RHEINMETALL AG

Commented by André Will-Laudien on September 26th, 2025 | 07:25 CEST

Shooting down Russian drones and fighter jets? NATO keeps its focus on Rheinmetall, Almonty and Hensoldt!

On the financial markets, Russian provocations involving jet and drone overflights are primarily perceived as a security risk. Such actions increase political instability and often trigger a flight to safe havens such as gold, government bonds, or the US dollar. At the same time, defense stocks and companies in the security sector tend to benefit, as investors anticipate rising defense spending in Europe and within NATO. For the broader equity market, the increased risk often translates into higher volatility and temporary price setbacks. In the long term, such threat scenarios are factored into risk premiums and valuation models, leading to more selective capital allocation in security-related sectors. Here are a few ideas.

ReadCommented by Stefan Feulner on September 22nd, 2025 | 07:45 CEST

Almonty Industries, Rheinmetall, D-Wave Quantum – Alarm bells are ringing

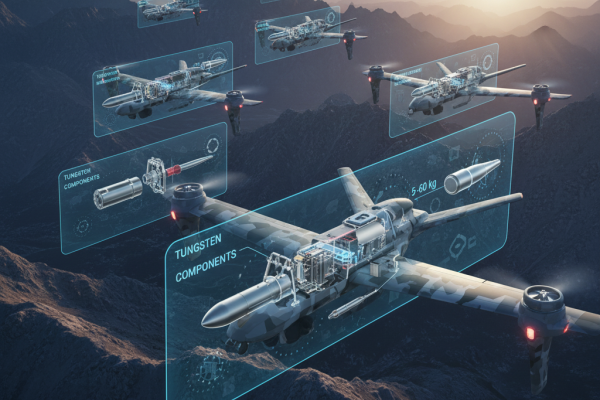

Tungsten is one of the most strategically critical raw materials in the global economy. With its extremely high melting point, exceptional density, and hardness, the metal is indispensable, especially in the defense industry and semiconductor technology. Tungsten is also essential in toolmaking, aviation, and medical technology. The problem: over 80% of global production comes from China, a massive dependency that is increasingly viewed critically in times of geopolitical uncertainty. With the global expansion of defense and high-tech, demand is rising rapidly, but secure Western supply chains are virtually non-existent.

ReadCommented by Armin Schulz on September 22nd, 2025 | 07:25 CEST

How to profit from the arms race: Rheinmetall on the ground and Volatus Aerospace and DroneShield in the air

The global security landscape is undergoing a historic shift. Driven by geopolitical tensions, modern warfare is moving into the digital realm, with drones emerging as a crucial key technology. This paradigm shift is creating a billion-dollar market for defense systems and offering investors exceptional growth opportunities. While defense giant Rheinmetall strengthens the backbone of national defense with conventional technologies, specialists like Volatus Aerospace and DroneShield are positioning themselves at the forefront of this technological revolution.

ReadCommented by Fabian Lorenz on September 18th, 2025 | 07:10 CEST

MAJOR DEVELOPMENTS for megatrend stocks: Rheinmetall, BioNTech, First Hydrogen

Rheinmetall is going full throttle: on land, at sea, in the air, and even in space. Its latest bombshell is the announced takeover of Lürssen's naval division. Will this provide the tailwind the stock needs to break through the EUR 2,000 mark on a sustained basis? Analysts view the transaction positively, though some cautionary voices remain. Meanwhile, a major development in Canada is boosting sentiment around First Hydrogen. North Americans aim to be at the forefront of the small modular reactors (SMRs) movement. The potential is enormous. BioNTech also holds significant promise in the fight against cancer. However, challenges have emerged - ironically in the world's largest pharma market. The US government plans to cut or even stop funding for new mRNA vaccine development. BioNTech shares reacted accordingly and may break through their sideways trend downwards.

