September 1st, 2022 | 10:26 CEST

K+S AG, BrainChip, Bayer - Shares in waiting position

At the end of last week, FED head Jerome Powell brought down the stock markets with the announcement of further interest rate steps and a hawkish stance by the US Federal Reserve. A similar scenario looms next week at the European Central Bank meeting. Here, speculation is mounting that an interest rate step of even 0.75% could be imminent due to rampant inflation. In the long term, however, the contingent of the European monetary guardians is limited because too strong an increase would lead to the collapse of the debt countries. Moreover, this would mean a further slowdown of the already weakening European economy. Therefore, a return to the loose monetary policy in the fourth quarter does not appear to be out of the question, which could result in a further stock market boom.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

K+S AG NA O.N. | DE000KSAG888 , BRAINCHIP HOLDINGS LTD | AU000000BRN8 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

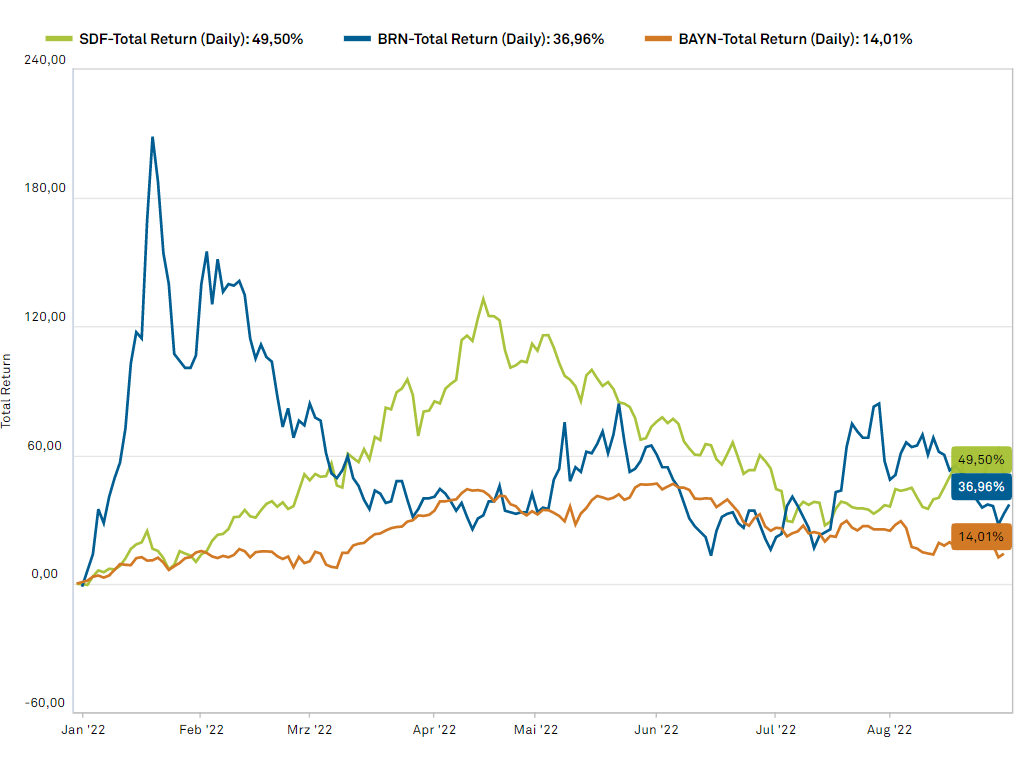

K+S AG - Stable despite setback

Following the recently published figures for the second quarter - K+S AG was able to more than double revenues to EUR 1.5 billion compared with the same period last year - the downward slide of the potash share was halted, at least temporarily. With the successful defence of the support zone in the area of EUR 20.20, the fifth largest potash producer turned north again. The next hurdle will likely be the EUR 25.94 mark, the annual high from 2018.

