NORDEX SE O.N.

Commented by Fabian Lorenz on March 17th, 2025 | 07:10 CET

Hydrogen stocks make a comeback and attract billions in investment! Nel ASA, Nordex, First Hydrogen

Almost 100% in three days. The Nel share celebrated a brilliant comeback last week. The entry of the Samsung Group as a new major shareholder in the Norwegian company shows that hydrogen continues to have a future. Can the rally continue? First Hydrogen's timing could hardly have been better. Shortly after announcing its expansion into Europe, the EUR 500 billion package for infrastructure in Germany has been approved. Of this, EUR 100 billion is reserved for the Climate and Transformation Fund (KTF). Accordingly, stocks in the renewable energy sector ended the week on a positive note. First Hydrogen is not the only company hoping to get a piece of the billion-euro pie; Nordex shareholders are also hoping for rising revenues. Analysts see potential.

ReadCommented by Armin Schulz on March 4th, 2025 | 07:00 CET

BYD, Nova Pacific Metals, Nordex – From raw materials to electric vehicles or wind turbines: The strategies behind the boom

In a world caught between climate targets and geopolitical tensions, three companies in seemingly different industries are driving the green transformation with disruptive technology and strategic foresight. In recent months, the EU has announced two infrastructure packages worth billions for renewable energies and critical raw materials. Whether e-mobility, mineral raw materials or wind power – they all share one goal: to redefine their sectors. However, the starting point is always the raw materials needed for the electrification of the world.

ReadCommented by Fabian Lorenz on March 3rd, 2025 | 07:00 CET

50% upside potential or end of the rally? Nordex, Barrick Gold, and Golden Cariboo Resources

Analysts see 50% upside potential at Nordex. The wind turbine manufacturer is entering the new year with a strong base. The outlook for 2025 is convincing, and there could even be a surprise in terms of EBITDA. Perhaps there will even be a dividend soon? However, there are risks in the important US business. Gold is among the winners of the Trump era. As the scandal in the White House on Friday showed, the geopolitical situation remains unstable. Although the gold price has not managed to break through the USD 3,000 mark, the upward trend remains intact. The stock of Golden Cariboo Resources is still cheap. The security of the largely undiscovered gold pearl has just overcome a resistance, and promising drilling results have been obtained. Experts advise buying. And what is Barrick Gold doing? The struggling industry giant recently made positive headlines, but the stock is weakening.

ReadCommented by Armin Schulz on February 20th, 2025 | 07:00 CET

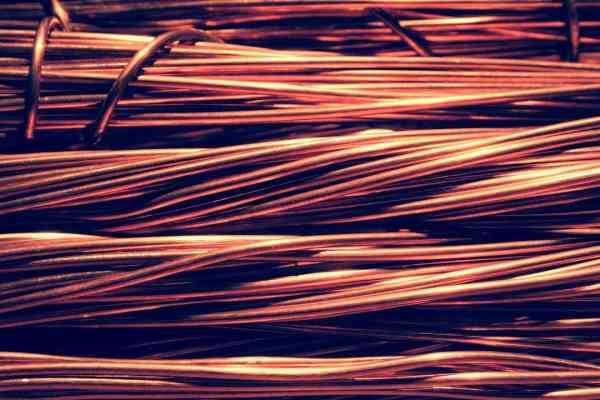

BYD, Benton Resources, Nordex – Copper Boom: The hidden treasure of the greentech industry

In a world balancing between climate targets and geopolitical tensions, three companies are working on the future of the energy and mobility transition and depend on critical raw materials like copper. While the 2025 German federal election is reigniting the debate on renewable energies – with demands for clear framework conditions for wind power and critical voices from the political arena – other players are pushing ahead with disruptive technologies. BYD showcases the future with AI-driven assistance systems. Benton Resources is unlocking key resources for green technologies like copper, nickel, zinc, and gold, and Nordex receives record orders despite uncertain markets. These companies have more in common than their focus on sustainability: they represent a new era of innovation in which strategic decisions made today determine tomorrow's competitiveness.

