RENK AG O.N.

Commented by Armin Schulz on July 29th, 2025 | 07:10 CEST

RENK, Almonty Industries, thyssenkrupp: Three stocks that are benefiting NOW from the new security dividend

Geopolitical turmoil is accelerating growth in key sectors. As defense budgets rise worldwide and supply chains are realigned, specialized players are positioning themselves as indispensable partners. High demand for security-critical technology, strategic raw materials, and innovative industrial solutions is driving this development, giving selected companies extraordinary momentum. We take a look at RENK, Almonty Industries, and thyssenkrupp to see who is benefiting now.

ReadCommented by Fabian Lorenz on July 28th, 2025 | 07:05 CEST

Shares with up to 200% Upside! Barrick Mining, RENK, and Dryden Gold

RENK's share price has more than tripled in the current year, and analysts still see further upside. However, expectations for revenue growth and order intake are sky-high, so investors are advised to proceed with caution. According to analysts, Dryden Gold is set to triple in value. The Company is currently developing a high-grade deposit where visible gold can be seen on surface - a promising indicator of future resource potential. Analysts also see a bright future for Barrick Mining. With a gold price of USD 4,000, they estimate the stock could gain 50%—or potentially even more.

ReadCommented by Armin Schulz on July 23rd, 2025 | 07:15 CEST

Critical raw materials such as rare earths in the spotlight – How European Lithium is saving RENK, BYD, and your returns

The global battle for lithium and rare earths will determine the future viability of industry. While countries are investing billions to gain control of critical value chains, companies without secure access to raw materials are becoming pawns in the midst of geopolitical tensions. A notable example is the Pentagon's investment in MP Materials. RENK, a defense specialist in high-performance transmissions, and BYD, the electric mobility giant, are existentially dependent on stable supply chains. This is exactly where European Lithium comes in: the Company could break Europe's strategic dependence through domestic production.

ReadCommented by Fabian Lorenz on July 22nd, 2025 | 07:20 CEST

Defense hype, high-tech hope, valuation question: RENK, Salzgitter, and Argo Graphene Solutions

Three shares, three stories – ranging from high-tech hopes to defense-driven fantasy to valuation concerns. Argo Graphene Solutions is bringing the "miracle material" graphene to the construction industry. The stock is on an upward trend. If the rollout is successful, a multi-fold increase is possible. At Salzgitter, hopes for a revaluation based on defense fantasies evaporated after a sharp forecast cut; however, the price loss may have been excessive. And RENK? The defense supplier remains in demand, but valuation concerns are growing. Where is it still worth getting in?

ReadCommented by André Will-Laudien on July 21st, 2025 | 07:20 CEST

150% with Gold, Caution in Defense stocks! BYD, AJN Resources - Are RENK and Steyr headed for a crash?

The stock market is currently experiencing fluctuations. While defense stocks are leading the performance list, precious metals have also been back in focus for several months. The reason: Currency devaluation is accelerating as inflation rates remain high. Now, there are rumors that Donald Trump may want to replace his hawkish monetary watchdog, Jerome Powell. Wall Street is betting that a more dovish figure will soon steer US interest rate policy. That would be the next rocket boost for stocks. However, risk-averse investors are increasingly turning to gold. In 2025, the price per ounce has already risen as high as USD 3,490. Due to low production costs, projects in Africa remain firmly in focus. One example is AJN Resources, which has recently refinanced and is repositioning itself in Ethiopia. Where do the real opportunities lie for dynamic investors?

ReadCommented by Fabian Lorenz on July 17th, 2025 | 07:10 CEST

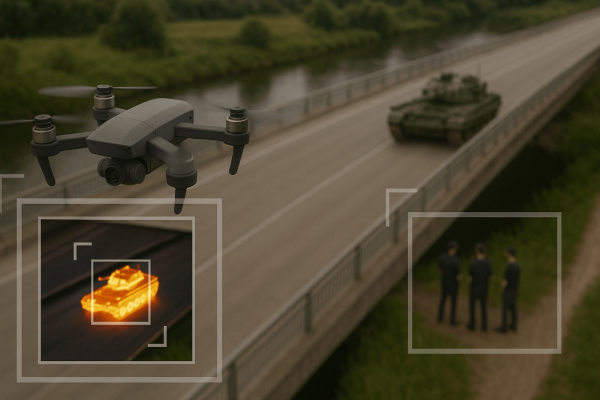

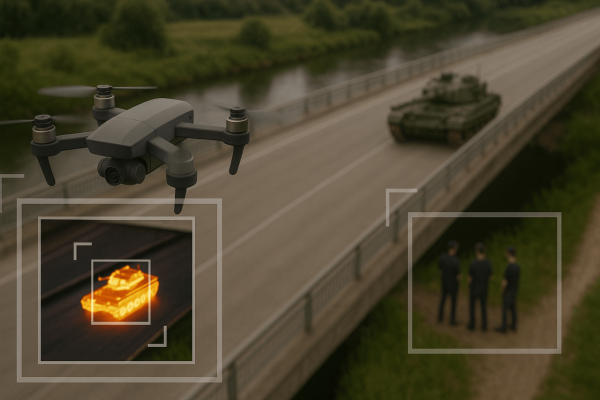

Armament stocks make a splash! RENK, DroneShield, Volatus Aerospace - Drones instead of tanks?

