March 1st, 2023 | 14:24 CET

Greentech in focus: BASF, Meta Materials, Nordex, JinkoSolar - Invest now in the Climate Action Plan 2.0!

In the daily press, in addition to the terrible images from Ukraine, we are also occupied with unresolved questions about the energy industry of the future. It has been decided that the path will lead via innovations and renewable energies, but the underlying pace will not be sufficient for a quick turnaround. Moving away from the internal combustion engine is just as much a matter for discussion as condemning nuclear energy. Resourceful researchers are therefore developing new ideas for technological concepts that will change vast areas of life. However, implementing the solutions will cost a lot of money and require scarce raw materials. What should investors be focusing on at the moment?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BASF SE NA O.N. | DE000BASF111 , Meta Materials Inc. | US59134N1046 , NORDEX SE O.N. | DE000A0D6554 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nordex and JinkoSolar - Fully on the green wave

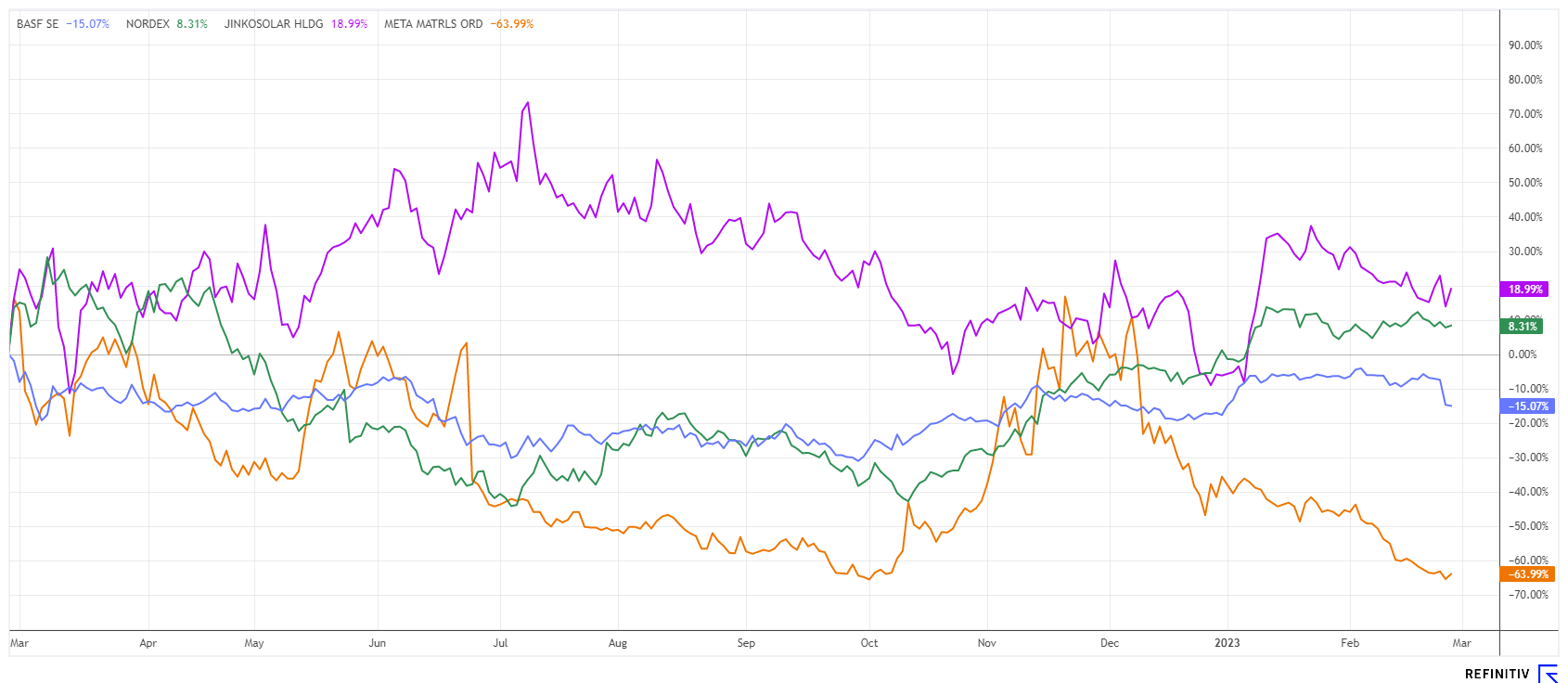

Two well-known representatives of the "alternative energy" sector are wind turbine manufacturer Nordex and solar panel expert JinkoSolar. While Nordex is still down 4% on a 12-month view after several profit warnings and despite a steep recovery rally, JinkoSolar has lost 40% since mid-2022 after a rollercoaster ride but can still boast a share price gain of 11% due to the outstanding order situation.

