October 6th, 2025 | 07:10 CEST

Defense first, then sell – Now it is time to load up on critical raw materials! Globex Mining, Hensoldt and RENK

Daily madness on the capital markets. While foreign drones circle over NATO territory conducting espionage, politicians in Brussels feel compelled to increase defense budgets once again. Even Ursula von der Leyen feels the pressure to act at the Denmark summit: "We must invest in real-time space surveillance so that no troop movements go unnoticed. We must heed the call of our Baltic friends and establish a drone defense system. This is not an abstract ambition – it is the basis of credible defense!" This is the next boost for the defense industry, and for the raw materials stock Globex Mining, things are really taking off now! We highlight which stock could become the next big gainer.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

GLOBEX MINING ENTPRS INC. | CA3799005093 , HENSOLDT AG INH O.N. | DE000HAG0005 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Hensoldt – Record orders, but high valuation

Defense specialist Hensoldt continues its steep growth trajectory: With a record order backlog of over EUR 7 billion, capacity utilization is secured well beyond 2035. In the first half of 2025, revenue rose by 11% to EUR 944 million, and the book-to-bill ratio of 1.5 indicates a strong order pipeline. The operating margin now sits around 18%, with planned free cash flow at 50 to 60% of EBITDA. Tailwinds are coming from rising defense spending in Germany and Europe - high-tech orders command top prices!

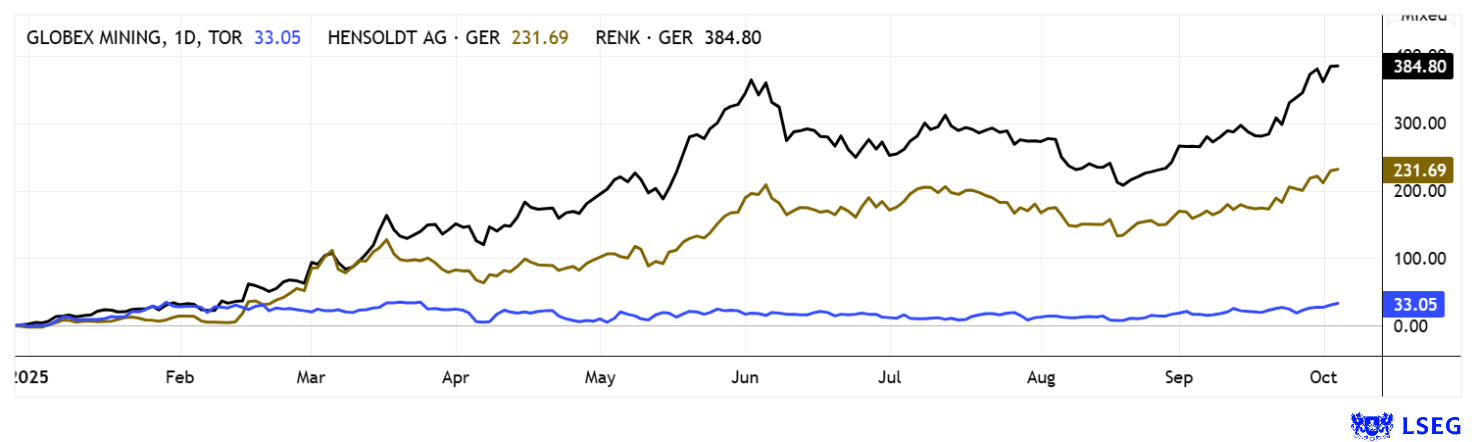

At the DSEI 2025 trade fair, Hensoldt presented TAROSS, a modular electro-optical sensor box for remote-controlled weapon stations, turrets, and unmanned systems. TAROSS can be seamlessly integrated into platforms, uses Ceretron for data fusion, and increases soldier safety through precise reconnaissance. This strengthens Hensoldt's role as a technology leader in networked combat operations. At the same time, the Company is massively expanding its capacities: the new "Ulm II" site is being built near Ulm, with an investment in the mid double-digit million range. From 2027, around 1,000 radars for air defense and drone defense, especially for the German Armed Forces, are to be produced there annually. With a strong order backlog, innovations, and expanded production capacities, Hensoldt confirms its 2025 annual forecast with further revenue and profit growth. Estimated sales of EUR 3.5 billion in 2027 (after EUR 2.5 billion in 2025) are now valued at a factor of 3.8, with the corresponding P/E ratio reaching values above 40. On the LSEG platform, there are now only 4 out of 14 positive analysts, with a consensus 12-month price target of EUR 90.70. The high valuation of the stock, therefore, calls for a degree of caution, but the euphoria and momentum remain strong. Short sellers should nevertheless start sharpening their knives!