ReadCommented by Armin Schulz on September 17th, 2025 | 07:10 CEST

Rheinmetall, Almonty Industries, RENK: The next wave of the defense stock mega boom is rolling in

Geopolitical tensions and a paradigm shift toward increased national security are fueling a sustained boom in the defense industry. Rising budgets worldwide are ensuring full order books and unprecedented growth prospects for specialized companies. This development is making defense stocks one of the most dynamic, albeit controversial, investment themes. Three listed companies that are perfectly positioned to capitalize on this environment are Rheinmetall, Almonty Industries, and the RENK Group.

ReadCommented by Carsten Mainitz on September 17th, 2025 | 07:05 CEST

Pure Hydrogen, Rheinmetall, RENK – Tailwind from the Fed and positive news

This week, decisions from several central banks are on the agenda. The US Federal Reserve is considered the most important signal setter. Investors firmly expect the Fed to cut interest rates by 25 basis points. In addition, stock market participants are eagerly awaiting signals from Fed Chair Jerome Powell regarding the further pace of monetary easing. Stocks from the commodities and defense sectors remain at the top of the list of favorites.

ReadCommented by Nico Popp on September 16th, 2025 | 07:15 CEST

Defense industry expands – New growth drivers: Hensoldt, Almonty and Rheinmetall

An industry once largely overlooked by the public is now dominating the headlines. On Monday, it was announced that Rheinmetall will acquire the Marine Division of the Bremen-based Lürssen Group. This includes the Blohm + Voss shipyards, the Norderwerft shipyard in Hamburg, the Peene shipyard, and the Neue Jadewerft shipyard in Wilhelmshaven. This move underscores how the defense industry is venturing into new domains. Meanwhile, tensions between Russia and NATO continue to escalate. The drones that flew over Poland last week are considered by experts to be a serious provocation. In this context, we take a closer look at three high-flyers in the defense industry and highlight where investors may find the greatest opportunities.

ReadCommented by Fabian Lorenz on September 15th, 2025 | 07:05 CEST

NATO without drone defense! Opportunity for Rheinmetall, DroneShield and Volatus Aerospace!

Is a new rally starting for drone stocks? The shooting down and crash of Russian drones in Poland has painfully highlighted NATO's vulnerability in this area. Recent years have shown how unmanned aerial vehicles are revolutionizing warfare. However, NATO appears to have a lot of catching up to do in terms of its drone inventory, detection and defense. Volatus Aerospace—which trains pilots and monitors borders, among other things—and drone defense specialist DroneShield should benefit from this. Both stocks had multiplied in value at the beginning of the summer. After the setback, prices could now rise again. Rheinmetall is also becoming increasingly involved in this area. What does Germany's largest defense contractor have to offer?

ReadCommented by André Will-Laudien on September 11th, 2025 | 07:00 CEST

In peace and war – Defense stocks poised for the next leap: Volatus Aerospace, thyssenkrupp, DroneShield and Rheinmetall

Europe's defense industry is facing an unprecedented wave of investment. The combination of long-term secure financing, political resolve, and technological modernization is creating an attractive environment for providers of defense systems, sensor, and AI solutions. Analysts expect average growth rates of 5 to 10%, which will see the market expand from around EUR 125 billion to approximately EUR 170 billion by 2030. The key drivers are the EU's massive investment offensives, which aim to mobilize up to EUR 800 billion through the new SAFE financial instrument. This is a historic turning point for rearmament - especially after 25 years of disarmament. The package includes EUR 150 billion in loans for the joint procurement of high-tech systems such as drones, air defense, and artillery. Which stocks stand to benefit from this scenario?

ReadCommented by Armin Schulz on September 10th, 2025 | 07:15 CEST

Critical raw material supply: Rheinmetall's risk, Almonty Industries' opportunity, and Xiaomi's trump card

One strategic metal dominates the plans of military and tech companies: tungsten. Indispensable for high technology, from precision ammunition to powerful electric car motors, its supply is becoming a geopolitical issue. Western nations are fighting for supply independence, catapulting a previously overlooked mining operator into a unique position. This development reveals drastic dependencies and creates clear winners. Three companies exemplify this new reality: Rheinmetall, Almonty Industries, and Xiaomi.

Read