July 4th, 2025 | 07:05 CEST

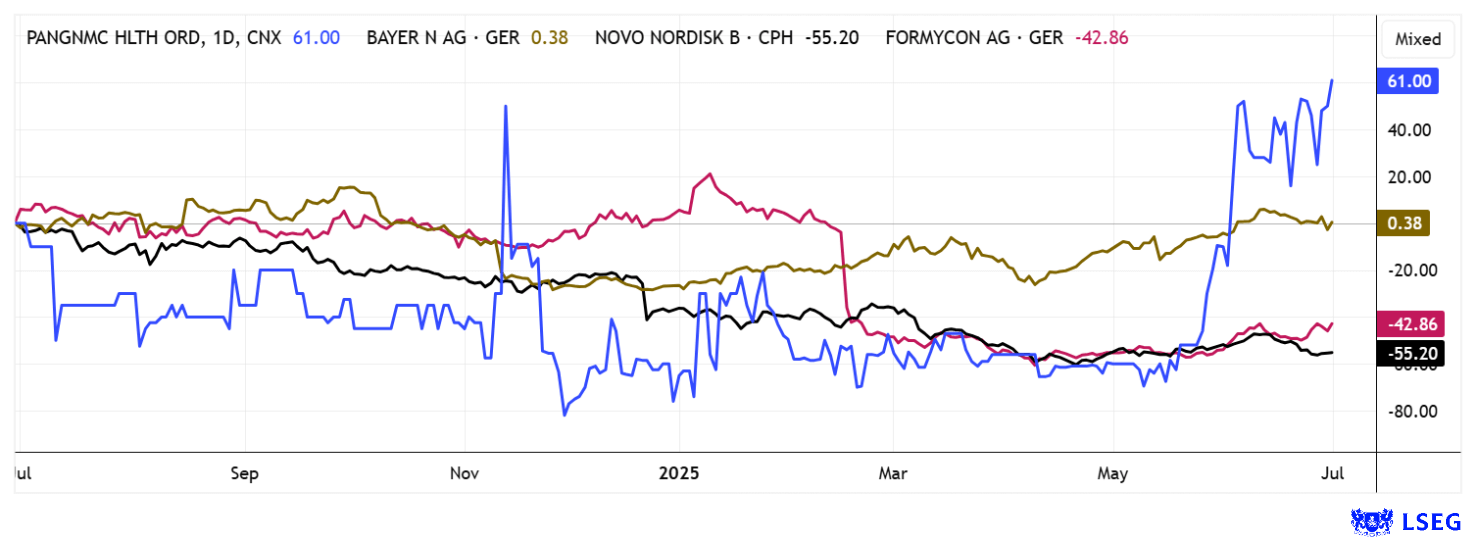

Lightning on the horizon in the biotech sector: Refinancing on the rise! Keep an eye on Formycon, PanGenomic Health, Bayer, and Novo Nordisk

In the first half of 2025, the biotech sector demonstrated resilience and innovation despite macroeconomic uncertainties. Venture capital financing reached an impressive USD 6.5 billion, with a focus on companies with clinically validated data. Large financing deals such as the USD 365 million for Pathos AI underscore the strategic investor focus on AI and digitalization. The IPO market remains highly selective, but strong stock market debuts such as that of Caris Life Sciences are sending positive signals. At the same time, the M&A sector is booming with billion-dollar acquisitions by pharmaceutical giants such as J&J and Novo. So far in 2025, the biotech sector has demonstrated targeted capital allocation, dynamic consolidation, and growing confidence in medical breakthroughs. Here are a few ideas for a balanced portfolio of opportunities.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

FORMYCON AG | DE000A1EWVY8 , PANGENOMIC HEALTH INC | CA69842E4031 , BAYER AG NA O.N. | DE000BAY0017 , NOVO NORDISK A/S | DK0062498333

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Formycon – How to place debt capital

German biosimilars pioneer Formycon provides a great example of financing. Due to delays and market conditions, the Company had to accept a one-third reduction in its share price at the beginning of the year. But now the Munich-based company is back on the rise. The share price rose by over 40% in just three months and is now back at the EUR 30 mark. The Company recently surprised with a EUR 50 million bond, which was then increased to EUR 70 million at short notice. The unsecured, floating-rate bond with a term of four years was thus successfully and fully placed on the capital market. The coupon was set at 7.0% p.a. + 3-M Euribor at the lower end of the target range, and allocation had to be rationed even at this level.

