RENK AG O.N.

Commented by Carsten Mainitz on October 21st, 2025 | 07:40 CEST

Power Metallic Mines, RENK, BYD – An explosive combination! And the winners are?

Many topics are dominating the headlines. Peace in Gaza – and soon in Ukraine? This prospect initially put a significant damper on defense stocks – but only temporarily. After just a few days of correction, prices are already rising again. Gold at an all-time high is another major topic being covered in the media. Meanwhile, the geopolitical shifts we were reluctant to acknowledge for far too long are now catching up with many companies: China is cutting the world off from critical raw materials and rare earths. Read here to find out how investors can identify promising high-potential opportunities in this constellation.

ReadCommented by Fabian Lorenz on October 20th, 2025 | 07:00 CEST

BUYING OPPORTUNITY!? Gerresheimer crash! RENK correction! Nakiki shares following in the Bitcoin footsteps of Strategy and Metaplanet!

Nakiki SE is increasingly electrifying stock investors and the Bitcoin community. Following in the footsteps of Strategy, the Company aims to become the first German Bitcoin Treasury company in the regulated market. Around the initial Bitcoin purchases, Metaplanet and Capital B achieved price gains of over 100%. Could Nakiki follow suit? RENK shares are currently undergoing a correction. One analyst recently pointed out issues in the US business. Thursday could be an exciting day for RENK shareholders. Is it worth entering now? As for Gerresheimer, the stock appears unable to find a bottom. Analysts are far too slow in adjusting their price targets.

ReadCommented by André Will-Laudien on October 15th, 2025 | 07:05 CEST

Supply chains on the NASDAQ! Critical metals sold out? What is next for Almonty - Caution advised with Rheinmetall, Deutz, and RENK

Snip-Snap! In and out of the markets! At the moment, all stock market wisdom applies, because there is nothing more unpredictable for investors than the current US president. And who would have thought that the critical metal supply chains would suddenly become a major driving force behind the NASDAQ rally? Just as Xi Jinping threw rare metals into the ring as a bargaining chip, Donald Trump blew a fuse. Punitive tariffs of up to 100% were suddenly on the table, and the markets went into a tailspin. Yet just one trading day later, everything is put into perspective, and the markets have to find their new valuation point – no easy task. Yesterday, nervousness returned, as reflected in a sharp rise in the volatility index. What should investors be keeping a close eye on now?

ReadCommented by Armin Schulz on October 14th, 2025 | 07:00 CEST

Why RENK Group needs Antimony Resources just as much as the largest US defense contractor, RTX

The global defense industry is facing a fundamental supply crisis. Antimony, a largely overlooked metal that is indispensable for high-performance electronics, armor-piercing alloys, and flame-resistant propulsion systems, is becoming a key strategic factor. Prices are skyrocketing, and massive supply bottlenecks are emerging. This shortage is hitting defense giants and suppliers hard, forcing them to radically rethink their procurement strategy. Today, we take a closer look at the current situation of the RENK Group, the explorer Antimony Resources, and the largest US defense contractor RTX.

ReadCommented by Fabian Lorenz on October 13th, 2025 | 07:30 CEST

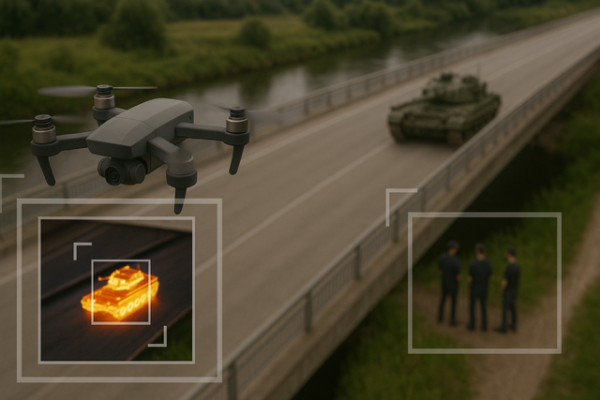

Drone boom and multiplication: Following DroneShield, RENK, and Standard Lithium, NEO Battery Materials shares are taking off!

