NORDEX SE O.N.

Commented by Stefan Feulner on January 13th, 2025 | 07:00 CET

Nordex, XXIX Metal, D-Wave Quantum – Demand is driving prices

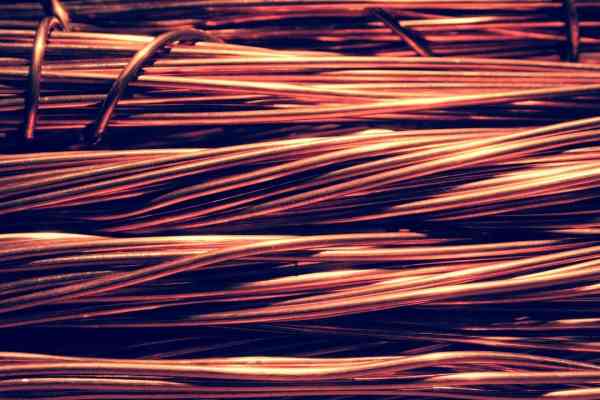

The decarbonization of the energy industry and the accelerated expansion of data centres for calculating artificial intelligence are creating a steadily increasing demand for energy sources that are as clean and efficient as possible. In addition to the ramp-up of solar energy, wind power plays a major role. The energy transition is leading to an enormous increase in the demand for copper. Forecasts assume that the demand for copper could increase by around 50–70% by 2030. By contrast, the past decade has seen a failure to meet rising demand by developing new projects. As a result, the few copper producers are likely to benefit from rising prices in the long term.

ReadCommented by Fabian Lorenz on December 27th, 2024 | 07:30 CET

Renk electric tanks with Rheinmetall? Buy Nordex shares? XXIX Metal profits!

Is electric mobility coming to the battlefield soon? This is likely to be only a matter of time. For example, Renk is already working on hybrid models that are expected to offer clear advantages in the field and could also be used to electrify Rheinmetall tanks in the future. In addition, the new transmissions pave the way for autonomous driving tanks. Electric vehicles are driving the demand for copper just as much as artificial intelligence and renewable energies. XXIX Metal is benefiting from this. The Company emerged from a merger this year and has become a leading player. The copper content of the projects, which already exists, is convincing. And what is Nordex doing? The wind turbine manufacturer has reported a new order. The stock has remained relatively stable throughout 2024. Analysts see upside potential, but there are also risks.

ReadCommented by Stefan Feulner on December 16th, 2024 | 07:15 CET

Ballard Power, F3 Uranium, Nordex – Alternative energies with a clean rebound

While the stock market is still shining, it is dark in Germany - not referring to the current government still in office but to the weather. In addition to the fact that the sun is hardly showing, the wind is also blowing even weaker than usual. As a result, significantly less energy is being generated during the dark doldrums. Gas and coal-fired power plants have to step in here, but their electricity production is considerably more expensive. A clean alternative embraced by the rest of the world is nuclear energy. While the traffic light coalition took the last reactors off the grid, the expansion of uranium production is being strongly pushed there.

ReadCommented by André Will-Laudien on November 11th, 2024 | 07:00 CET

Traffic light madness! The turnaround at BASF, Altech Advanced Materials, Nordex and Siemens Energy

The traffic light coalition departs – and the economy breathes a sigh of relief. Key future topics such as the energy transition, e-mobility and the energy storage market now have good prospects. With a redefinition of industrial policy in Germany, confidence is returning to small and medium-sized companies. With a constant stream of new regulations, high energy costs and excessive bureaucracy, the failed coalition had many things in mind – but not the economic well-being of Germany. A murmur is going through the fragile industrial complexes with the announced new election. We expect a surge of innovative ideas, especially in the areas of energy security and mobility. Check your portfolio!

