NORDEX SE O.N.

Commented by André Will-Laudien on March 31st, 2022 | 11:57 CEST

Varta, Phoenix Copper, JinkoSolar, Nordex: Numbers upon numbers, where is the explosive?

The copper price reached its preliminary high on March 7, 2022, at around USD 10,730. Since then, we have seen a standard consolidation of 3-4%, which is not an unusual occurrence in the present uptrend. Thus, the coveted metal has exploded by over 100% since the beginning of 2020. Large mining groups and copper mines have often been able to post a multiple of this performance for themselves in the same period. For many market participants, the medium-term upward scenario for the industrial metal remains set. Since the political closing of ranks on e-mobility, demand for copper and battery metals has shot through the roof. Mine operators and governments worldwide are alarmed because the current recoverable capacities cover just 85% of the current year's demand. Who can close the gap?

ReadCommented by Carsten Mainitz on March 30th, 2022 | 12:50 CEST

Nordex, Altech Advanced Materials, Varta - Winners of the energy turnaround!

Renewable energy generation and energy storage are taking on an increasingly important role. The challenges for the infrastructure with decentralized energy sources are also increasing. Given the explosively rising lithium prices, which are essential for the production of batteries, innovations are gaining importance. Some solutions have the potential to powerfully shake up the industry. Long-term investors can profit from the megatrends in various ways.

ReadCommented by Nico Popp on March 23rd, 2022 | 10:47 CET

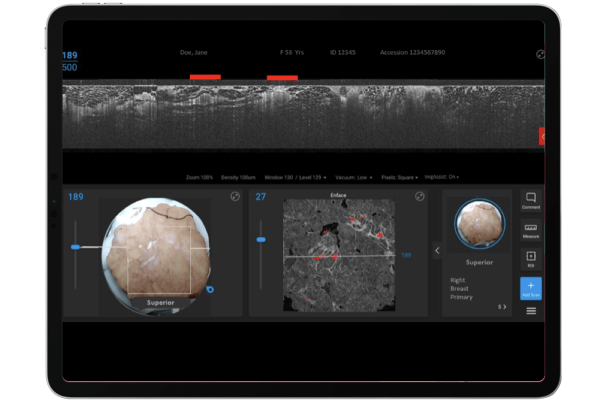

Stocks that change the world: TeamViewer, Perimeter Medical, Nordex

When new technology meets the right opportunity, things can go up quickly for companies. One example is the German company TeamViewer, which already had an established remote desktop solution that many users had heard of when the pandemic broke out. When we moved to the home office overnight but had to use software from the office, it made sense to install TeamViewer. Innovative solutions are also meeting with great demand in other industries. We analyze what this means for investors.

ReadCommented by Fabian Lorenz on March 15th, 2022 | 11:56 CET

Nordex, K+S, Defense Metals: Shares for the "inflationary shock"?

Russia's war in Ukraine is causing massive dislocations in the commodity markets. Not only for oil and gas but also for metals and agricultural commodities. The consequences are clear: Everything is getting more expensive. At the same time, resources outside Russia and China are becoming strategically more important. That speaks in favor of the German potash producer K+S. However, the share has already done very well, with analysts issuing warnings. The situation is different for Defense Metals. The Canadian rare earth explorer is described as an "undiscovered pearl" with takeover fantasy. In the meantime, renewable energy must also be called a commodity. Nordex benefits from this and receives tailwinds from analysts. But, there are also problems at the wind turbine manufacturer, and these need to be solved.

ReadCommented by Nico Popp on March 11th, 2022 | 10:15 CET

Nordex, MAS Gold, Hensoldt: Shares for the new era

Even if the negotiations between Ukraine and Russia inspire hope, regardless of the interim status, much will change in the coming months and years. The civilian power EU must rethink - in many areas. Gas as a transitional technology can hardly be justified after Putin's war of aggression. Putting national security in the hands of NATO, which is largely supported by the United States, also seems risky - after all, Trump is already preparing his election campaign. In the future, the EU and Germany will have to accelerate climate change and push ahead with rearmament. We present three stocks that could benefit.

ReadCommented by Carsten Mainitz on March 10th, 2022 | 12:09 CET

Nordex, Phoenix Copper, E.ON - Under power

The Ukraine war is making the stock markets nervous. Once again, we realize that normality can end overnight. Massive sanctions have hit Russia. The dependence on our eastern neighbor for energy and raw materials is becoming abundantly clear. The oil and gas prices are soaring, which again strengthens the desire to rely on renewable energies. The growth of electromobility should gain further momentum due to current developments.

ReadCommented by Fabian Lorenz on March 10th, 2022 | 10:22 CET

Nordex, K+S, Desert Gold: Commodities out of control

While the broad stock market suffers from Russia's war of aggression in Ukraine, commodities are becoming increasingly expensive. On Tuesday, the price of nickel had doubled, and the London Metal Exchange even suspended trading. Prices are also going through the roof for virtually all other commodities such as oil, gold, gas and wheat. Accordingly, shares from these sectors are currently in demand. Such as the potash producer K+S because large competitors from Russia and Belarus are currently cut off from the world market. Analysts have recently been cautious. Desert Gold is benefiting from the high gold price. In addition, the Canadian explorer has published promising resource estimates. Driven by the political announcements to replace fossil fuels even faster with renewable energies, Nordex was one of the past week's winners. Now, however, the Company has published sobering figures. But hope remains.

ReadCommented by André Will-Laudien on March 7th, 2022 | 12:48 CET

Attention: Nordex, Siemens Energy, Memiontec, Siemens - Out of the crisis with GreenTech!

Renewable energies promise lower and more stable energy prices in the medium term and greater independence from oil and gas from abroad. Accordingly, the current developments could lead to a further intensification of efforts for the energy turnaround in Europe. The armed conflicts between important raw material suppliers expose the risks of historical dependencies. For an energy importer like Germany, ongoing sanctions can pose a serious supply threat. Currently, the government may even be called upon to reduce levy-induced additional costs on fuels and postpone the phase-out of nuclear energy. In this mixed situation, GreenTech manufacturers will experience a real boost. We show which values are interesting.

ReadCommented by Carsten Mainitz on March 2nd, 2022 | 13:21 CET

MAS Gold, Nordex, Hensoldt - Profit from the crisis!

War in Europe! After the end of the Balkan conflict and the ceasefire in Northern Ireland and the Basque country, no one could have imagined that it could happen again so quickly. On the stock exchanges, armed conflicts seldom cause storms of enthusiasm. On the contrary, investors take refuge in supposedly "safe investments," such as precious metals. Therefore, it is all the more important to closely examine the news situation in order to identify which stocks can benefit from the overall negative situation.

ReadCommented by Fabian Lorenz on March 1st, 2022 | 11:40 CET

Nordex, Rheinmetall, Triumph Gold: Russia crisis causes price swings

Since last Thursday, war has been raging in the euro, and the world has been spinning faster. Over the weekend, Chancellor Scholz announced a new defense and energy policy for Germany in response to Russia's invasion of Ukraine. The German armed forces is to receive EUR 100 billion as special assets. In addition, according to Chancellor Scholz, NATO's 2% target is to be met in the future. Energy independence is to be increased by, among other things, two German LNG terminals. Finance Minister Lindner calls renewables "freedom energies." Accordingly, shares in Nordex and Rheinmetall were in strong demand on Monday. The price of gold also picked up, with Triumph Gold's shares posting double-digit gains.

Read