November 8th, 2024 | 07:00 CET

Myriad Uranium, Plug Power, RWE: New US policy creates winners and losers in the energy sector

Donald Trump's victory in the US presidential elections could lead to significant shifts in the global energy markets. While some market participants will have to reposition themselves, promising prospects are opening up for others. The Canadian explorer Myriad Uranium will benefit from the strategic realignment of US energy policy. The decision to ban the import of Russian uranium and the successful drilling results at the Copper Mountain project in Wyoming are excellent opportunities. Hydrogen specialist Plug Power, on the other hand, is experiencing a price decline of over 22% on NASDAQ – a possible indicator of the expected changes in funding policy. Global energy supplier RWE is attracting increased attention due to speculation surrounding the entry of the activist investor Elliott...

time to read: 4 minutes

|

Author:

Juliane Zielonka

ISIN:

MYRIAD URANIUM CORP | CA62857Y1097 , PLUG POWER INC. DL-_01 | US72919P2020 , RWE AG INH O.N. | DE0007037129

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Myriad Uranium Announces High-Grade Uranium Discoveries at the Copper Mountain Project in Wyoming, USA

Domestic uranium production is becoming increasingly important for the US. With the recent ban on imports of Russian uranium and the planned reduction of dependence on imports from Kazakhstan and Uzbekistan, US uranium projects are coming into focus. About 25% of the enriched uranium for US reactors currently still comes from Russia. The Copper Mountain project of the company Myriad Uranium, in which Union Pacific already invested in the 1970s, could play a key role in this. The timing of this development could hardly be better.

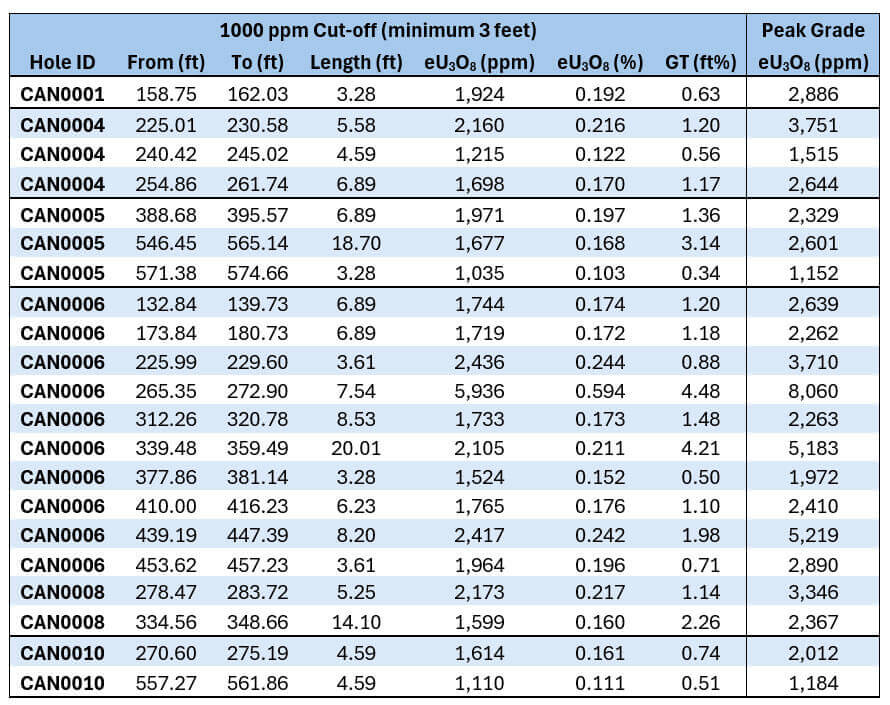

For Myriad Uranium reports exceptional drilling results from its Copper Mountain project in Wyoming. The first ten drill holes have not only confirmed the historical data but have, in some cases, significantly exceeded it.

The spectral gamma ray measurement shows the following values:

- Peak values of up to 8,060 ppm (0.8%) uranium oxide in drill hole CAN0006

- Several sections with over 1,000 ppm over longer distances

- 29 intervals with more than 500 ppm uranium oxide over at least 0.91 m in length

CEO Thomas Lamb emphasizes that the preliminary results of the first drilling program are extremely promising and confirm the confidence in the historical data available to the Company. Jim Davis, former Union Pacific General Manager, confirms this finding. As Myriad's current technical advisor, he is pleased with the accuracy of the resources that Union Pacific demonstrated at the time.

It is not yet clear how the outcome of the US election will affect the country's energy policy. However, the more energy sources available to the US in its near abroad and neighboring countries, the more secure the country's supply will be.

Hydrogen stock Plug Power collapses dramatically after US election result

The hydrogen specialist Plug Power recorded a dramatic price drop of over 22% on the NASDAQ yesterday. The main trigger for the slump was Donald Trump's victory in the US presidential elections, which is putting pressure on the entire renewable energy sector. The declining revenue figures, which fell by 27.6% over the past year, are worrying. The negative gross margin of -95.05% and a return on equity of -46.19% underscore the tense financial situation.

The increased trading volume of the shares indicates nervous market sentiment. The absence of insider purchases in the last three months also reinforces investors' skeptical attitude. The political realignment in the US could bring further challenges for the hydrogen sector, which still depends heavily on subsidies.

Plug is inviting guests to its 6th annual symposium on November 13, 2024, at its headquarters in Slingerlands, New York. At the event, company management and industry experts will gather to present current hydrogen industry projects and showcase innovative solutions for the future.

RWE: Market reacts to possible engagement from investor Elliott

The global energy provider RWE is attracting investor attention following rumors of a possible entry by activist investor Elliott Management. An activist investor typically acquires a minority stake in a listed company in order to actively influence corporate governance and strategy. According to a Bloomberg report, the hedge fund founded by Paul Singer has built up a significant position and pushed management to implement share buybacks.

RWE shares reacted positively to the news, rising by 3.3%. In the middle of the week, Elliott denied parts of the Bloomberg report, stating that no talks with RWE regarding investments or share buybacks had taken place. However, the hedge fund did not disclose whether it had actually purchased shares or is currently building up a position.

Investors are obliged to disclose holdings of 3% or more in RWE. For derivatives, this threshold is 5%. The future development of the share price will likely depend largely on the clarification of Elliott's stake and the future US energy policy. As a global player, RWE is strongly focused on the US.

The initial drilling results of the explorer Myriad Uranium at the Copper Mountain project exceed the historical data with peak values of up to 8,060 ppm uranium oxide. With the US import ban on Russian uranium and the strategic location in Wyoming, the Company is ideally positioned in the emerging domestic uranium market. Plug Power is in a critical situation, with a 27.6% decline in sales and a -95.05% gross margin. The 22% drop in the share price after Trump's election victory indicates the high dependence on political support through subsidies in its business model. RWE is benefiting from speculation that the activist investor Elliott Management is entering the market. Despite Elliott's denial of direct talks, the market situation remains dynamic. Two factors are crucial for investors: the actual size of Elliott's stake, which is only reportable above the 3% threshold, and the specific design of future US energy policy.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.