November 14th, 2022 | 13:54 CET

K+S, Saturn Oil + Gas, Aurora Cannabis - Multiplication candidates

Uncertainties concerning the global geopolitical situation and concerns about a further cooling of the economy with simultaneous rising inflation have caused shares and other asset classes, such as commodities and precious metals, to correct significantly in recent months. With the publication of the quarterly figures, the negative share development of many companies is confirmed with the latest values. However, there are also positive surprises, which have the chance of a significant outperformance due to their presented figures and the positive outlook.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

K+S AG NA O.N. | DE000KSAG888 , Saturn Oil + Gas Inc. | CA80412L8832 , AURORA CANNABIS | CA05156X8843

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Saturn Oil & Gas - Further acceleration of growth

In less than 2 years, Saturn Oil & Gas, recently a relatively unknown oil producer, grew into one of Canada's major producers thanks to two transformative acquisitions in the Oxbow and Viking areas of Saskatchewan. Saturn's production has multiplied more than 50-fold in less than two years to about 12,000 barrels of oil equivalent per day (boe/d).

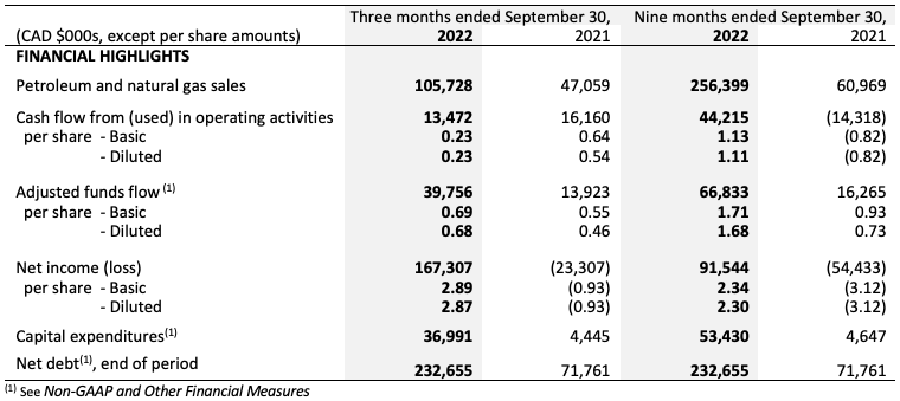

The Viking transaction, completed in July, added another 4,000 boe/d of production, which has now been reflected in the third quarter figures for the first time, resulting in record cash flow. Average production reached 10,965 boe/d, up 57% from 6,970 boe/d in the third quarter of 2021. Revenues reached a new record of CAD 105.7 million, up from CAD 82.2 million in the second quarter, and were up as much as 124% YOY. On an adjusted basis, operating profit also showed a correspondingly substantial increase of 179% to CAD 50.3 million. Calculated on the fully diluted share, this results in a net profit of CAD 2.87 in the quarter; after 9 months, this is CAD 2.30. In comparison, the share price is quoted at CAD 2.90.

The massive undervaluation of Saturn Oil & Gas compared to its peer group has not gone unnoticed by various analyst firms. Thus the analyst house Velocity Trade Capital sees in the Canadians an "Outperformer" with a price target of CAD 7.19, while Eight Capital provides the rising oil producer with a "Buy" rating and a price target of CAD 7.50. The experts at First Berlin Equity Research also initiated coverage with a buy rating and a price target of CAD 7.00.

A detailed summary of the figures for the third quarter can be found at researchanalyst.com.

K+S AG - Below expectations despite record year

At first glance, the figures of the fifth-largest potash producer read positively, but analysts would have hoped for more in terms of operating profit than the published EUR 633 million. The Kassel-based company was able to almost double its sales in the third quarter to EUR 1.47 billion. At EUR 633 million, EBITDA more than quintupled compared with the prior-year quarter but was below analysts' consensus estimates. Net profit fell to EUR 379 million from around EUR 1.3 billion in the third quarter of 2021. Per share, earnings fell from EUR 6.61 to EUR 1.47. However, these two key figures cannot be compared, as last year, there was a positive one-off effect from an increase in the fixed value for production sites.

For the full year, management is also confident that the strong increase in the average price in the Agriculture customer segment will significantly exceed the expected cost increases, especially for energy, logistics and materials. Assuming that there are no production restrictions at the German plants due to bottlenecks in the availability of natural gas, the MDAX-listed company expects EBITDA for the financial year 2022 of around EUR 2.4 billion; previously, the range was between EUR 2.3 billion and EUR 2.6 billion. K+S will thus achieve the best annual result in the Company's history and exceed the previous peak of EUR 1.5 billion in 2008 by almost EUR 1 billion.

The quarterly results and K+S's forecasts met with little positive reaction from the analyst community. The major Swiss bank UBS reiterated its price target of EUR 21 and its "neutral" investment rating. Thus, the fertilizer producer disappointed with EBITDA, but convinced with the outlook for free cash flow, wrote analyst Andrew Stott. In contrast, US bank JPMorgan left its rating for K+S at "overweight" with a price target of EUR 38.

Aurora Cannabis - Strong after weak quarterly figures

The boom times of cannabis stocks were already about four years ago. Back then, shares of Canopy Growth, Tilray or Aurora Cannabis were hailed as new stock market stars due to the excellent prospects of the female cannabis plant. Aurora Cannabis, a publicly traded cannabis and medical marijuana producer based in Edmonton, Canada, was trading at a whopping USD 150.30 in October 2018. Since then, the sector has corrected sharply, and the share price of the global third-largest group lost 99% of its value. For months, Aurora shares have been building a bottom, and just with the announcement of relatively weak figures for the first quarter of the fiscal year, the breakout from the sideways movement followed with a gain of over 15% to USD 1.53. The next target for the share is likely to be the downward trend formed since March 2019 at USD 3.34.

Aurora Cannabis reported a net loss of CAD 51.9 million on revenue of CAD 49.3 million for the first quarter of the current fiscal year, 2023. That said, management remains committed to achieving profitability by the end of this calendar year while planning annual cost savings of CAD 170 million. Aurora, which has refocused its business on medical marijuana, reported CAD 31.6 million in net medical cannabis revenue for the quarter, representing nearly two-thirds of consolidated net revenue. The Company's net revenue from medical cannabis sales decreased 14% from the previous quarter and 23% from the same period last year.

"We are rapidly approaching our goal of positive Adjusted EBITDA and are on track to achieve up to USD 170 million in annualized cost savings by December 31, 2022, having already realized USD 140 million by the first quarter of 2023. Our strengthened balance sheet and strong cash position have enabled the early repurchase of approximately USD 160 million of convertible notes in 2022. Through profitable growth opportunities, particularly in our high-margin global medical cannabis business, where we remain the #1 Canadian LP, disciplined capital deployment and the completion of our cost structure rationalization, we are well positioned to drive the long-term value of our differentiated global cannabis business," said Miguel Martin, CEO of Aurora.

Emerging Canadian oil producer Saturn Oil & Gas posted excellent growth numbers. At fertilizer producer K+S, operating profit was below analysts' forecasts despite record figures. At Aurora Cannabis, the end of the bottom formation may have been heralded.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.