NORDEX SE O.N.

Commented by Nico Popp on September 1st, 2021 | 10:39 CEST

Gazprom, Kodiak Copper, Nordex: This is how the energy transition pays off

Keeping the economy moving requires energy. This energy can come from a variety of sources. Fossil fuels, such as oil and gas, have come under fire for their CO2 emissions. However, what is clear is that these energy sources will remain important for a long time to come. As a climate-neutral alternative, electricity from renewable sources is gaining in importance. However, this requires investments in storage facilities and transmission lines. We present three stocks related to the energy sector.

ReadCommented by Carsten Mainitz on August 30th, 2021 | 11:33 CEST

Central African Gold, Nordex, Varta - Performers for the second half of the year!

Climate and energy transition are more than just buzzwords. They affect us all to an ever increasing extent. The production of green energy and the currently also politically favored spread of electric mobility place considerable demands on the availability of raw materials, the sufficient production of green energy and the existence of an area-wide infrastructure. As steering mechanisms, states offer extensive support measures. A market for emission certificates creates incentives as well. It is also important to keep an eye on the development of increasingly stringent ESG standards in the investment sector. Companies that do not do their homework will sooner or later lose out. These three companies have the potential to profit from the energy transition. Who will win the race?

ReadCommented by Stefan Feulner on August 18th, 2021 | 11:37 CEST

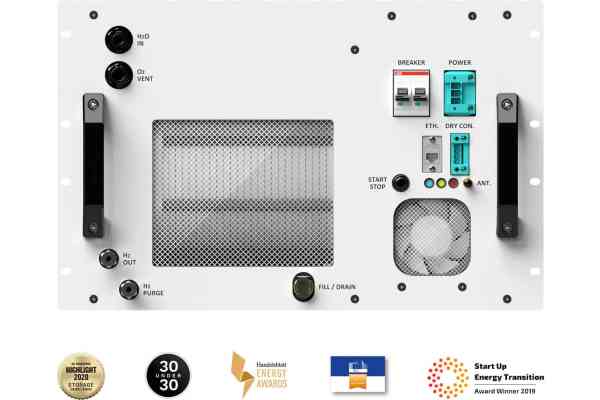

Nel ASA, Enapter, Nordex - Highly acclaimed and deeply fallen

The euphoria around renewable energy shares was huge last year. Companies from the hydrogen, wind energy or electromobility sectors were able to multiply and reached valuations that they would never justify in the next few years. This run was fueled by billion-dollar programs to promote the energy turnaround by politicians. A market shakeout has been underway for months. Which stocks are now promising and which have further correction potential?

ReadCommented by Fabian Lorenz on August 17th, 2021 | 11:32 CEST

Varta, Nordex, Saturn Oil & Gas - Buy or Sell?

It was a generally positive week on the stock market last week; however, things seem to be more unsettled this week. After the jump above the 16,000 point mark in the DAX, profit-taking is to be expected. On Monday, negative news from Asia weighed in on the mood: In China, the retail and industry's economic data were weaker than expected. In addition, the spread of the Delta variant of the Covid-19 virus is worrying market participants. On the corporate side, analysts are speaking out. Varta, for example, has failed to meet expectations, and the forecast hangs on Apple. In contrast, the shares of Nordex and Saturn Oil & Gas have been recommended as a buy. A 200% price potential beckons.

ReadCommented by André Will-Laudien on August 16th, 2021 | 12:41 CEST

Alcoa, FYI Resources, Varta, Nordex - Ready for takeoff in the high-tech sector?

The current climate trend makes a necessity obvious - our planet needs relief from CO2 and further investments in sustainable energy generation. Global warming is already well advanced, and we will likely no longer stop the dangerous basic trend. Therefore, the decisive factor for our future actions remains the "impact", i.e. the intensity and quantity of the production of pollutants. Many companies have already taken hold of the baton and are converting their processes, while others are trapped in old operating procedures and are acquiring pollution certificates. The industrial value chain starts with explorers and mining companies, followed by the basic materials industry. We look at some representatives of this supply chain.

ReadCommented by Carsten Mainitz on August 13th, 2021 | 10:34 CEST

Desert Gold, Barrick Gold, Nordex - These are the winners!

Even if inflation in the US has fallen slightly compared to the previous month, it is still at a high level of over 5%. This cannot be explained away. Despite all efforts of central bankers worldwide to regard the high inflation as only a temporary phenomenon, it is more advisable to adjust to the more realistic scenario of a persistently high inflation rate. To protect oneself as an investor against the loss of purchasing power, it helps to invest in tangible assets such as shares, real estate and commodities. With the following three companies, investors have good cards to be on the winning side.

ReadCommented by Stefan Feulner on August 10th, 2021 | 12:45 CEST

Nordex, Saturn Oil & Gas, BP - Pressure on the pipeline

Despite record figures from Saudi oil giant Saudi Aramco, with profits quadrupling in the last quarter, the oil price fell more than 4% due to resurgent concerns over the Corona pandemic. A correction is more than healthy after a price quadrupling and the brilliant recovery rally since the crash in the spring. Experts see black gold beyond the USD 100 mark in the long term, despite the energy transition and the switch from fossil fuels to renewables.

ReadCommented by Carsten Mainitz on August 4th, 2021 | 10:11 CEST

Defense Metals, BYD, Nordex - Buy the trend!

Whether a laptop, cell phone, electric motor or wind turbine - rare earths are an indispensable raw material for producing all these goods. The megatrends of electromobility and renewable energies, in particular, are fuelling demand. Motors for electric vehicles and generators for wind power plants require powerful permanent magnets, and this is where rare earths such as neodymium and dysprosium come into play. We show you how to profit from this trend.

ReadCommented by André Will-Laudien on August 3rd, 2021 | 13:41 CEST

Nordex, Silver Viper, Siemens Energy - Watch out for storm warnings!

Since the last flood disaster in Germany, the political pressure for more climate protection has been palpable. The final realization comes late, and at the same time, it is a bit sad what has to happen before lip service turns into new laws. But the pace is now clear: decarbonization and new climate targets will determine global economic activity, and those who pollute the atmosphere will have to accept high payments in the future. In other words, sustainable business is all the more worthwhile because the "cleaners" will be credited for what others pay more. In this way, incentives are created for sustainable business models. We take a closer look.

ReadCommented by Stefan Feulner on July 30th, 2021 | 13:28 CEST

Aixtron, Defense Metals, Nordex - Strong growth

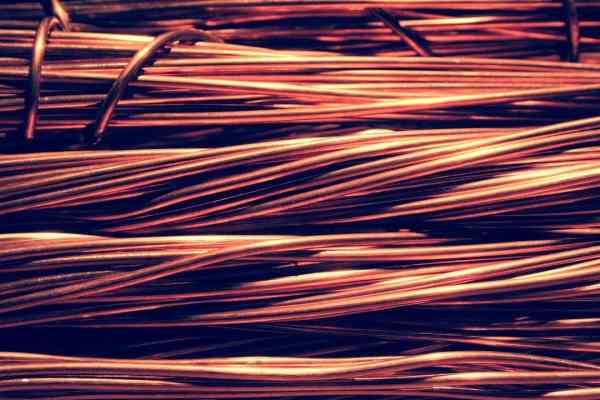

The global economic recovery and rising investment in more climate-friendly energy infrastructure are driving higher commodity prices amid supply chain disruptions. Shortages of industrial metals, which are urgently needed for climate change, are likely to materialize further in the coming years. The swelling trade conflict between the USA and China will exacerbate this significantly. There is a threat of massive bottlenecks in production and sharply rising prices for the respective materials.

Read