Missed out on the multiplication of shares such as DroneShield, RENK, and Standard Lithium? Investors can still get in early with NEO Battery Materials. The Company is benefiting from the drone boom and the raw materials conflict between the US and China. NEO Battery Materials has developed advanced battery technology. The first manufacturer of drone batteries has already placed an order. In the future, the Company also plans to offer complete batteries itself. To save time in commercialization, a factory has been leased. This will allow for rapidly increasing sales and profits. The tariff and raw materials conflict between the US and China is likely to give NEO an additional boost. When will the stock take off?

ReadCommented by Fabian Lorenz on October 8th, 2025 | 07:05 CEST

New opportunities in GOLD and defense! Are Steyr Motors and AJN Resources better than RENK? Profit-taking at First Majestic?

The rally in defense, gold, and silver is underway! Is it time to take profits and take a closer look at latecomers like Steyr Motors and AJN Resources? Steyr is digesting its 200% rally since March and continues to deliver positive news. AJN Resources shares have catch-up potential in the gold sector. In the vicinity of a mega mine, the Company's project shows potential for several million ounces of gold. Exciting results are expected in the coming weeks. And what are the core investments RENK, Barrick Mining, and First Majestic Silver doing? Are gains of up to 380% enough?

ReadCommented by Carsten Mainitz on October 7th, 2025 | 07:45 CEST

Aspermont, Palantir, RENK – AI sets the pace. Where is the next run?

International stock markets are booming. The Dow Jones recently surpassed 47,000 points, seemingly unaffected by the US government shutdown. The topic of artificial intelligence (AI) continues to be the focus of investor interest, and recent company announcements are causing a stir. Japanese electronics giant Hitachi and ChatGPT provider OpenAI are partnering to build AI infrastructure and global data centers. Meanwhile, Fujitsu and leading AI chip manufacturer Nvidia are expanding their collaboration and plan to jointly develop a platform that uses AI in a targeted manner for specific industries, such as healthcare and robotics. In view of the AI boom, it is becoming increasingly compelling to explore second- and third-tier stocks that could benefit from the surge in innovation and investor interest.

ReadCommented by André Will-Laudien on October 6th, 2025 | 07:10 CEST

Defense first, then sell – Now it is time to load up on critical raw materials! Globex Mining, Hensoldt and RENK

Daily madness on the capital markets. While foreign drones circle over NATO territory conducting espionage, politicians in Brussels feel compelled to increase defense budgets once again. Even Ursula von der Leyen feels the pressure to act at the Denmark summit: "We must invest in real-time space surveillance so that no troop movements go unnoticed. We must heed the call of our Baltic friends and establish a drone defense system. This is not an abstract ambition – it is the basis of credible defense!" This is the next boost for the defense industry, and for the raw materials stock Globex Mining, things are really taking off now! We highlight which stock could become the next big gainer.

ReadCommented by André Will-Laudien on September 30th, 2025 | 07:10 CEST

Gold boom boosts critical metals! Another 100% with Power Metallic, BYD, Hensoldt and RENK

The geopolitical situation continues to escalate, but the stock markets continue to boom! Trade conflicts, sanctions, and military tensions dominate the headlines, but behind the front lines of a new Cold War, another competition has long been raging: the battle for access to critical metals. Without copper, lithium, nickel, cobalt, or rare earths, not only would the e-mobility revolution come to a standstill, but defense technologies, digitalization, and the energy transition would also grind to a halt. Supply chains are coming under increasing pressure from geopolitical power games, and the battle for resources is becoming a key strategic factor in a multipolar world order. For Western industrialized nations, security of supply is becoming a matter of survival, and for investors, this is creating new opportunities. Anyone looking for tomorrow's winners today should keep a close eye on the global raw materials poker game.

ReadCommented by Fabian Lorenz on September 23rd, 2025 | 07:20 CEST

NATO under pressure! Almonty target price rises! RENK not a favorite at Goldman Sachs! DroneShield hits milestone!

Russia is testing NATO! Drones and fighter jets are repeatedly being spotted in European airspace, showing that de-escalation is not happening. NATO must continue to strengthen its defenses. This offers opportunities for investors across the entire value chain of the defense industry. In the raw materials sector, Almonty shares are a top pick. Analysts expect the tungsten producer to see an explosion in profits in the coming years and are raising their price target. Could the US government even step in? DroneShield has reached a milestone thanks to follow-up orders from the US Department of Defense. The drone defense specialist sees itself well-positioned for the future. Goldman Sachs has commented on RENK for the first time, but the analysts have other favorites.

Read