The successful placement of the new bond was largely due to intensive dialogue with investors and the consistently positive feedback received during the roadshow. Such strong oversubscription highlights both the attractiveness of the product and the confidence in Formycon's biosimilar business model, as CFO Enno Spillner emphasizes. Particularly high interest was shown by institutional investors in Germany and abroad, while many private investors also took advantage of the subscription opportunities. While the Management Board is making waves with share purchases, Warburg Research confirms its "Buy" rating with a price target of EUR 40. This represents a significant turnaround in the share price, and with full coffers, the outlook remains favorable.

PanGenomic Health – Innovative in the pursuit of health

Since we first presented PanGenomic Health (ticker: NARA), the stock has more than quintupled its value. Such price developments are not seen every day. Like BioNTech and Moderna, the Company was born out of the challenges of the COVID-19 pandemic, in response to the lack of easily accessible mental health care. In just five years, the Company has evolved from a pandemic project to an innovative player at the intersection of technology, genetics, and preventive medicine. At its core are three AI-powered platforms: NARA (personalized naturopathic programs based on genetic profiles), Mindleap (digital stress management), and MUJN (precise neurological diagnostics). At the center is the Company's proprietary Nustasis AI platform, which evaluates health data in real time and generates personalized therapy recommendations.

PanGenomic pursues a hybrid business model that combines subscription revenues, digital diagnostics, and herbal health products. The clever combination of data-driven analysis, alternative medicine, and scalable online access clearly distinguishes NARA from traditional telemedicine providers. Particularly exciting is the expansion from women's health care to mental performance enhancement, a high-growth market that is increasingly appealing to men as well. With its expertize in AI and validated data sources, PanGenomic is laying the foundation for high-quality, personalized healthcare solutions. The PanGenomic Health health tech portfolio is currently valued at around CAD 10 million on the stock market, a drop in the ocean when considering its future growth prospects. Scalability, recurring revenues, and a strategic focus on AI make PanGenomic a potential outperformer in the digital health market, as the Company is benefiting from the megatrend toward self-optimization and provides tools to make prevention tangible, smart, and effective.

Bayer and Novo Nordisk – Two titans fight their way back

In the first half of 2025, pharmaceutical giant Bayer remained in a weakened position: revenue and margins stagnated, particularly in the agricultural sector due to ongoing legal risks surrounding glyphosate. The pharmaceuticals division remained stable, but there were no real growth impulses. The key triggers for the second half of the year are now the expected decision on the split of the group, new study data on the anticoagulant Asundexian, and possible legal relief in the US. After a long period of consolidation between EUR 19 and EUR 24, the stock broke out to the upside in June. 8 out of 23 analysts on the LSEG analysis platform expect an average price of EUR 28.20 in 12 months, just 6% above the recent price of EUR 26.55. That seems likely to go higher.

In contrast, Novo Nordisk shone in the first half of the year with double-digit revenue growth, driven by continued strong demand for GLP-1 drugs such as Wegovy and Ozempic. The operating margin remained above 40%, and the outlook was raised again. Important momentum in the second half of the year could come from approvals for new indications, production expansion in the US, and study results on Alzheimer's and heart failure. While Bayer is hoping for structural decisions and legal relief, Novo is scoring points with operational strength and medical innovation. At EUR 59.20, Novo shares are still not far from their low for the year of EUR 50.54, but 18 out of 28 analysts see a 40% chance of reaching around EUR 84. The negative sentiment could therefore soon turn in Novo Nordisk's favor.

The biotech sector is showing positive trends again. These are still somewhat underrepresented compared to high-tech and defense, but the recent good inflation figures give hope for an interest rate cut in the US. This could trigger a sector rotation in favor of higher-risk investments. Bayer and Novo Nordisk are suitable as standard stocks, while more volatility - but also greater upside potential - can be expected from Formycon and PanGenomic Health.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.