NORDEX SE O.N.

Commented by André Will-Laudien on November 30th, 2021 | 12:12 CET

Varta, Manganese X Energy, Nordex, Siemens Energy: This could be a crash à la Tesla!

Climate protection, green energy & mobility and digital infrastructure were the hype topics of the bull market year 2021. Price developments like in the current year were last seen during the 2000 tech bubble. Higher, bigger, faster, further - the Olympic concert consistently brought double- to triple-digit price gains until the US Thanksgiving, some shares from the hydrogen sector even managed the magic 1000% hurdle. Now, however, inflation rates have risen sharply in parallel, and the virus, which had fallen into the background, is suddenly on everyone's lips again in a highly contagious variant called Omicron. How the stock markets will deal with this issue remains to be seen. We take a look at well-known protagonists from the green energy sector.

ReadCommented by André Will-Laudien on November 26th, 2021 | 11:28 CET

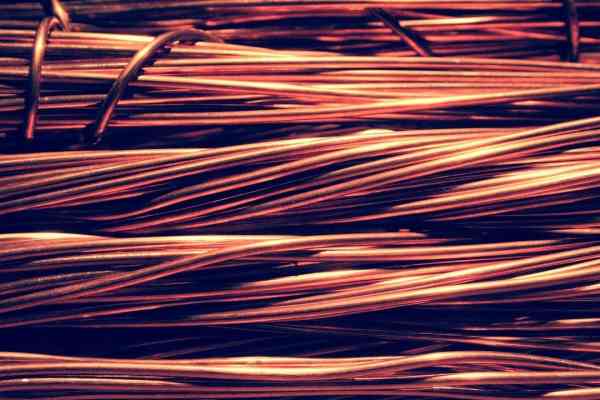

The copper sensation continues! Nordex, Nevada Copper, JinkoSolar, Daimler

When it comes to calculating the copper market in the next few years, expert opinions differ. According to a study by Wood Mackenzie, primary copper demand will increase by 30% to approximately 25 million tons by 2030. The main argument for further rising prices remains the global copper shortage because demand continuously exceeds supply, and recycling rates cannot cover industrial stockpiling either. The German copper smelter Aurubis is trading at an all-time high and wants to build a multi-metal plant in the USA. Such news is confirmation of an awakening among investors to allow new mining and processing operations to emerge. There are few new mines in sight at the moment, but there is news from Nevada.

ReadCommented by Stefan Feulner on November 24th, 2021 | 10:13 CET

Nordex, Kodiak Copper, Xiaomi - Long-term trend

The current copper chart could have been copied from the textbook "Technical Analysis of Financial Markets" written by John J. Murphy. After a ten-year high at USD 10,720.15, the red metal corrected to the support zone at around USD 8,800. After several months of sideways movement, it is now heading north again. Once the USD 9,700 mark has been overcome, a new attempt to reach the five-digit range should only be a matter of time. Copper is in demand as never before and will remain so in the coming years.

ReadCommented by Nico Popp on November 23rd, 2021 | 10:12 CET

Nordex, Memiontec, JinkoSolar: Where sustainable returns await

The motto "After me, the deluge" has had its day. Today, industrial companies have to take responsibility for their actions. That includes cleaning up pollution and offsetting CO2 emissions from production. Hence the trade in emission rights. It is also favorable for a company's image if it is sustainable and communicates this to its customers. We present three stocks that can score points with sustainability.

ReadCommented by Nico Popp on November 18th, 2021 | 12:07 CET

RWE, Nordex, Water Ways, JinkoSolar: These shares are just starting to blossom

Sustainability pays off! Even utility RWE believes that the EUR 50 billion the Company plans to invest in transforming its corporate structure is capital well spent and expects profit increases of up to 10% annually in the course of the measures. Since operating sites also determine whether a company's sustainability account is in the green or not, photovoltaic suppliers are also likely to benefit from climate change. Industrial companies will also fare better in the long term with renewable energy - companies like Nordex are already looking forward to it. This article explains where opportunities are waiting around climate change and whether there are still niches that have received little attention from the market.

ReadCommented by André Will-Laudien on November 17th, 2021 | 12:40 CET

Leoni, Sierra Grande Minerals, Varta, Nordex - Critical raw materials, skyrocketing prices!

According to the active suggestions of many climate protectionists, we are all best off riding bicycles. Because the climate measures, in particular the CO2 taxes, will soon make movement with fossil fuels impossible. In October, the E10 fuel price reached the EUR 2.00 mark at some filling stations. As a result, 80% of the gasoline price target formulated by the Greens in the 1990s of 5 D-Marks has been achieved. Calculated on the oil price, a liter of refined fuel would only cost about EUR 0.60; the rest is made up of duties and taxes, as is well known. Interestingly, in the Federal Audit Office records, it is precisely the political climate protection protagonists who stand out with an impressive number of car trips and air miles. It seems that only some people are supposed to restrict themselves, while other more privileged groups enjoy a free ride. Is this the future of individual mobility?

ReadCommented by Stefan Feulner on November 16th, 2021 | 12:58 CET

Nordex, Saturn Oil + Gas, TotalEnergies - Good numbers, bad numbers

While the third-quarter figures of many companies in the renewable energies sector were disappointing, oil companies were able to profit from rising oil and natural gas prices. Even though the recently concluded World Climate Conference resolved to move away from fossil fuels, experts believe that oil demand is likely to continue, if not increase, in the coming decade.

ReadCommented by Nico Popp on November 11th, 2021 | 11:36 CET

Nordex, Defense Metals, American Lithium: USA pushes lithium market - will rare earths follow?

The run on lithium has caused a furor on the stock market in recent weeks. Almost all companies with "lithium" in their names have made significant gains. The background to this is the governments' e-car offensive and a lot of government funding and subsidies for battery technology. The lithium required is held mainly in the ground by smaller companies. Investors who missed out on this wave may be wondering where the music will play next. To find out, one only has to spin the e-car story further: As Tesla, BYD or even VW's green runabouts are preferred to be charged with green electricity, rare earths could soon experience a similar hype. We present shares around the hype topics of e-mobility and the energy transition.

ReadCommented by Stefan Feulner on November 10th, 2021 | 11:07 CET

Nordex, Clean Logistics, Nikola - Hardly manageable changeover

Climate neutrality must be achieved as quickly as possible. The politicians share this view at the climate conference currently taking place in Glasgow. One critical point here is the reduction of CO2 emissions from the transport sector. Unlike in the energy sector or industry, for example, CO2 emissions in the transport sector have not fallen since 1990. Most of the debate focuses on emissions from passenger cars. However, according to the Federal Environment Agency, a good 35% of transport emissions are attributable to commercial vehicles. However, a rapid changeover, as the theorists are calling for, seems almost impossible.

ReadCommented by Fabian Lorenz on November 9th, 2021 | 13:17 CET

Nordex, Gazprom, Saturn Oil + Gas: Rising oil and gas price drive

Leading politicians and industry leaders are meeting in Glasgow until November 12 for the climate conference. So far, however, there has been nothing more than "hot air" to report. Not only climate activists are disappointed. Even German Development Minister Gerd Müller criticized the interim results. "The emerging resolutions are not enough to achieve the 1.5-degree target," the CSU politician told Redaktionsnetzwerk Deutschland. There is also little news on the expansion of renewable energies. It is therefore not surprising that the oil price is picking up again. With a rise to USD 83.78, the price for the Brent variety has ended the correction. There is also no relief in sight for the price of gas. The shares of Gazprom and Saturn Oil & Gas are benefiting from this. But Nordex is also attracting attention with new orders.

Read