June 26th, 2025 | 07:00 CEST

New biotech boom ignites: Are Evotec, BioNxt, Bayer, Novo Nordisk, and Formycon poised for the next price surge?

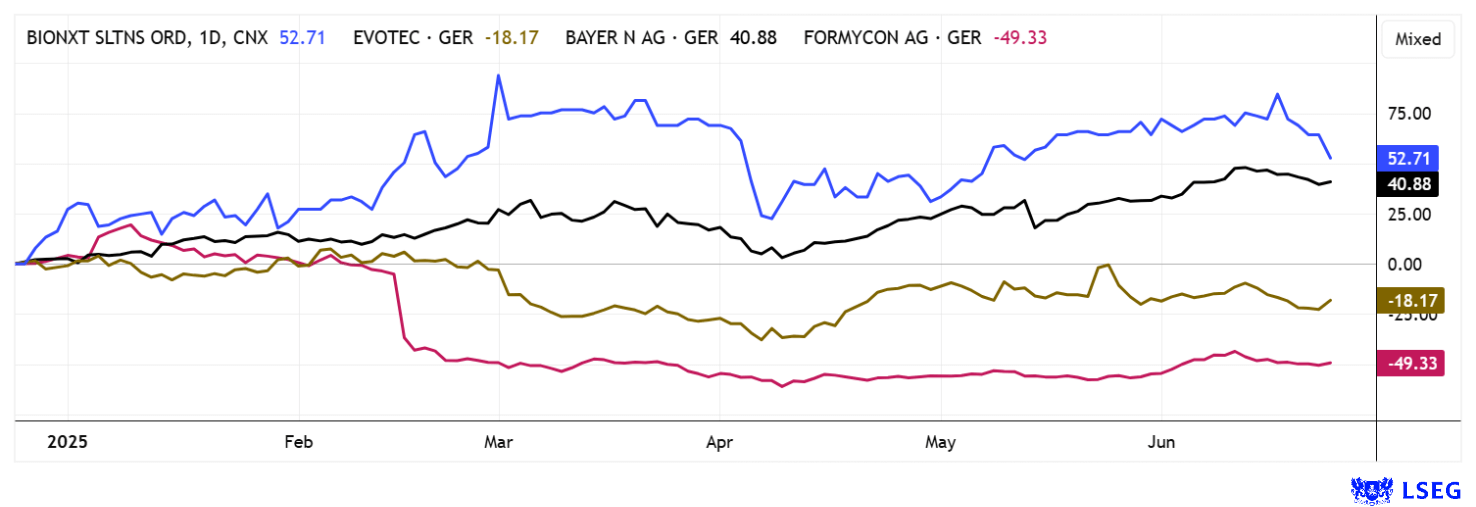

The biotechnology industry is currently experiencing a remarkable renaissance. Innovations in personalized medicine, advances in mRNA technologies, and new therapeutic approaches to cancer and autoimmune diseases are fueling investor interest worldwide. In this dynamic environment, established players such as Evotec and Bayer, as well as specialized up-and-comers like BioNxt and Formycon, are moving into the spotlight of strategic investments. While Evotec scores with its strong partner network, Bayer is working on a realignment with a focus on promising research. BioNxt impresses with a lean business model and promising pipeline products in the field of drug delivery. Formycon, on the other hand, is benefiting from the biosimilar boom and is currently undergoing a turnaround. The industry is highly innovation-driven, and those who bet on the right players could reap above-average rewards.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , Bionxt Solutions Inc. | CA0909741062 , BAYER AG NA O.N. | DE000BAY0017 , NOVO NORDISK A/S | DK0062498333 , FORMYCON AG | DE000A1EWVY8

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec and Bayer – On the verge of breaking out of their downward spiral?

After a mixed 2024 and an equally weak start to the first quarter of 2025, Evotec and Bayer are showing the first clear signs of a technical bottoming out. Both stocks suffered from structural challenges, disappointing figures, and a challenging market environment. However, recent developments are giving investors hope again. Evotec presented solid Q1 figures with stable revenue and a clear focus on margin improvement. The Company is sticking to its strategic plan of bringing new drugs into the clinical phase with partners from Big Pharma. The revenue target for 2025 is EUR 850 million, with the aim of achieving operating profitability. After the recent share price slump to EUR 6.50, there was increased buying interest at important support levels. Yesterday, prices were back up to EUR 7.27, triggered by news of a new collaboration in the field of kidney disease. Evotec will work closely with the NURTuRE-AKI consortium over the next three years to collect biological samples and clinical data from over 950 patients. Particular attention will be paid to heart surgery patients and the progression from acute to chronic kidney failure. The data obtained will be incorporated into Evotec's Molecular Patient Database (E.MPD), significantly advancing the identification of new therapeutic target molecules and biomarkers for acute kidney failure. Once again, investors are hoping for more at the EUR 7 mark!

