April 13th, 2023 | 22:22 CEST

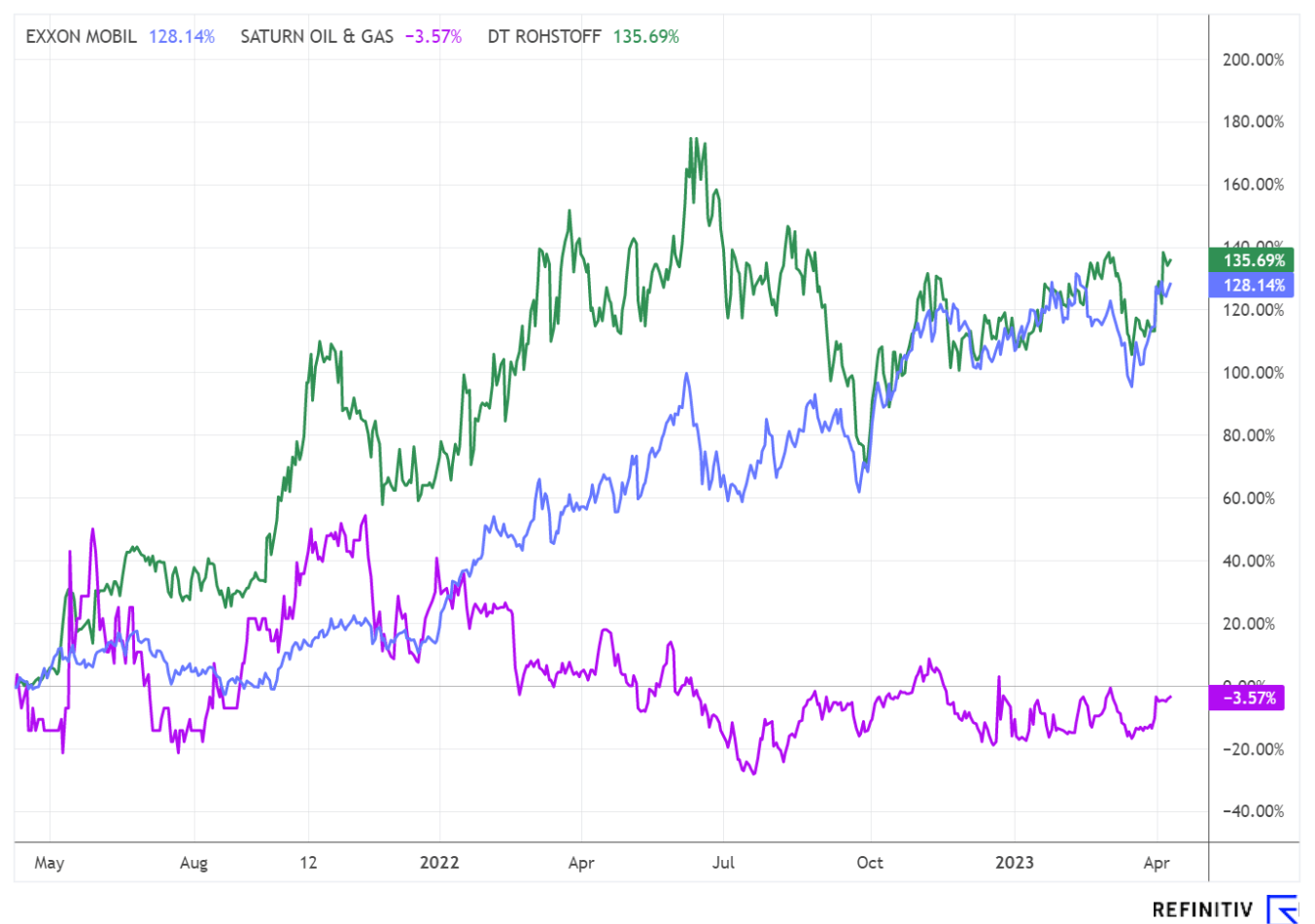

Oil more expensive after OPEC shock - Exxon Mobil, Saturn Oil + Gas, Deutsche Rohstoff AG

Supply is getting tighter, and prices are rising significantly. By cutting oil production quotas, the eight producer countries of OPEC+ ended the correction in the oil market that had been going on since July last year. This is bad news for motorists in Germany because the days of "cheap" petrol and diesel below EUR 2.00 will soon be a thing of the past. In addition to the producing countries, it is mainly producers from the western regions that are benefiting.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