A major shake-up in the defense industry! KNDS is set to go public later this year, and the German federal government may participate in the IPO, which would also result in an indirect stake in RENK. KNDS has a stake in the gearbox specialist, and the two companies are jointly building the Leopard 2, among other things. But are tanks still relevant? The war in Ukraine has at least exposed their vulnerability and ushered in the age of drones. Volatus Aerospace and DroneShield are benefiting from this, with their shares having multiplied in recent months. However, more and more orders are now coming in from NATO. Revenue and profits are likely to explode in the coming years.

ReadCommented by Fabian Lorenz on July 14th, 2025 | 07:10 CEST

Siemens Energy gifted away? RENK is betting on AI! First Hydrogen shares rally 100%!

The opportunities of hydrogen and nuclear power in one stock? First Hydrogen offers just that. Over the past 4 months, the stock has more than doubled. Nevertheless, it still does not appear to be expensive, as the global hunger for energy and thus the potential for First Hydrogen is huge. This energy demand is also driven by the AI hype, which is causing data centers to spring up like mushrooms. RENK is turning to artificial intelligence for the future. The Company may focus even more on defense going forward. Analysts view this positively. Siemens Energy shares have increased more than tenfold in recent years. But is the core business still being offered for free? A look at India suggests this might be the case. A buying opportunity?

ReadCommented by André Will-Laudien on July 9th, 2025 | 07:25 CEST

1,000 tanks for NATO - another 150% with armaments and gold? Rheinmetall, Dryden Gold, Hensoldt, and RENK in focus

The news hit like a bombshell. NATO plans to deploy up to 1,000 modern main battle tanks along its eastern flank. Amid growing tensions with Russia and against the backdrop of the ongoing war in Ukraine, the defense alliance is sending a clear signal of deterrence. The plan is part of a comprehensive rearmament program to strengthen what is called "Forward Defense." Germany, Poland, and other Eastern European member states, in particular, are set to serve as logistical and operational hubs. It is not just about tanks; ammunition, spare parts, and maintenance infrastructure are also to be built up on a large scale. In addition, the defense sector will see investments of over EUR 1 trillion over the next decade. Reason enough for the next price explosion at Rheinmetall and Co. Security is also likely to be the reason for the impressive gold rally since the beginning of the year. Where will it end?

ReadCommented by Armin Schulz on July 7th, 2025 | 07:10 CEST

RENK, Globex Mining, BYD: The raw materials gap – A threat to defense and e-mobility, An opportunity for miners

Global industry is facing a turning point. While defense giants like RENK are experiencing record demand yet continue to face investor skepticism, and electric vehicle leader BYD grapples with market saturation, raw materials are redefining the competitive landscape. Raw materials such as tungsten, antimony, and rare earths are essential for high-tech industries. Globex Mining is directly benefiting from this shortage of strategic metals – an effect that is permeating supply chains, from tank manufacturing to electric vehicle production. The diverging paths of these three players underscore the importance of supply security in determining success. An analysis of the current status of RENK, Globex Mining, and BYD reveals the strategic levers for future value creation.

ReadCommented by Fabian Lorenz on July 4th, 2025 | 07:00 CEST

Over 100% gains! Better than RENK and DroneShield shares? NATO contract for drone insider tip: Volatus Aerospace!

Changing of the guard for defense stocks? While RENK shares have lost more than 20% in recent weeks, drone specialists DroneShield and Volatus Aerospace have exploded. Volatus remains relatively inexpensive. Now, the Company has also secured a NATO contract. In terms of valuation, the Canadians remain something of a hidden gem – their peer group is valued significantly higher. That includes DroneShield. The Australians are now valued at more than AUD 2 billion. Admittedly, their pipeline is also impressive. In addition to the drone revolution, a lot of money continues to flow into tanks and other armored vehicles. The German Armed Forces alone plans to procure thousands of new vehicles. RENK wants a large slice of the billion-dollar pie and is investing EUR 500 million. Does this mean the consolidation is now over?

Read