January 17th, 2023 | 16:27 CET

Niiio Finance, Aspermont, MicroStrategy - Digital turn of the times

Digitization is one of the most radical processes of change humanity is currently going through. Hardly any industry is left out of the transformation. The Internet of Things, artificial intelligence, blockchain or Industry 4.0. are common terms that have already found their way into our lives. The financial industry is also facing tremendous upheavals. Thus, novel, highly scalable business models are emerging that could replace those of traditional banks in the future.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

NIIIO FIN.GRP AG NA O.N. | DE000A2G8332 , ASPERMONT LTD | AU000000ASP3 , MICROSTRATEG.A NEW DL-001 | US5949724083

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Aspermont - Market leader expands

An undiscovered champion, at least on the stock market, is Aspermont. With a market capitalization of EUR 31.28 million, the Australians are significantly undervalued in a peer group comparison. Only a few companies with organic sales growth of 20% and margins of over 50% have a price-to-sales ratio of only 3. Yet Aspermont has shown continuous revenue growth for 25 quarters. For the full-year 2022, the Australians reported total revenue of AUD 18.7 million, up 17% from fiscal 2021, with the key recurring revenue metric growing to 75% from 70% a year earlier and gross margin at 64% on gross profit of AUD 12 million. Normalized EBITDA growth was 41% to AUD 2.8 million compared to full year 2021.

The Mediatech company's foundation is a highly scalable platform technology. With an Anything-as-a-Service (XaaS) model, Aspermont distributes high-quality content to a growing audience via a subscription model. In addition to the standard subscription, it is also possible for customers to book further premium content services. As a result, the B2B service provider receives high recurring revenues on the one hand, and on the other, the revenue per customer is continuously increased by adding new services. In addition, a data and services business has been built up in recent years to leverage the Company's paid audience base and offer marketing and information services. As a result, Aspermont has advanced to become the leading provider of business-to-business digital media in the mining, energy and agriculture sectors.

The year 2023 will continue to be marked by expansion. Thus, the platform is to be further expanded from the free cash flow and cash funds amounting to EUR 4.25 million at the end of the fiscal year. Last year, the financing platform "Blu Horseshoe" was launched with partners, enabling qualified customers to access the lucrative market of secondary emissions on the ASX. In addition to expanding the workforce, the launch of the Skywave, Esperanto and Archive platforms is planned for this year. In terms of geographic expansion, the Company plans to move into North America. In addition, a Nasdaq listing should be imminent here in the near future. By then at the latest, more and more private and institutional investors are likely to take notice of Aspermont.

Niiio Finance - Clear visions

The Company, based in Görlitz near Dresden with a market capitalization of EUR 32.82 million, offers an innovative cloud-based platform with Software-as-a-Service solutions. The vision and future strategy of founder and major shareholder Johann Horch are clearly formulated. The Company wants nothing less than to digitize asset and wealth management in the financial industry. Currently, the market is highly fragmented, with many providers offering only individual solutions. Niiio's goal is to provide a one-stop-shop solution for customers that spans the entire value chain. That would make it the leading SaaS platform with full coverage of back- and front-end processes in Pan-Europe. The European market for WealthTech solutions was estimated at EUR 15.0 billion p.a. in 2022.

The expansion is expected to succeed through targeted acquisitions and rapid integration into the platform. Last year, a "proof of concept" was delivered with fintech Patronas and order routing provider FixHub. Accordingly, revenues are expected to more than triple from EUR 2.4 million in 2021 to EUR 7.5 to 7.9 million in the past fiscal year. Organic growth was in the low double-digit range. Another 15 potential acquisition targets are already on the docket. In the long term, the Company is targeting a sales growth of a whopping EUR 300 million. By consolidating the market and offering a one-stop solution, the broader Niiio Finance is positioned, the greater the economies of scale and cross-selling opportunities.

