October 23rd, 2024 | 07:30 CEST

More than 100% upside potential! Bayer, Plug Power and 123fahrschule – Which stock is convincing?

Analysts see more than a 100% upside potential in the 123fahrschule stock. The exciting second-line stock wants to make driver education more modern and efficient and is getting support from politicians. Accordingly, sales and profits should rise sharply. Plug Power can also show rising sales, but like industry colleague Nel, the Americans are unable to get a grip on their losses. Will the quarterly figures turn things around? Bayer shareholders have been waiting for a turnaround for quite some time. But analysts also expect falling profits in the coming quarterly report. Is there still potential for a 40% increase in the DAX share?

time to read: 4 minutes

|

Author:

Fabian Lorenz

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , PLUG POWER INC. DL-_01 | US72919P2020 , 123FAHRSCHULE SE | DE000A2P4HL9

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

123fahrschule: Further price increases in sight

The 123fahrschule share is currently experiencing strong momentum. Germany's largest national driving school covers the entire value chain, from driving school training to the training of driving instructors and the production of driving simulators through the recently acquired Foerst GmbH. The stock has shot up from EUR 2.3 to over EUR 3 since the end of September. Analysts believe the security could potentially double again.

According to the analysts of NuWays AG, the management of 123fahrschule made a convincing impression at the most recent investor presentation. Accordingly, the Company will benefit greatly from the amendment of the driving training pushed through by the Federal Ministry for Digital and Transport (BMDV). Among other things, online theory is to be reintroduced, and the use of driving simulators for up to 10 hours of instruction will be possible.