ReadCommented by Fabian Lorenz on February 6th, 2025 | 07:20 CET

Puma, Nordex, and Power Nickel - Potential for a price jump? Analysts see opportunities in these stocks

Power Nickel's shares were among the commodity high flyers of 2024. The upward trend appears to be continuing in the new year. Power Nickel's high-grade Nisk project is increasingly turning into a gold mine with numerous valuable metals. To increase its value further, it will continue to drill and spin off non-core activities. Will analysts soon be raising their price targets? Puma shareholders have been waiting in vain for a price jump for quite some time. The sporting goods company is caught in a margin trap. The target prices are widely divergent. After difficult years, Nordex is actually doing well. But the US is becoming more and more of a concern. And now there is also a headwind in Germany.

ReadCommented by André Will-Laudien on January 29th, 2025 | 07:00 CET

Watch out! VW and BMW are turning, Benton Resources is stepping on the gas, while Nordex and Siemens Energy are on the sidelines

For the German economy, a 180-degree shift in economic policy is needed to stop the ongoing migration of industries abroad. However, this requires signs of a consistent refocusing on burning issues, which neither the parties with a claim to the government nor the opposition can really present. International investors have refocused on European markets at the beginning of the year, as reforms are expected. The premature praise for Donald Trump has generated new highs in the US, but now the NASDAQ seems to be running out of steam. Germany, as the laggard in terms of economic growth, offers very low valuations that have rarely been seen for longer periods. We highlight some opportunities.

ReadCommented by Fabian Lorenz on January 27th, 2025 | 07:00 CET

Better than Nvidia! Vistra, Siemens Energy, Nordex, XXIX Metal

With a gain of 264%, Vistra Energy outshone Nvidia in 2024. Who would have thought that a "boring" stock could increase tenfold in less than four years. But the stock is benefiting massively from the AI hype. The same goes for the German company Siemens Energy. Both are still unstoppable in the new year. At the beginning of the energy value chain, commodity stocks have catch-up potential. One promising stock is XXIX Metal. The Company focuses on copper in Canada and has takeover potential. The stock has also been listed in Frankfurt since this month and recently published positive results. Nordex could become a Trump loser. US business accounts for a noticeable share of the bulging order book. What happens next?

ReadCommented by Fabian Lorenz on January 22nd, 2025 | 07:15 CET

Caution advised with Nordex and Plug Power! Momentum stock Globex Mining continues to rise!

The stock of Globex Mining is currently very momentum-driven. With its gold projects, the mining incubator is one of the winners of the Trump presidency. Additionally, there is more positive news from its risk-diversified resource portfolio. The chart also looks positive. The stock is marching towards its all-time high and remains attractively priced. In contrast, there has been a shock at Nordex! In his inaugural speech, the new US president has already put pressure on the wind energy sector, which he despises. If it were up to him, all wind projects in the US would be stopped! Furthermore, news from the industry adds to the strain. Plug Power is also among the Trump losers. At least the outgoing US president left a farewell gift worth billions. What is next for these shares?

ReadCommented by Fabian Lorenz on January 15th, 2025 | 07:00 CET

Horror for Nel share! Nordex and First Hydrogen impress!

Nel ASA is plunging - both operationally and in its stock performance. The hydrogen pioneer is shocking the capital market with massive job cuts and a production stop at its main plant. What are the reasons? Is there any improvement in sight? On the day of the Nel crash, First Hydrogen delivered a positive highlight. As a result, the share price even rose slightly. The technology company belongs to the new generation of hydrogen specialists. Its fuel cell commercial vehicles have passed the practical test, and the stock appears ready for a re-rating. Analysts believe that Nordex shares could make a comeback. The Company is considered one of the promising German midcaps. Operationally, things are going well, too, with a new major order from North America recently reported.

ReadCommented by André Will-Laudien on January 13th, 2025 | 07:10 CET

Greentech stocks make a flying start in 2025 – Tax package on the way? Nel ASA, dynaCERT, Plug Power, and Nordex in focus

The stock market kicked off the year with significant volatility. However, while the DAX 40 index is setting new records daily, the NASDAQ is consolidating at a very high level. Some profit-taking is weighing on the recently favoured "Magnificent 7" stocks, while long-neglected stocks in the greentech sector are starting to make a comeback. Canadian hydrogen specialist dynaCERT has now cleared all regulatory hurdles and strengthened its emissions trading team with the appointment of a new board member. In Germany alone, the environmental certificate market represents an annual volume of EUR 18.5 billion. We analyze which greentech stocks are now in a position to unlock their potential.

Read