September 11th, 2025 | 07:00 CEST

In peace and war – Defense stocks poised for the next leap: Volatus Aerospace, thyssenkrupp, DroneShield and Rheinmetall

Europe's defense industry is facing an unprecedented wave of investment. The combination of long-term secure financing, political resolve, and technological modernization is creating an attractive environment for providers of defense systems, sensor, and AI solutions. Analysts expect average growth rates of 5 to 10%, which will see the market expand from around EUR 125 billion to approximately EUR 170 billion by 2030. The key drivers are the EU's massive investment offensives, which aim to mobilize up to EUR 800 billion through the new SAFE financial instrument. This is a historic turning point for rearmament - especially after 25 years of disarmament. The package includes EUR 150 billion in loans for the joint procurement of high-tech systems such as drones, air defense, and artillery. Which stocks stand to benefit from this scenario?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VOLATUS AEROSPACE INC | CA92865M1023 , THYSSENKRUPP AG O.N. | DE0007500001 , DRONESHIELD LTD | AU000000DRO2 , RHEINMETALL AG | DE0007030009

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Volatus Aerospace - Innovative drone technology for defense, the environment and industry

From 2035, NATO countries will commit to investing 5% of their GDP annually in defense and security-related infrastructure, which means additional spending of over EUR 320 billion per year across Europe. These funds will be invested in state-of-the-art technologies, with priorities on air defense, ammunition, drones, cyber defense, and AI, but securing critical logistics and infrastructure is also gaining in importance. Volatus Aerospace is a Canadian specialist in state-of-the-art, digitized aerial surveillance. With advanced sensor technology and AI-supported image analysis, the Company serves a wide range of industries from energy to logistics and achieves impressive ranges and data volumes through the use of drones, aircraft and helicopters. Over 1.7 million kilometers of pipeline inspection and 16,000 transport flights demonstrate the scalability and practicality of the solutions. The defense segment is growing rapidly, and Volatus recently received a multi-million dollar order for tactical drone systems from a NATO partner country, underscoring its commitment to security.

In addition to military applications, Volatus also focuses on environmental and climate solutions. In cooperation with environmental innovator Ki Reforestation, the Company operates the heavy-duty Condor XL drone system for large-scale, automated reforestation of Canadian forest areas destroyed by wildfires. This project is groundbreaking for the rapid, precise, and cost-effective restoration of destroyed ecosystems and is scheduled to go into series production in 2026.

"The partnership with Ki Reforestation fits perfectly with our mission to leverage aerospace innovation to address global sustainability challenges. The Condor XL has the payload, range, and precision necessary to scale reforestation efforts and restore ecosystems more efficiently than any other method currently available," said Glen Lynch, CEO of Volatus Aerospace.