Rare earths from Arizona, gold from Québec – Globex strengthens North America's commodity security

Globex Mining Enterprises Inc. continues to expand its role as a diversified commodity holder with strategic projects in Canada and the US. In times of geopolitical tensions and growing uncertainty surrounding international supply chains, the focus is shifting to stable North American supply structures for critical metals and rare earths, a field in which Globex occupies a promising position. The Québec-based company has 260 projects across Canada, including more than 50 with historical or current resource estimates in accordance with NI 43-101 standards. Globex is debt-free and holds cash and shares worth approximately CAD 30 million.

Canada offers a first-class environment: strong energy supply, infrastructure, legal stability, and constructive cooperation with indigenous landowners. Globex recently optioned its Virgin Mountain rare earth and beryllium property in northern Arizona to Australia's Arizona Mountain Pass Heavy Rare Earths Pty. Ltd. The agreement provides for payments totaling CAD 1.4 million over 42 months and a 3% royalty, secured by exploration expenditures of CAD 2.5 million. The project area comprises 23 claims covering approximately 192 hectares and hosts high-grade structures such as the Hummingbird Zone with grades of 0.3 to 1.24% TREO and exceptional enrichment in particularly valuable heavy rare earth elements (HREE) such as terbium, dysprosium, and holmium. In addition, there is a beryllium deposit in pegmatic zones dominated by the valuable mineral chrysoberyl, a potentially favorable source material for high-purity beryllium products, which are particularly needed in aviation, electronics, and defense technology.

Through the combination of Canadian precious metal assets and North American interests in critical metal projects, Globex is strengthening its strategic relevance for the development of secure and localized supply chains. Globex benefits twice over, as a licensor with long-term royalties and as the holder of attractive development projects in stable jurisdictions. After weeks of sideways movement, GMX shares are now taking off again. At the start of October, resistance was encountered at CAD 1.60, but with rising sales, the high of CAD 1.63 should now be surpassed. **Operationally, there is nothing more that can be done; now investors just need to realize what a gem Globex Mining is. Do not hesitate, the commodity express is leaving the station! A 100% gain by year-end would not be surprising!

Further information will be available from the upcoming International Investment Forum being held on Wednesday, October 8, 2025. There, investors will receive exclusive updates on 20 listed companies, and CEO Jack Stoch will also provide insight into the big world of critical metals at 3:30 pm CET. Click here to register.

RENK – What are analysts saying about the gear specialist?

Although RENK shares are predominantly rated as a "Buy" by analysts, these assessments obscure the considerable risks. The price targets range from EUR 55 to EUR 84, with the LSEG average at EUR 68.90. In fact, the share price has already risen to EUR 90.25 in the last week, marking a new all-time high. There is currently a high degree of uncertainty about the actual valuation, as Warburg Research rates the stock as a "Hold" and emphasizes the weak short-term growth prospects. Although there is a solid order backlog of around EUR 5 billion, this is spread over the next five years and is heavily dependent on the politically driven defense sector. Analysts expect revenue growth from EUR 1.1 billion in 2024 to EUR 1.3 billion in 2025, but the market capitalization has already reached the EUR 9 billion mark. This puts the revenue valuation at a factor of 7. Operationally, margins are still rather fragile, as recent reports have shown. In addition, the market could suffer from supply chain problems.

The euphoric price performance observed since the beginning of the year reflects short-term market trends rather than genuine fundamentals. Long-term targets such as doubling sales by 2027/2028 appear very ambitious from today's perspective. Unlike the high-tech company Hensoldt, RENK is focusing on hybrid drives and unmanned tracked vehicles, whose economic success is anything but guaranteed. Even positive analyst opinions put the potential into perspective, as the current share price hardly reflects the project risks. Overall, RENK shares remain highly risky from today's perspective and offer only limited reliable potential despite positive forecasts. Compared to the analysts' price targets, there is a gap of around 30% at prices near EUR 90 – a rare case of overvaluation, likely artificially created by ETF weightings. Here, it could easily turn into a nosedive!

**The stock market is willing to pay a very high fundamental premium for the defense sector. This may continue for months, but investors' focus has recently shifted more to the supply chains of strategic metals, which are of immense importance to the defense industry. Sensible reallocations can therefore be made calmly now. Once the storm hits, it will be difficult because then things will likely move very quickly!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.