NORDEX SE O.N.

Commented by Fabian Lorenz on October 28th, 2021 | 12:52 CEST

Nordex, Standard Lithium, Central African Gold: Raw materials for the energy transition

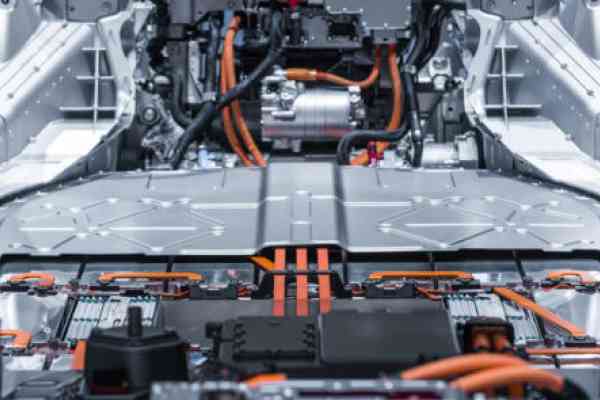

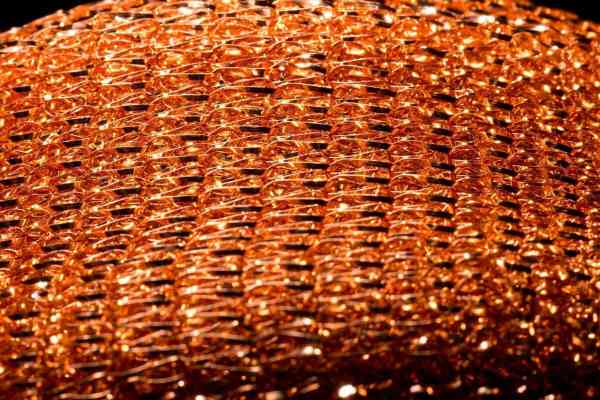

The energy turnaround is supposed to save the climate and significantly reduce the consumption of fossil fuels. But what is often overlooked: In practice, this means that demand for other raw materials is rising massively. In the EU alone, demand for cobalt is expected to increase more than tenfold by 2030. Copper and lithium are also in hot demand. Nordex, for example, needs rare earths for the production of wind turbines. Standard Lithium benefits from the exploding demand for batteries and Central African Gold's raw materials are included in practically every future technology.

ReadCommented by Armin Schulz on October 27th, 2021 | 11:43 CEST

Defense Metals, Nordex, Xiaomi - Battle for raw materials intensifies

China is scaling back its magnesium production due to electricity problems. The Chinese government is aiming to reduce energy consumption and thus emissions. It will inevitably lead to supply bottlenecks worldwide, and in Germany, it will initially affect the metal industry. However, since China produces 90% of the world's magnesium, there are, in fact, no alternatives. Similar problems exist with tungsten and rare earths, needed for almost all new technologies, from renewable energies to consumer electronics and e-cars. If you want to reduce this dependence, you have to look for alternatives.

ReadCommented by André Will-Laudien on October 25th, 2021 | 11:41 CEST

GSP Resource, Nordex, JinkoSolar - Alternative energies on the rise!

The political course set in Germany is also decisive for further progress in the EU's complex opinion-making process. Nordic countries want to promote alternative energies much more strongly, while more southern members are increasingly focusing on nuclear power. French Prime Minister Macron intends to invest a total EUR 30 billion in the expansion of nuclear energy, hydrogen technology and e-mobility as part of his "France 2030" plan for the future. Nuclear power is set to disappear from the German energy mix. The race is already evidently on in Europe to see who will be allowed to cover our electricity shortfall in the future.

ReadCommented by Stefan Feulner on October 19th, 2021 | 13:06 CEST

Steinhoff International, Osino Resources, Nordex - Best conditions

Despite concerns about a possible real estate crash in China as well as continued high inflation and investors' fears of demonetization, global indices pushed up again last week and are preparing for another assault on new all-time highs. In addition, strong business figures for the third quarter from the US supported the stock market barometers. The DAX also started the number season with good guidance from the software giant SAP.

ReadCommented by Carsten Mainitz on October 18th, 2021 | 13:05 CEST

Defense Metals, Nordex, Varta - These are the reasons for the rising prices!

Rare earths are indispensable for the production of laptops, cell phones, electric motors and wind turbines. However, their extraction is complicated, which is why the supply is also relatively low. The EU has classified many of these metals as critical with regard to their availability given their great importance for many industries, also because of China's dominance as the largest supplier. Efforts to build rare earth mines outside China are proceeding at full speed.

ReadCommented by Stefan Feulner on October 15th, 2021 | 13:23 CEST

Nordex, Tembo Gold, Plug Power - Great rebound potential

"If you don't have the shares when they fall, you don't have them when they rise", this quote comes from the stock market legend André Kostolany. The words of the old master can be applied to the current state of both the stock and precious metals markets. The renewable energy sector currently offers great comeback opportunities. The prices of most wind, hydroelectric and hydrogen stocks have lost more than half their value in recent months, and the bottoming process is underway. Which companies are coming back and continuing their upward trend?

ReadCommented by André Will-Laudien on October 14th, 2021 | 13:55 CEST

Varta, Standard Lithium, Sierra Grande Minerals, Nordex - The next hype rolls in!

In Germany, politics is becoming significantly greener! But what do the mobility concepts of the climate protectors look like? In addition to the publicly demanded reduction of unnecessary business flights, the bicycle would also be an alternative for 30-kilometer journeys. Fossil energy has already become 50% more expensive in 2021, and gas prices are going through the roof. There is still a high demand for energy in Germany because we are currently buying cheap nuclear power abroad. This is how it can go when a botched energy policy is associated with climate protection goals. No matter how things go, the world needs copper for modern technologies, and this raw material, along with lithium and other critical metals, is just terribly scarce. How are the typical industry players doing?

ReadCommented by Stefan Feulner on October 8th, 2021 | 11:28 CEST

Nordex, Desert Gold, TUI - The wind is changing

The DAX is back on top after a brief but painful correction and the slide below the psychologically important 15,000 mark. Was that it, and is the German stock market barometer preparing for a year-end rally and a renewed jump above the 16,000 mark, or will further price losses follow? A long consolidation phase could also be over for certain individual stocks, just like in the precious metals markets.

ReadCommented by Stefan Feulner on October 1st, 2021 | 11:33 CEST

Volkswagen, Royal Dutch Shell, Enapter, Nordex - Green investment opportunities

The climate targets formulated are ambitious. According to the Paris Climate Agreement, Germany has committed itself to work with the international community to limit global warming to 1.5 degrees. According to current research, this would only be possible if the Federal Republic became climate-neutral by 2035. Unfortunately, the reality is sobering. For example, in the first 3 quarters of 2021, the share of renewable energies in electricity consumption fell to just 43%. Policymakers must act and rely on the pioneering spirit of young companies.

ReadCommented by André Will-Laudien on September 30th, 2021 | 12:46 CEST

TeamViewer, Silver Viper, Nordex: Please board - the train is departing!

Uncertainty and high volatility! After months of upswing on the capital markets, an uneasy feeling is setting in among investors due to some imponderables in China. The coefficient of fluctuation, expressed by the VDAX and VIX, skyrocketed from values around 17 to 25 early this week. It does not mean much for ordinary investors, but the cost of hedging increases for institutional investors, and those who want to lower the risk a bit have to adjust the investment ratio accordingly. All this is still happening in a relatively stable environment because those who want to get out can still sell at good prices. Where should one look closely now?

Read