RHEINMETALL AG

Commented by Armin Schulz on August 15th, 2025 | 07:00 CEST

War and raw material shortages = Your profit: How Rheinmetall, Almonty Industries, and RENK are now cashing in

The global security architecture is collapsing, and with it, the rules of the game in the defense industry are changing. While superpowers like the US are pumping billions into strategic raw materials to break critical import dependencies, resource security is becoming the new currency of military strength. Tungsten, rare earths, and high-performance metals are now decisive factors in technological sovereignty. Those who take advantage of this shift stand to benefit from unprecedented government initiatives. Three companies are positioning themselves decisively in this area: Rheinmetall, Almonty Industries, and RENK.

ReadCommented by André Will-Laudien on August 12th, 2025 | 07:25 CEST

Crash in the defense sector? Geopolitical conflicts drive up metal prices! Rheinmetall, Sranan Gold, Hensoldt, and RENK

Strategic metals are a decisive factor in the economic strength and military power of entire nations. International hotspots like the Middle East, Ukraine and, most recently, Africa are exacerbating shortages, as long-established trade routes can collapse abruptly. The high concentration of production in a few countries increases the vulnerability of supply chains to political intervention. Export bans, sanctions or targeted supply restrictions by China or Russia can quickly lead to critical supply shortages. In this environment, precious metals like gold, which is currently trading at historic price levels, are becoming even more important for investors, not least against the backdrop of record-high government debt worldwide. Those who act flexibly can benefit from this commodity dynamic. The long-running favorites of recent months in the defense sector now appear to be consolidating. Where to put the money?

ReadCommented by Fabian Lorenz on August 11th, 2025 | 07:00 CEST

Rheinmetall & Hensoldt disappoint! The real WINNERS of the DEFENSE BOOM: Alzchem and Almonty!

Rheinmetall and Hensoldt have disappointed stock market investors with their quarterly figures. Growth, profitability, and, in particular, order intake are lagging behind high expectations. Are the second-tier companies perhaps the real winners of the defense boom? Namely, the suppliers that can deliver to virtually every defense contractor. Take Almonty, for example. The tungsten specialist is inundated with inquiries and is set to begin operations at the largest Western mine later this year. Defense contractors can only dream of such profit margins. Analysts see more than 50% upside potential. Alzchem is also doing good business with numerous defense companies. Among other things, the German company supplies specialty chemicals for explosives. A new major shareholder is causing a stir. However, not all analysts see room for further price gains.

ReadCommented by Armin Schulz on August 7th, 2025 | 07:00 CEST

Tungsten crisis hits defense boom: Why Almonty Industries, Rheinmetall, and RENK Group stand to benefit

Geopolitical upheavals are shaking global supply chains. As the trade dispute between the US and China reaches new heights, dependence on strategic raw materials is becoming an existential threat. Tungsten, which is indispensable for defense equipment and high-tech, is in extremely short supply due to Chinese export restrictions. At the same time, global conflicts are fueling a defense boom that is causing demand and prices to skyrocket. Investors are now turning to companies that offer security of supply or technologies that are crucial in warfare. Three players are coming to the fore in this tense environment: Almonty Industries, Rheinmetall, and the RENK Group.

ReadCommented by Fabian Lorenz on August 6th, 2025 | 07:10 CEST

A bombshell and blatant undervaluation: RENK, Rheinmetall, and Veganz Group

A bombshell at the Veganz Group: In a recent podcast, founder Jan Bredack estimated the value of its subsidiary Mililk at over EUR 80 million, citing "extreme" demand. And new CEO Rayan Tegtmeier also plans to step on the gas and address the "blatant undervaluation" of the foodtech stock. A purchase of Veganz shares appears increasingly compelling. Meanwhile, a bombshell is also looming at Rheinmetall. Analysts are speculating about an upward revision of the Company's forecast. They recommend buying the stock and expect it to soon breakout above the EUR 2,000 mark. Analysts are also optimistic about RENK and are raising their price targets. Incidentally, both defense companies will soon be publishing their quarterly figures.