After doubling in price since October 2022, the signs for Nordex are currently pointing to consolidation. However, with a new 80 MW order from the Baltic States, orders continue to go through the roof. Recently, the Hamburg-based company started series production of a new 6 MW N163/6.X turbine. Demand for the new turbine is very high throughout the EU. The Netherlands, Finland, Estonia, Germany and Turkey are all interested in the new turbines. In these countries, there are some weaker wind sites, limited expansion areas, and partly limited grid capacities, which require a turbine with a flexibly configurable output in the 6 MW range. In the current environment, the price of the Nordex share should be able to hold in the EUR 13 to 15 range. A profit at group level is not expected until 2024.

At JinkoSolar, the order situation is convincing. Recently, a 300 MW plant in Saudi Arabia was signed. It is a good sign that the Gulf state, in addition to its abundant oil and gas reserves, is also pushing ahead with the expansion of renewable energies. Only Goldman Sachs criticizes the low margin of the Chinese panel manufacturer because, at the holding level, they doubled sales in the last quarter and generated a small profit through income from subsidies, but all with a low margin. The rating is, therefore, "Sell", with a price target of USD 41. The stock is currently trading at USD 53.2. JinkoSolar could tempt to enter again after a 15% consolidation.

Meta Materials - Excitement before the annual figures

New patented processes are needed to refine surfaces and create unique environmental-technological properties. After all, to save energy, it is necessary to optimize industrial processes and increase efficiencies, especially concerning consumption values and climate friendliness. At the Canadian company Meta® Materials, everything revolves around high-tech applications in the field of surface coatings on glass, building structures and other design elements. For example, the Company develops sensibly integrated antennas and camouflage caps for armaments. The product metaAIR®, for example, protects the crew of an aircraft from glare and irritation caused by laser beams hitting the cockpit.

With its innovative developments, META®-Materials is repeatedly the focus of the manufacturing industry - solutions for 5G networks, e-mobility, autonomous driving and much more and intended. Recently, the Company signed a contract in the field of nano-optics for banknote security with a G10 central bank. The contract has a term of 10 years and a potential sales volume of USD 41.5 million. The addressable market segment for in-demand banknote authentication and brand protection solutions is estimated to be USD 1.32 billion in 2022. According to expert estimates, it may grow to USD 1.55 billion by 2026.

"META® is developing a globally unique metamaterial nano-optical technology and anti-counterfeiting feature for our G10 central bank customer," said George Palikaras, President and CEO. "We are pleased to make progress on this prestigious and important contract with Meta Materials, the largest in the history of banknote security feature development. In 2023, META® plans to launch its unique meta-material nano-optical technology KolourOptik® worldwide, which combines multi-directional motion, 3D stereo depth, high resolution and multiple colours." A perfect technology to make banknotes more counterfeit-proof. The stock has come down recently but could surprise on the upside again as we look ahead to the release of the 2022 full-year results on March 17.

BASF - False start after profit warning

After the disappointing figures for 2022 and a subdued outlook, it is expected that the drastic changes for BASF will be greater than many experts had suspected. CEO Dr Martin Brudermüller wants to close one of the two ammonia plants at Europe's largest chemical site due to high energy costs. Much more importantly, he wants to phase out the large, modern TDI production facility and thin out the European precursor lines for polyamide. All measures will affect the "Materials" business, one of the largest sectors in the Group.

The action is justified by the sharp drop in earnings in the two main plastics-relevant sectors, "Chemicals" and "Materials", which had to absorb additional energy costs of EUR 3.2 billion in 2022. New EU regulations in connection with achieving climate neutrality in 2050 are also likely to play a role in shifting certain energy-intensive process steps abroad. BASF plans to invest EUR 10 billion in China over the next 5 years. From a climate perspective, this approach is a global zero-sum game; only in Germany and Europe are valuable jobs lost with such actions.

BASF plans to save an additional EUR 500 million annually from 2025 onwards in central areas outside production, primarily affecting 2,600 jobs in Germany. Plant closures and relocations are expected to reduce fixed costs by an additional EUR 200 million. BASF's share price has slipped to around EUR 48 following the announcements. Although the valuation is low, with a 2024 P/E ratio of 9.2, the short-term outlook is not inspiring. Keep watch!

Huge efforts are needed to achieve the EU's ambitious climate targets. In addition to government investments, the capabilities of private companies are also needed here. Nordex and JinkoSolar are swimming on the green wave, and Meta Materials continues to be very innovative. Chemical giant BASF will likely have to consolidate for a few more quarters.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.