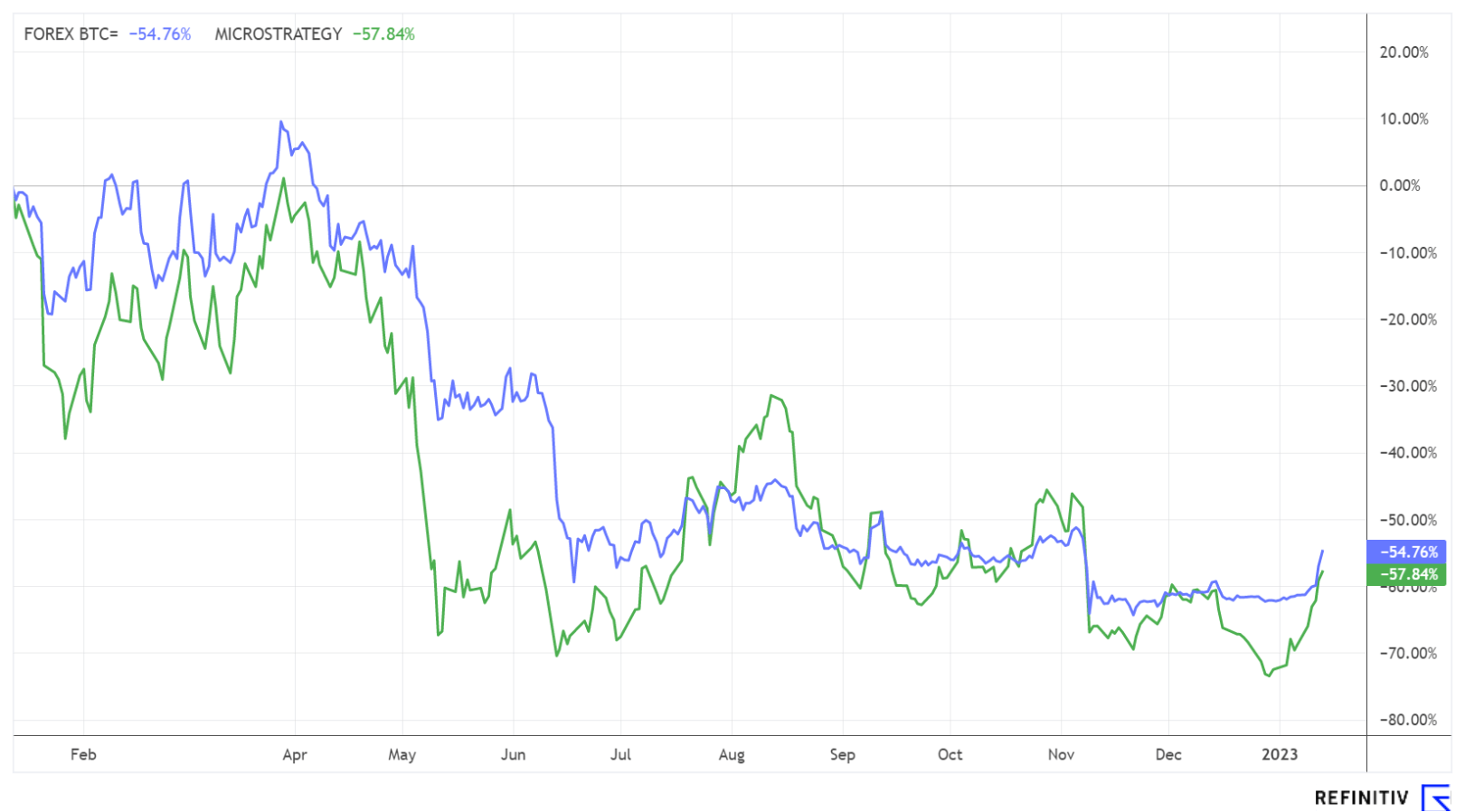

MicroStrategy - Ready for the Summer

For months, the crypto exchanges were in deep winter mode. Thus, the leading currency, Bitcoin, fell in value by almost 80% since November 2021 and was quoted at an interim low of USD 15,632.00. Since then, the cryptocurrency has been working on a bottoming out. In the past few days, however, increased demand came into the market under high volume, pushing the price above the mark of USD 21,000. With a jump above the high from November last year at USD 21,473.00, the chart picture would brighten further and generate another buy signal.

Hoping for this buy signal and a long-term trend reversal is crypto stalwart and MicroStrategy board chairman Michael Saylor. The former CEO is also head of the investment committee that looks after the Company's Bitcoin acquisition strategy. In the process, MicroStrategy's bitcoin holdings total 132,500, more than any other company globally.

In the old year, the stocks were again expanded by 2,000 coins. In total, the Company invested USD 4.03 billion and an average purchase price of about USD 30,397. Should the crypto market turn in the long term, the MicroStrategy share is considered a real alternative to a direct investment in bitcoin due to tax considerations.

Everything is going digital. Whether currencies, publishing or financial services. Aspermont is cheaply valued at a P/E of 3 due to its highly scalable platform. MicroStrategy is positioning for an upward move in bitcoin. Niiio Finance enters the market with a clearly defined acquisition strategy that should take the Company into other dimensions in the future.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.