April 29th, 2025 | 07:05 CEST

Out of RENK and Co. and into Almonty shares? China's sharpest sword! Another 100% price gain with the tungsten high-flyer?

"Restrictions on the export of rare earths are the sharpest sword China can wield," Harald Elsner of the German Raw Materials Agency told FAZ. Reserves are likely to last only a few weeks for German industry. While RENK, KNDS, and Co. are trembling in the face of export restrictions, Almonty's strategic importance for the Western defense industry and beyond is becoming increasingly clear. Like defense stocks, the tungsten producer's share price has more than doubled in the current year. However, the valuation remains low, and analysts see more than 100% upside potential. There are good reasons why the tungsten stock rocket could ignite the next stage as early as tomorrow.

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Analysts raise price target

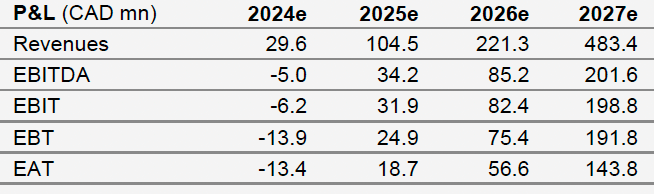

Analysts continue to see significant upside potential for Almonty shares, which are also actively traded on German stock exchanges. Most recently, experts at Sphene Capital renewed their "Buy" recommendation for the tungsten producer's shares and raised their price target from CAD 5.20 to CAD 5.40. Rare earths and critical metals are increasingly being used as weapons in the tariff dispute between the US and China. Almonty is benefiting from this. After years of development work, the Company plans to start operations at what is likely to be the largest tungsten mine outside China in South Korea in the near future. Production is already underway in Portugal. The new Sangdong mega-mine is expected to cause revenue and profits to skyrocket. Analysts expect Almonty to increase its revenues from around CAD 29 million in 2024 to CAD 104.5 million in the current year. With the expansion of the mine in South Korea, revenues of CAD 483.4 million are expected in 2027. Experts forecast earnings per share of CAD 0.20 for 2026 and CAD 0.51 for 2027 Link to the study. This means that the current share price of around CAD 2.40 appears to be anything but expensive – especially when compared to defense companies such as RENK and Co.

This view is also shared by analysts at GBC Research. They recently initiated coverage of Almonty with a "Buy" recommendation and a price target of CAD 4.20 (Link to the study). In an (interview) with Stockhouse presenter Lyndsay Malchuk, GBC analyst Matthias Greiffenberger explains his assessment of Almonty.

China wields the raw materials sword

"Restrictions on the export of rare earths are the sharpest sword China can wield," Harald Elsner of the German Raw Materials Agency told the Frankfurter Allgemeine Zeitung (FAZ). In an article published last Friday, experts highlighted how dependent the West is on China for rare earths and critical metals such as tungsten. China has restricted exports since the beginning of April and, in some cases, even blocked them entirely. If no solution is found, the production of defense equipment, medical technology, and other high-tech products in the West could come to a standstill in just a few weeks.

The FAZ article also discusses tungsten and Almonty. More than 80% of tungsten production comes from China and is used, among other things, to harden ammunition. In South Korea, Almonty plans to produce around 2,300 MTU of tungsten trioxide in the first year, rising to 4,800 MTU in the second year. Almonty CEO Lewis Black told the FAZ: "I realize that I have to tell many interested parties that I am unfortunately unable to supply them immediately." Perhaps this will even make Almonty a takeover candidate?

Next big move: NASDAQ listing?

The US is likely at the top of Almonty's customer list, alongside Europe, South Korea, and Japan. In addition, the tungsten is further processed in the US. Thus, the decision to relocate the Company's headquarters there seems sensible. In addition, US General Gustave F Perna has been appointed to Almonty's board of directors, and the Company is involved with American Defense International. Could tomorrow's annual general meeting see the next big announcement with the listing on NASDAQ? The chances are good, as the option of a NASDAQ listing was already mentioned in the last letter to shareholders.

Sangdong mine with high tungsten content

In the shareholder letter, Lewis Black confirmed the positive outlook: "Looking ahead, Almonty is entering a new chapter of growth. With the upcoming start of production at Sangdong, a strengthened balance sheet, and an optimized corporate structure, we are well positioned to benefit from rising tungsten demand and create sustainable, long-term value for my fellow shareholders." It was pointed out that the Sangdong mine is not only huge but also has a high tungsten content. This is 0.14% at Almonty's Panasqueira mine in Portugal. At Sangdong, it is 0.46%.

Molybdenum deposit further price driver

What is currently being overlooked in the hype surrounding tungsten and has hardly been evaluated by analysts is a molybdenum deposit in the immediate vicinity of the Sangdong mine. The mine is scheduled to go into production in 2026. SeAH Group, a steel producer that supplies the aerospace company SpaceX, has already signed an exclusive agreement to purchase the expected production volume at a minimum price. At full production, 5,600 tons of molybdenum are to be mined per year. The mine is expected to have a lifespan of 60 years. This confirms the raw material treasure and additional share price driver that Almonty has at its disposal.

Conclusion: Out of RENK and Co. and into Almonty?

The price fireworks at Almonty is likely far from over. Sangdong is about to go into operation, the battle for critical raw materials is intensifying, a NASDAQ listing is likely only a matter of time, and the valuation remains low. Therefore, while you do not necessarily have to sell RENK and Co., it seems that much more is already priced into the defense companies' shares.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.