EXXON MOBIL CORP. | US30231G1022 , Saturn Oil + Gas Inc. | CA80412L8832 , DT.ROHSTOFF AG NA O.N. | DE000A0XYG76

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Deutsche Rohstoff AG - On a record-breaking hunt

The Mannheim-based company has been listed on the stock exchange since 2010. The focus is on developing attractive raw material deposits, primarily in North America, Australia and Europe, and then selling them, with an emphasis on the development of oil and gas deposits in the US. In addition to the oil and gas projects in the US, Deutsche Rohstoff is involved in high-grade gold, copper and tungsten projects. In the future, the experienced management will also analyze the market for strategic metals, which are mainly needed for high-performance batteries. One core investment of the Company is Almonty Industries, which specializes in tungsten and already has a producing property in Portugal. However, with the construction of the Sangdong project in South Korea, Almonty could become the Western world's most important tungsten producer, as the mine is expected to supply around 30% of tungsten demand outside China.

After the end of the first quarter of 2023, Deutsche Rohstoff AG is on track for a record production of 10,500 barrels of oil equivalent per day (BOE/D), about 7% above management's expectations. Thus, the Company is fully on course to pulverize its annual target of over 10,000 BOE/D. Especially for the second and third quarters, the Mannheim-based company has even more aces up its sleeve, as numerous drilling sites will start production here and further increase production. Above all, the Knight drilling site in Colorado, the drillings from the program with Oxy, and the continued strong production in Utah were responsible for exceeding the Company's forecasts.

From a chart perspective, too, everything is green for the Company. At EUR 28.10, the share is on the verge of reaching a new high for the year at EUR 28.60. A significant rise above this would open the door to a new high. A significant breach would open the door wide to the all-time high at EUR 34.00.

Saturn Oil & Gas - analysts see enormous price potential

Growth is also at the top of the agenda for Canadian oil producer Saturn Oil & Gas. 18 months ago, the daily production was still 700 barrels of oil equivalent (BOE) per day. According to the Company's forecast, this is expected to explode to over 31,000 BOE in the second half of 2023. The reason for the strong expansion of the production quota is the recent acquisition of Ridgeback Resources at the end of February, which is expected to expand production by around 17,000 BOE per day. Although this increases the debt by CAD 375 million to CAD 594.8 million, the net present value of Saturn Oil & Gas reserves at a 15% discount rate has been increased from CAD 698.6 million to CAD 1,472.4 million.

The most recent reserve valuation, still excluding the Ridgeback acquisition, resulted in a net asset value of CAD 6.92 per share for developed and suspected reserves of both the Oxbow and Viking oil fields. When adding the proved and suspected reserves of the newly acquired property, the net asset value rises to CAD 12.88 per share.

With a current price of CAD 2.67, there is an acute undervaluation; in any case, various analyst firms see enormous price potential. CG Capital Markets, for example, sees a target price of CAD 7.00, while the experts at Eight Capital set a target of CAD 7.50.

Exxon Mobil - Close to new record highs

The US oil multinational Exxon Mobil is also on the verge of new highs with a price of USD 116.53. The previous all-time high was USD 119.63 on 6 February this year. The share is getting a tailwind from the indicators. The daily MACD trend tracker is even close to a buy signal, and the relative strength indicator is neutral and far from the overbought zone.

After a record result in the last financial year and full coffers, Exxon is now on the lookout for a bride. The target of desire is the US oil producer Pioneer Natural Resources. According to the Wall Street Journal, citing unnamed sources, Exxon Mobil has held initial talks about buying US shale oil giant Pioneer Natural Resources. If Exxon acquires Pioneer, which has a market capitalization of about USD 49 billion, it would be the biggest deal since its mega-merger with Mobil in 1999, strengthening Exxon's position in the oil-rich Permian Basin of West Texas and New Mexico and bringing together the leading Western oil company, more than 140 years old and worth more than USD 468 billion, with a driller that has significant oil reserves in America's most coveted fracking hotspot.

OPEC is cutting back production quotas, which has led to rising prices in the oil market. Deutsche Rohstoff AG is expected to post record results after a better-than-expected first quarter. Saturn Oil & Gas is massively undervalued, according to analysts. Exxon Mobil is on the verge of new highs and is planning a mega takeover.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.