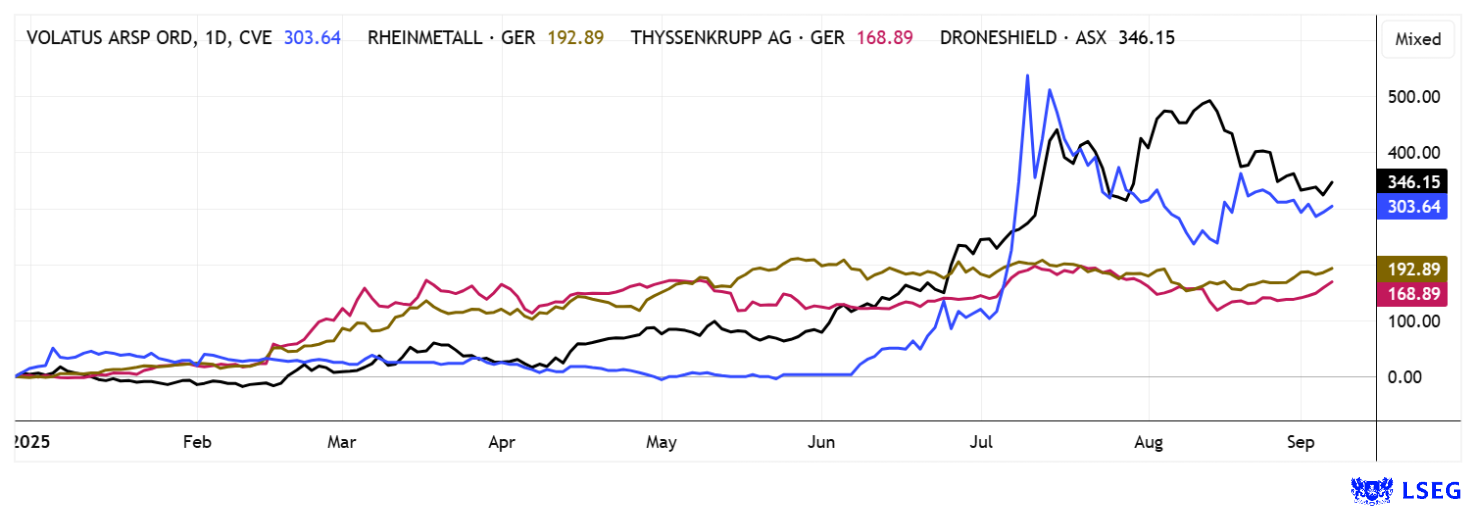

Volatus has made another leap forward in terms of regulatory approval. Transport Canada, the aviation authority, has granted significant approval for autonomous drone flights beyond visual line of sight, made possible by high-tech radar systems and air traffic management. This approval lays the foundation for the expansion of automated drone services, known as drone-in-a-box networks. They are used for infrastructure monitoring, early detection of forest fires, and industrial inspections. The combination of technology partnerships with Kongsberg Geospatial and MatrixSpace makes Volatus the leading provider of safe, scalable drone services in North America and lays the foundation for international expansion. The share price has corrected from CAD 0.96 to around CAD 0.50 and, following the latest capital increase at CAD 0.52, offers a new entry point for investors who have not yet been able to jump on the bandwagon.

DroneShield – Drone defense is growing internationally

DroneShield, an Australian specialist in drone defense technologies, also remains on an international growth path and is setting new standards in revenue and product innovation. Fueled by massive defense investments, geopolitical tensions, and strong expansion in Europe, DroneShield aims to increase its current manufacturing capacity fivefold and scale its order volume to up to AUD 2.4 billion by 2026. To this end, a state-of-the-art 3,000-square-meter factory is currently being built in Sydney. The Company scores with its AI-supported solution portfolio for mobile, stationary, and fully autonomous applications. It has already been mandated in the multinational NATO defense project "Project FlyTrap" and equips armies and civilian infrastructures worldwide. With currently over 300 projects, DroneShield has recently significantly increased its pace. Projections for the second half of the year already stand at AUD 176 million in secured orders. The stock, recently added to the S&P/ASX 200, has gained over 300% since the beginning of the year and, after a period of consolidation, showed another upward surge in mid-September. The correction appears to be over, and investors should take the high valuation into account and hedge their position with trailing stops.

thyssenkrupp – TKMS restructures the parent company's balance sheet

thyssenkrupp shares have gained over 240% in the last 12 months. The reason: the stock market is speculating on a blockbuster IPO of its naval subsidiary TKMS. But is the euphoria justified? The IPO is planned for October 2025 on the Frankfurt Stock Exchange. thyssenkrupp will continue to hold 51% of the shares via a holding company, while the remaining 49% will be transferred proportionally to existing thyssenkrupp shareholders. Becoming independent will give TKMS greater entrepreneurial freedom to respond more quickly to tenders, promote innovation, and expand investments at its Kiel and Wismar locations. The shipyard in Kiel, which holds a historic order backlog of around EUR 18 billion, plans to create up to 500 new jobs. Meanwhile, the Wismar shipyard, acquired at the end of 2022, is also expected to grow and already has orders from Norway, Israel, and Singapore.

The German government is supporting the project with a security agreement that includes, among other things, a right of first refusal on major share sales and a seat on the supervisory board for the federal government in order to help shape security-related decisions. The IG Metall trade union criticizes the IPO and instead calls for a high level of state participation to ensure job security. Overall, despite unresolved questions about state control, the spin-off of the profitable TKMS creates the basis for a focused growth strategy that gives the struggling parent company, thyssenkrupp, the necessary leeway for restructuring.

Rheinmetall – A veritable flood of orders

Things are also looking up for Rheinmetall. Numerous large orders have already been booked in the current year, which will keep the Company busy well beyond 2030. The order backlog reached a record level of around EUR 63 billion in the middle of the year, up 156% on the previous year. Air defense systems such as the Skyranger are in particularly high demand – Germany alone needs between 200 and 300 units, while a total of more than 1,000 systems are to be built by 2035. In the ammunition sector, Rheinmetall has received orders worth millions from Sweden and a European NATO country, among others, through 2027. Production will be massively expanded with the new plant in Lower Saxony. In addition, new locations in Europe, the US, and South Africa will be expanded to meet the growing international demand for tanks, ammunition, and AI-based defense and communication systems. Analysts on the LSEG platform remain optimistic. Earnings per share are expected to rise to around EUR 29.7 in 2025. The share price has already risen by over 190% since the beginning of the year. After a brief consolidation to EUR 1,650, it is now continuing its upward trend above EUR 1,800, with the annual high reaching EUR 1,945. Fantastic!

With the incidents in Poland, no one is thinking about détente at the moment. This is grist to the mill for defense investors. It is difficult to imagine that there will be any major declines here. On the contrary: as border security and reconnaissance take on an increasingly dominant role, companies like Volatus Aerospace and DroneShield are coming into closer focus.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.