The share price was stable despite news relating to the disposal of production residues in a disused mine in Thuringia. The Kassel Regional Council had safety concerns regarding the discharge of saline solutions. It has "initially not given its approval" for the project, an RP spokeswoman said Wednesday. According to K+S, however, it is not a rejection. Instead, the Kassel-based company will be given the opportunity to address the concerns.

The MDAX title recently received a tailwind from analysts. After the publication of the figures, DZ Bank reiterated its "buy" recommendation with a target price of EUR 37. At the same time, Deutsche Bank Research assigned the same target price and issued a "hold" recommendation.

BrainChip Holdings - Sales explosion

Due to the change in strategy of the central bank and the announcement to initiate further interest rate increases, growth companies with high capital requirements, in particular, are suffering on the stock market. The Nasdaq-100 technology barometer, for example, fell by around 26% since the beginning of the year. The share of the Australian IP company BrainChip Holdings even lost 60% in the course of the year after reaching an annual high of AUD 1.67 in mid-January. However, it should not be forgotten that the share from Down Under advanced to become one of the global stock market stars last year and increased more than sevenfold within the last three months of 2021.

From an operational perspective, BrainChip has established itself on the market in recent months. That is demonstrated, among other things, by a cooperation with Mercedes-Benz on EQXX. The Akida technology makes the "Hey, Mercedes" voice control in the EQXX five to ten times more efficient than previous technologies. In addition, the next-generation chip, the Akida chip developed in-house, has been accepted into ARM's AI Partner Program. The advantages over traditional chips are easily explained. Akida is extremely low-power, high-performance and promotes edge AI technology growth through the use of a neuromorphic architecture, a type of artificial intelligence inspired by the biology of the human brain. BrainChip enables the universal use of efficient edge computing in real-world applications such as connected cars, consumer electronics and the Internet of Things.

Akida's impressive first-half sales figures show that the product has taken off in the market. Compared to the same period last year, revenues increased by 529% to USD 4.83 million. According to the Australians, the long-term partnership with the Japanese company MegaChips was responsible for the quantum leap. BrainChip says licensing revenue from its Akida-1000 technology, which was booked in the reporting period, largely contributed to the increase.

As for any highly innovative growth company, total expenses grew 37% to USD 12.9 million. That was due to higher charges for R&D, sales and marketing, administration, and stock-based compensation. The net loss was USD 8.25 million, down from USD 9.29 million in the first half of 2021. The cash situation also improved, with USD 28.4 million as of June 30, 2022, compared to last year, when there was only USD 19.36 million in cash.

Due to its outstanding technology and cooperation with global market leaders, BrainChip is considered a potential takeover candidate. Due to the sharp correction, the stock appears attractive for the long term at current levels.

Bayer with a chance of a rebound

Analysts are also optimistic about pharmaceutical and agricultural giant Bayer. US investment bank JPMorgan raised the price target for the shares of the Leverkusen-based company from EUR 75 to EUR 80, and the rating was repeated with "overweight". According to analyst Richard Vosser, the reasons for the increase are higher price estimates for seeds in the second half of 2022 and the first half of 2023 and raised forecasts for the agricultural division. Vosser also referred to raised forecasts for Bayer's pharmaceuticals unit.

Also positive is major Swiss bank UBS, which continues to see Bayer shares as a buy with an unchanged price target of EUR 96. Phase II data on the anticoagulant Asundexian presented over the weekend fully supported the group's decision to now initiate a pivotal stroke prevention trial, analyst Michael Leuchten wrote.

From a chart angle, Bayer shares could see a short-term trend reversal. After successfully defending the EUR 51.82 mark, the downward trend at EUR 53.35 now stands in the way. Should this be broken, there would be follow-up potential to the area of initially EUR 58.

After the heavy price losses, both K+S AG and Bayer were able to find a bottom and have the potential for a rebound. After a correction of 60%, the Australian IP company BrainChip also appears to be an attractive long-term option due to its revolutionary technology.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.