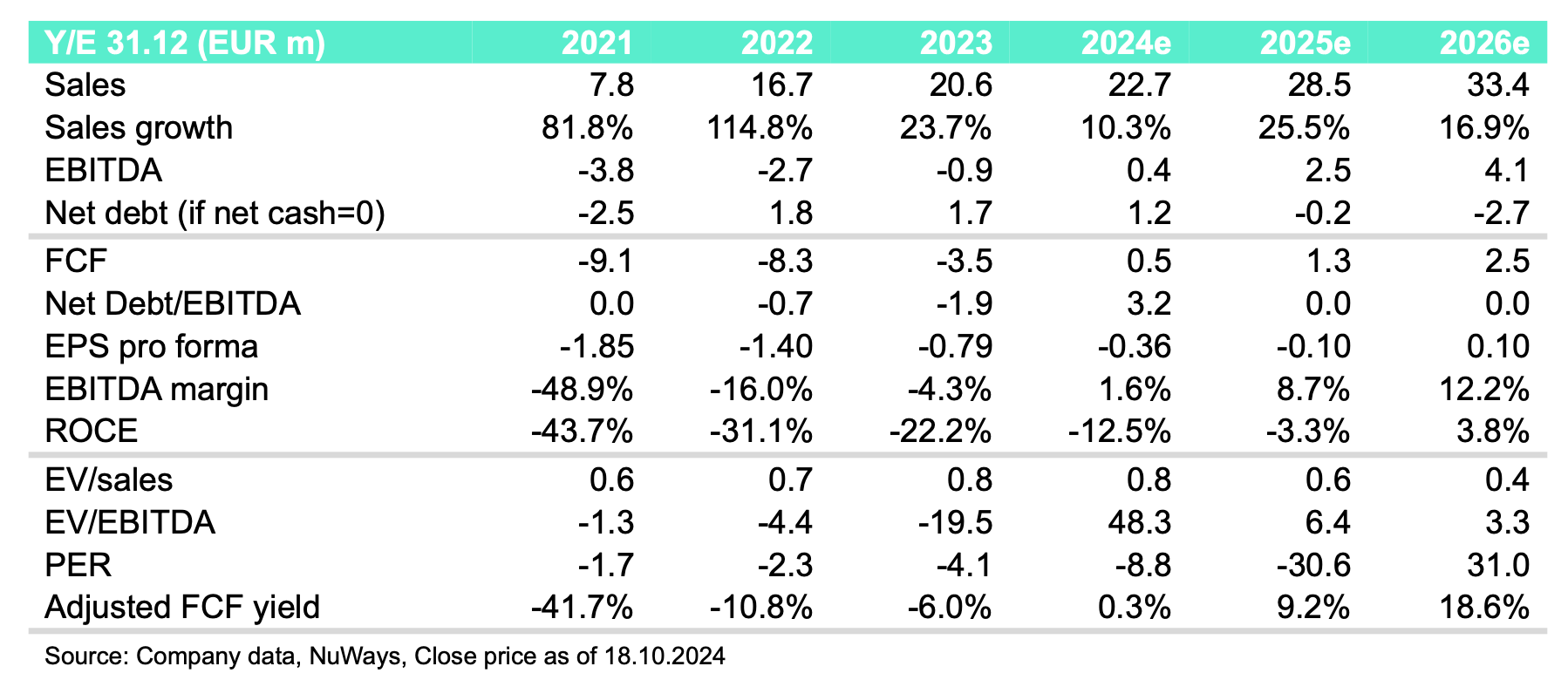

The digitalization of training should enable 123fahrschule to increase its margins significantly. In addition, the market share should increase because smaller, local competitors would not be able to use simulators for cost and space reasons. As a result, the analysts expect double-digit EBITDA margins to be achieved for the first time in 2026. Overall, the experts expect 123fahrschule to increase its revenues and profits significantly in the coming years. Revenues are expected to increase by over 50% from EUR 22.7 million in the current year to EUR 33.4 million in 2026. In addition, a positive free cash flow is expected to be achieved for the first time in the current year and is expected to increase to EUR 2.5 million by 2026. Given the growth and rising margins, the analysts see the fair value of the 123fahrschule share at EUR 7.20 Link to the study.

Bayer: 40% upside potential?

Bayer shareholders have been waiting for a buy recommendation for quite some time. Most recently, JPMorgan rated the agricultural and pharmaceutical company's stock as "Neutral." The experts' price target is EUR 34. This, however, is almost 40% above the current level. Bayer will report on its third-quarter performance in mid-November. JPMorgan analysts expect the pharmaceutical business to perform well. This should even be able to compensate for the difficulties in the agriculture sector. However, the experts believe that the consensus estimates for the full year 2024 are likely to be reduced with the study updates following the Q3 figures. The reason for this is negative currency effects.

Deutsche Bank sees significantly less upside potential for Bayer shares. The analysts expect Bayer to report a significant decline in earnings for the third quarter, accompanied by a slight increase in sales. As a result, the stock is only a "Hold" position.

Plug Power: The calm before the storm?

Anyone who has held Plug Power's stock since the beginning of the year is now sitting on losses of around 50%. Just like industry colleague Nel ASA, the Americans are suffering from slowing sales momentum and continued high losses. The Norwegians had reported a 21% increase in revenue to NOK 366 million. EBITDA in the third quarter amounted to NOK -90 million (Q3 2023: NOK -62 million). The net result improved from NOK -167 million to NOK -115 million. But Nel also disappointed in terms of incoming orders. Plug Power has not yet announced a date for the publication of its quarterly figures. Last year, it was November 9.

Overall, the hydrogen pioneer has reported little of substance in recent weeks. At the beginning of October, a binding framework agreement – but only a framework agreement – was announced with Allied Green Ammonia (AGA). The Australian green ammonia producer intends to order 3 GW of electrolyser capacity from Plug for its green hydrogen ammonia plant. The partnership is an important step towards building one of the world's largest green ammonia production plants, with a production capacity of around 2,700 tons per day. The delivery of the electrolyser system from Plug is scheduled for late 2026 or early 2027.

Andy Marsh, CEO of Plug, commented: *"Ammonia producers recognize the significant cost and carbon reduction benefits of electrolysis-based hydrogen.* We are delighted to have concluded this framework agreement with Allied Green Ammonia, a global leader in hydrogen and ammonia production and plant engineering. Our extensive experience in building and operating large-scale hydrogen plants, combined with our state-of-the-art PEM electrolyser technology, makes us the ideal partner for this transformative 3 GW project. Together, we are paving the way for a more sustainable future for environmentally friendly ammonia production while supporting the global transition to net-zero emissions."

A few weeks ago, Nel demonstrated that such a letter of intent can also quickly vanish into thin air. Therefore, investors should remain cautious with Plug Power. In contrast, 123fahrschule currently has a lot of momentum. Politics is providing growth impulses, and analysts advise buying. On the other hand, buying Bayer shares is not pressing, even though much negativity seems to be priced into the stock.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.