08 CET

SAP, Aspermont, Palantir - AI shares facing reassessment

Following a rise in the German benchmark index DAX of more than 2,000 points since the interim low at 12,431, there is indecision as to which direction to take. The situation in Ukraine, where an agreement on a ceasefire is still a long way off, serves as a mirror image. In contrast, we are getting closer to the development that artificial intelligence is becoming increasingly important in many areas of our lives as a result of digitalization. The aspect of AI security, both in terms of protection against external attacks and operational security, is gaining relevance accordingly. Companies currently listed on the stock exchange could be facing a revaluation soon.

ReadCommented by Juliane Zielonka on March 22nd, 2022 | 14:06 CET

Nevada Copper, Mercedes-Benz, BYD - Price increase for copper expected

The battle for raw material supply chains is intensifying in light of the Ukraine crisis. Copper as a raw material is an indispensable component for electric vehicles. According to Goldman Sachs, due to the geopolitical upheavals, the price of copper may rise rapidly in the coming months. To ensure smooth supply chains, the Company is revisiting Cold War strategies and focusing on local resources. Nevada Copper, a copper supplier in the US, can support Mercedes-Benz's new battery plant. In China, Tesla competitor BYD Electronics is also working with the Stuttgart-based automotive giant to test the luxury segment.

ReadCommented by Fabian Lorenz on March 22nd, 2022 | 12:31 CET

Analysts enthusiastic about S&T, Rheinmetall and Phoenix Copper - TUI share under review

The shares of S&T and Rheinmetall were among the day's winners yesterday. Austrian IT services provider S&T gave a positive outlook for the current year and fended off Viceroy's short attack. The loss of sales in its Russian business is expected to be partially offset by orders in the armaments and cybersecurity sectors. The guidance from January was raised slightly, and the dividend is also expected to increase. Analysts were pleased and the stock gained more than 10%. Rheinmetall shares benefit from positive analyst recommendations, with the price targets increasing up to EUR 210. In contrast, Jefferies is not convinced by the share of TUI. Phoenix Copper is benefiting from the commodity market. The experts at SISM Research see more than 100% upside potential for the commodity explorer.

ReadCommented by Nico Popp on March 22nd, 2022 | 11:22 CET

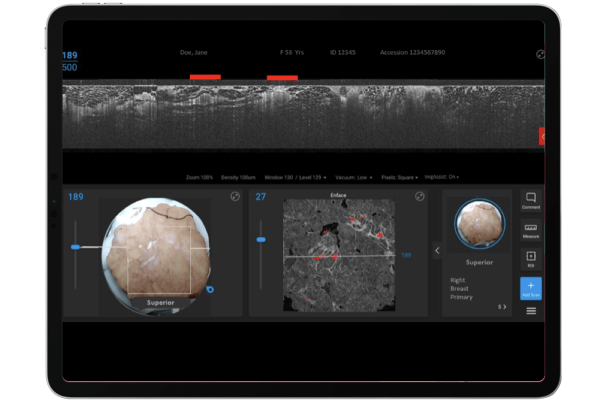

In the right place at the right time: BioNTech, Defence Therapeutics, Bayer

For years, the pandemic has kept the world on tenterhooks. Currently, the epidemic is taking a break, at least in the media. But while the world is looking tautly at Ukraine and more and more refugees are arriving in Germany, the Omicron figures are rising once more. In some cases, the incidence in Germany is over 3,000. Although fewer and fewer people are dying, more people than ever are in quarantine. We look at BioNTech, a typical pandemic stock, and present other exciting investments from the healthcare sector.

ReadCommented by André Will-Laudien on March 22nd, 2022 | 10:08 CET

NEL, dynaCERT, Plug Power, Ballard Power - Oil & Gas infinitely expensive, where are the hydrogen stocks?

What a dramatic move for oil and gas! It was a movement with an announcement. Fossil fuels are being traded as if any sources were about to dry up. Due to the armed conflicts in Ukraine, analysts see the danger of a severe supply shortage of oil and gas if the Western countries impose an embargo on Russian oil and gas supplies. Europe, in particular, is likely to suffer because of its heavy dependence on the East. In order to secure the supply, one hopes for an OPEC production adjustment, which is probably not yet political consensus. For the past 3 weeks, concepts for alternative energy generation have again been in the spotlight. The acceleration of hydrogen technology remains a topic of desire for all politicians. What is the current status?

ReadCommented by André Will-Laudien on March 21st, 2022 | 13:10 CET

Attention - MorphoSys, Valneva, CureVac, MAS Gold: These shares smell of a turnaround!

The biotech sector, especially around vaccine manufacturers, has recently fallen somewhat out of fashion - Germany's most extensive Corona measures have likely already taken place. The general willingness to vaccinate can hardly be increased, and the vaccination obligation was dropped without a trace after lawyers formed a massive wave of lawsuits. But now that the Omicron infection figures are exploding to unimagined heights, we can expect a hot autumn again after a summer with a breather. "Corona has come to stay!" said Karl Lauterbach when he was not yet health minister. We take a look at some shares that have recently rebounded strongly.

ReadCommented by Stefan Feulner on March 21st, 2022 | 12:13 CET

BYD, First Hydrogen, Continental - Hydrogen and e-mobility: Shares with huge potential

Germany must become more independent in terms of energy supply in the future. The war between Russia and Ukraine in the middle of Europe ruthlessly demonstrates how much the Federal Republic of Germany is at the mercy of fossil fuels. Now, at the latest, it should be apparent to every skeptic that the expansion of renewable energies and the transformation in the transport sector must proceed all the more quickly. The opportunities for the companies involved are enormous.

ReadCommented by Nico Popp on March 21st, 2022 | 11:15 CET

Shares between expropriation and the new era: Barrick Gold, Triumph Gold, Alibaba

Goldman Sachs has always been considered well-informed and well-connected in investor circles. Even if sometimes a little too much is read into the forecasts of the US bankers, investors should take note of them. Currently, Jeff Currie, commodity specialist at Goldman Sachs, assumes a "perfect upswing" for gold. The price target could be USD 2,500. Goldman sees the precious metal as the "currency of last resort" and points to rising ETF purchases and increasing demand from central banks. We take a look at three stocks and their prospects.

ReadCommented by Armin Schulz on March 21st, 2022 | 10:08 CET

TUI, Desert Gold, Steinhoff - Cheap Shares, bargain hunters watch out

Today, we look at three companies whose share prices appear cheap at first glance and then analyze which candidates have potential. An affordable stock is not necessarily cheap, just as an expensive stock is not automatically expensive. The problem with many retail investors is that they do not have the money to buy a few Amazon shares. Therefore, smaller stocks are more likely to be found, especially in smaller portfolios. One should look at the market sentiment of a company and its fundamentals to avoid betting on the wrong horse if possible.

Read