ReadCommented by André Will-Laudien on August 5th, 2025 | 07:10 CEST

Palantir, Rheinmetall, RENK, and Dryden Gold: Winners in the crossfire of trade war and NATO agenda

Tariffs, defense, and infrastructure! No wonder there is a considerable gap of around EUR 172 billion in the German federal budget between 2027 and 2029. Although the federal government is attempting to counter this with spending cuts, tax increases will ultimately be necessary, as migration and climate costs are also taking their toll. Those in government who now have to juggle everything at once are in for a rough ride! Government revenues are expected to continue to decline due to the sluggish economy and high inflation, meaning the government will face higher refinancing costs due to rising interest rates. For investors, this means that the price of gold is likely to increase further, making selective investments in precious metals a sensible move. We will briefly analyze whether there is still room for growth in the well-performing defense and military stocks.

ReadCommented by Fabian Lorenz on July 31st, 2025 | 07:05 CEST

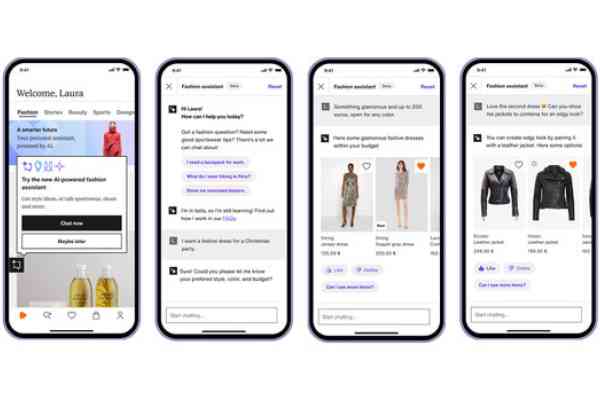

270% surprise! Rheinmetall, Zalando, Walmart partner MiMedia – Time to buy shares?

With a strong performance of 270%, MiMedia shares are one of this year's surprises. And the chances are good that the stock will continue to perform well in the future. With strong partners such as Walmart behind it, the cloud specialist aims to grow significantly in the coming years. Rheinmetall needs to grow massively to justify its ambitious valuation. However, the supercycle in the defense industry promises golden years ahead. The group also wants to carve out a large slice of the billion-dollar pie in other European countries. After a strong start to the year, Zalando shares have slipped considerably. The takeover of competitor AboutYou has now been completed, and analysts see upside potential.

ReadCommented by Nico Popp on July 29th, 2025 | 07:30 CEST

Drone hype: Who is getting the best deal? Volatus Aerospace, Renault, Rheinmetall

The days of tanks and howitzers are over. The war in Ukraine shows that drones are changing the face of combat—they provide reconnaissance, carry out precision strikes, and score points with low acquisition costs and high effectiveness. It is no wonder that major arms manufacturers and industrial companies want to jump on the drone bandwagon. Renault has even been asked by the French government to enter the business. But the barriers to entry in this market are high. We explain who is likely to profit from the drone business in the future and why size and capital are no guarantee of long-term success.

ReadCommented by Armin Schulz on July 28th, 2025 | 07:00 CEST

War, raw material shortages, cancer: Capitalize on megatrends with Rheinmetall, Antimony Resources, Merck KGaA

Three megatrends are expected to drive global markets in 2025. Revolutionary technologies, such as AI and cybersecurity, are fundamentally changing the defence sector. At the same time, demand for critical raw materials for defense, high-tech applications, and the energy transition is exploding, requiring new, sustainable supply chains. In parallel, the pharmaceutical industry is undergoing a dramatic shift due to advances in AI-driven research and intensified competition. These forces are shaping the future opportunities for companies. Those who are strategically positioned here will win, as key players Rheinmetall, Antimony Resources, and Merck KGaA demonstrate.

ReadCommented by André Will-Laudien on July 23rd, 2025 | 07:25 CEST

After a 500% increase - is the next rocket stage about to launch? Rheinmetall, Almonty, Hensoldt, and Steyr in focus!

Some investors are reluctant to add stocks that have already performed strongly to their portfolios. In general, this is not good advice, as a sharp rise often has fundamental reasons. For example, the Düsseldorf-based defense company Rheinmetall is expected to increase its business volume roughly fivefold in the coming years. However, its share price has already skyrocketed by a factor of 20 since the start of 2022. The second-tier defense stocks have not been able to make the same leap, but some have managed gains of up to 500%. What happens next? Technical analysts often say: "The trend is your friend." This suggests that after a correction, the sun will soon shine again. In the strategic metals sector, Almonty Industries has recently made strong progress, and the rally could continue significantly regardless of defense investments. We have done the math for you.

Read