Bayer is also increasingly focusing on the charts. The share price appears to have bottomed out at around EUR 19 and has since climbed to over EUR 27.50. There are also encouraging signs: Bayer's cancer drug Nubeqa (darolutamide) is awaiting approval in the EU for a third indication. The pharmaceutical company announced that the European Medicines Agency's Committee for Medicinal Products for Human Use has recommended approval of the drug for the treatment of patients with metastatic hormone-sensitive prostate cancer (mHSPC) in combination with androgen deprivation therapy (ADT). The EU Commission will now decide on approval, which usually follows the committee's recommendation. Bayer expects this to happen soon. This would be the approval of a third indication; it has already been approved in the US. Perhaps the share price of EUR 26.25 now presents a medium-term opportunity!

BioNxt Solutions – Munich to become the epicenter

BioNxt Solutions' share price has almost tripled since December 2024. The Canadian company focuses on next-generation drug formulations and delivery systems. In recent months, the focus has been primarily on transdermal and orally dissolvable preparations. The current patent series covers the sublingual administration of cancer drugs for the treatment of autoimmune and neurodegenerative diseases. In June, the biotech company initiated a feasibility study for the development of an orally dissolvable film (ODF) form of semaglutide, a GLP-1 receptor agonist known worldwide under the brand names Ozempic, Rybelsus, and Wegovy. Novo Nordisk and Eli Lilly share the market here. With this study, the Company is taking a significant step toward evaluating its proprietary thin-film technology, which is intended to offer a user-friendly and non-invasive alternative to conventional injections and tablet-based GLP-1 therapies. The aim is to analyze the suitability of semaglutide for the ODF platform and gain initial insights that are important for both further formulation optimization and securing intellectual property rights.

"We believe there is a compelling opportunity to rethink the delivery of complex molecules such as semaglutide. Our oral thin film platform is designed to improve treatment adherence and patient convenience. This feasibility study marks an important first step toward bringing a new delivery option to market," commented CEO Hugh Rogers.

Semaglutide is a GLP-1 analogue that has rapidly become a blockbuster drug for type 2 diabetes and obesity and is increasingly used to reduce cardiovascular risk. According to a 2024 report by Data Bridge Market Research, the global market for GLP-1 receptor agonists was estimated at USD 24.4 billion in 2023 and is expected to reach a volume of approximately USD 156.7 billion by 2030, driven by rising obesity rates and significantly increased demand for non-insulin therapies. Despite their effectiveness, the semaglutide formulations currently available mostly rely on weekly injections or large tablets that must be taken daily. This can affect the adherence of many patients to their treatment. A rapidly dissolving, orally administered thin film formulation could address this issue by facilitating access to treatment, simplifying administration, and significantly improving the overall patient experience.

This project represents a strategic expansion of BioNxt's platform for the delivery of drugs in the form of oral thin films (ODFs), which was developed for the non-invasive administration of high-quality therapeutics. The news led to significant increases in BNXT's share price, with fans of the biotech stock obviously remembering the enormous gains made in 2020/21. These could now be repeated quickly!

Formycon – Strong rise confirms turnaround

German biosimilar hopeful Formycon has been under pressure for some time. Write-downs, postponements, and temporary suspensions in sales weighed heavily on the Munich-based company's share price in 2024. Currently, it appears that the problems have been resolved, as the share price has been rising noticeably for two months. There is a reason for this, as Formycon has secured an important success. An exclusive distribution agreement has been signed with Valorum Biologics for the eye medication FYB203. The US company, which specializes in ophthalmology and oncology, will take over commercialization in the key regions of the US and Canada. Formycon announced that the agreement was concluded via Klinge Biopharma GmbH, which holds the global marketing rights to FYB203. Under the license deal, Klinge will receive upfront and milestone payments as well as sales-based revenues. The Munich-based company will receive a percentage share of these revenues, and Formycon will manage the commercial supply chain and receive additional volume-based payments. FYB203 is a biosimilar to Bayer's blockbuster drug Eylea, which will be marketed under the name Ahzantive. US approval has already been granted, and a decision for Canada is expected by the end of the year. However, a specific date for the market launch has not yet been set. Formycon is back on track and rising!

International stock markets are suffering from geopolitical uncertainty. They recently experienced a moderate correction, with high-tech stocks on the NASDAQ particularly hard hit. The biotechnology sector is now benefiting increasingly from this, receiving a fresh boost from capital shifts. The first signs of a reversal are already visible, for example, in stocks such as Evotec and Bayer. From a cyclical perspective, a sector rotation in favor of biotech stocks appears long overdue. BioNxt is making good progress!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.