ReadCommented by Stefan Feulner on September 27th, 2024 | 07:20 CEST

Almonty Industries, PowerCell Sweden, Nordex – It is all happening in quick succession

The FED's interest rate cut and announcements of further easing of monetary policy are giving the indices additional momentum. The German-leading index DAX, the Dow Jones, and the S&P 500 continue to jump from high to high. In contrast, companies in the hydrogen fuel cell sector are more than 90% away from their historical record highs. However, several companies are currently forming a sustainable bottom that could lead to a sharp rebound.

ReadCommented by Stefan Feulner on July 2nd, 2024 | 07:00 CEST

Nordex, Almonty Industries, Rheinmetall - Dramatic developments

The turning point that began with Russia's invasion of Ukraine changed many things, and not just in geopolitics. In addition to rearmament, which made the arms industry increasingly important, producers of critical raw materials from Western countries are likely to benefit from the further escalation of the trade war. The US Department of Defense published a report stating that the domestic industrial base for critical minerals, magnets, and metals will be further expanded.

ReadCommented by Juliane Zielonka on April 25th, 2024 | 06:30 CEST

dynaCERT, Nordex, Plug Power - Clean solutions for the environment with potential returns

Greece's capital, Athens, has been struggling with extreme air pollution caused by dense Saharan dust since Wednesday. The red mineral dust causes severe lung problems and has led to numerous emergency admissions in the metropolis. Three companies are currently providing a breath of fresh air on the stock markets. The Canadian company dynaCERT focuses on clean air through patented electrolyser technology that reduces pollutant emissions in the booming logistics sector. Wind turbine manufacturer Nordex is also causing a stir among analysts. The Hamburg-based company impresses with full order books and good figures. A court in New York will now decide retrospectively whether CEO Andy Marsh's words regarding the operational business at Plug Power are just hot air or have real substance.

ReadCommented by Juliane Zielonka on March 27th, 2024 | 08:15 CET

Energy sector on the upswing: Siemens Energy, Manuka Resources and Nordex Group focus on a sustainable future

International collaborations are lucrative ventures for energy companies such as Siemens Energy. As a strong partner for Iraq, the Group supports the country in the secondary utilization of by-product gases for power generation that would otherwise be lost. Vanadium, a critical raw material for sustainable construction and electromobility, is needed. China and Russia possess the most deposits but are politically insecure. This is reason enough for the company Manuka Resources to explore a rich vanadium area off the coast of New Zealand. Thanks to an accelerated procedure for granting mining permits by the New Zealand government, operations could commence soon. Wind turbine manufacturer Nordex is also in the starting blocks: with an order from South Africa, the Hamburg-based company will deliver 57 turbines to the coastal region. Here are the details.

ReadCommented by André Will-Laudien on February 23rd, 2024 | 07:00 CET

Will GreenTech soon be back in vogue? Nel ASA, Klimat X, Nordex, and Plug Power are under analyst scrutiny!

Despite new record highs in global stock markets, the GreenTech sector has yet to show any gains. The hydrogen sector, in particular, which was hyped in 2020/21, has been struggling for the past three years. With share price losses of 70 to 90%, investors are hopeful that a bottom could be reached in the foreseeable future. We analyze whether this could already be the case and present an alternative in the form of Klimat X. Business is running smoothly here, and the CO2 savings are even certified.

ReadCommented by Fabian Lorenz on February 15th, 2024 | 07:15 CET

The Nel share is tumbling, Nordex is gaining momentum, and dynaCERT is building strength

Is there a 70% upside potential in the Nordex share? This is what analysts are suggesting based on the convincing preliminary figures. But is this development sustainable? Shareholders are hoping for convincing quarterly figures from Nel, even though no major orders have been reported for some time. The share is in a clear downward trend, and analysts have recently drastically reduced the price target for the hydrogen pure-play. While the shares of Nel, Plug Power & Co. are stumbling, dynaCERT is showing relative strength. In an industry environment that is anything but positive, the shares of the Canadian hydrogen company are forming a base.

Read