August 12th, 2025 | 07:25 CEST

Crash in the defense sector? Geopolitical conflicts drive up metal prices! Rheinmetall, Sranan Gold, Hensoldt, and RENK

Strategic metals are a decisive factor in the economic strength and military power of entire nations. International hotspots like the Middle East, Ukraine and, most recently, Africa are exacerbating shortages, as long-established trade routes can collapse abruptly. The high concentration of production in a few countries increases the vulnerability of supply chains to political intervention. Export bans, sanctions or targeted supply restrictions by China or Russia can quickly lead to critical supply shortages. In this environment, precious metals like gold, which is currently trading at historic price levels, are becoming even more important for investors, not least against the backdrop of record-high government debt worldwide. Those who act flexibly can benefit from this commodity dynamic. The long-running favorites of recent months in the defense sector now appear to be consolidating. Where to put the money?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , SRANAN GOLD CORP | CA85238C1086 , HENSOLDT AG INH O.N. | DE000HAG0005 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall – Moderate figures kick off downward trend

Rheinmetall shares have fallen significantly since their high of EUR 1,940 and were last trading at around EUR 400 below that level, which has prompted CEO Armin Papperger to make some notable share purchases, either out of conviction or to send a signal to the market. In any case, the second-quarter results are acceptable, showing revenue growth of 9% to EUR 2.4 billion, driven by the defense segment. While EBIT rose by 2% to EUR 276 million, margins and cash flow are currently suffering from start-up costs for new programs and increased investments.

Of course, the Group and management confirm all growth targets and point to the broad, long-term order backlog, which at EUR 63 billion is about six times revenue. Analysts on the LSEG platform continue to rate the stock positively, with average price targets of around EUR 2,065. Morgan Stanley even sees long-term potential of up to EUR 3,000 if European defense spending continues to rise. The medium-term outlook also remains well secured thanks to solid political support, flexible financing structures, and a multi-year ramp-up.

The revenue targets of EUR 40 to 50 billion for 2030 are likely to be secured by new NATO orders. Strategically, Rheinmetall is advancing into promising areas with M&A activities, the sale of civilian divisions, and partnerships with Lockheed, Boeing, and Anduril. There are short-term risks due to delayed order placements and political uncertainties, but structurally, Rheinmetall is clearly positioned as a leading supplier with broad vertical integration and high visibility in the European defense market. Although many investors see their expectations confirmed, the momentum looks rather subdued in the short term. Therefore, buy in at a lower price – how low is difficult to predict. It also depends on how much the specific selling pressure in the boiler increases.

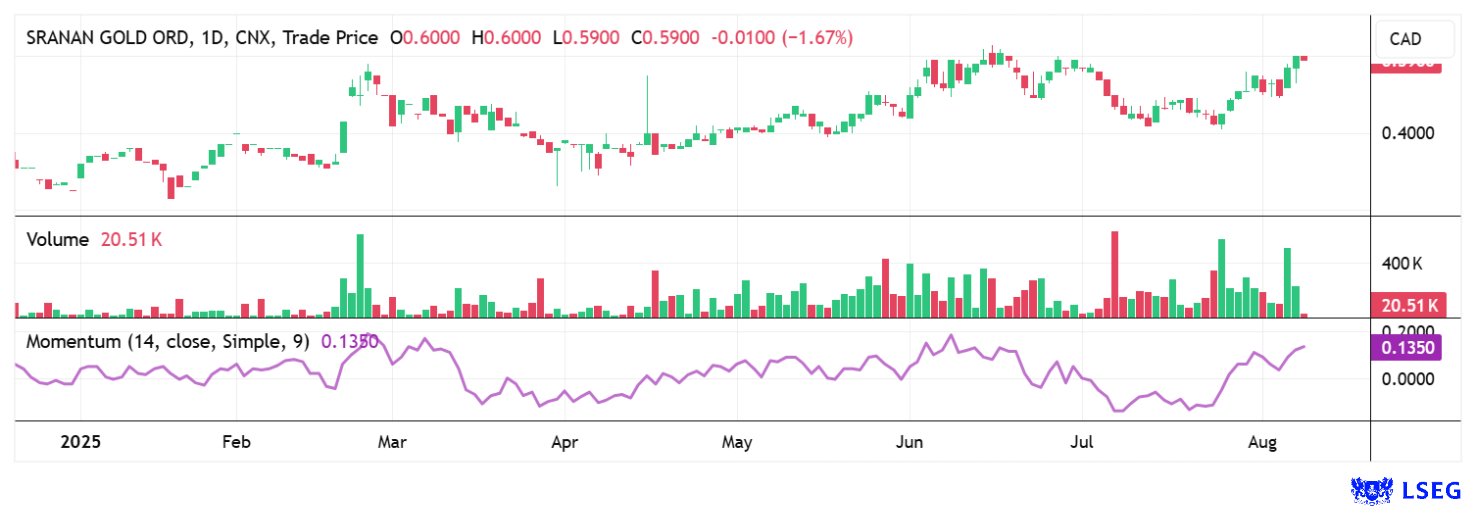

Sranan Gold – In Suriname, the world is still in order

An investment opportunity in gold is currently opening up in Suriname, South America. Canadian explorer Sranan Gold is working intensively in this resource-rich country, whose economy is heavily dependent on gold mining. Around 75% of export revenues come from this sector. In addition to the large Rosebel and Merian mines, thousands of small-scale miners extract gold, often under unregulated conditions. The new player, Sranan Gold, owns the 29,000-hectare Tapanahony project, one of the most promising exploration areas in the country. And this in an environment where predecessor companies have already identified the potential for over 15 million ounces of gold. CEO Oscar Louzada, who has been active in the country for over twelve years, wants to build on successes such as the Antino project in the Guiana Shield with Tapanhony.

Recent exploration results are attracting attention. In the Randy's Pit area, newly opened shafts were sampled by local miners, with hand samples returning peak values of 76.6 g/t and 23.7 g/t gold. The samples, obtained from depths of up to 30 m, were taken from quartz-rich, sericite- and limonite-rich structures, which are classic host rocks for gold in the Guiana Shield. Dr. Dennis LaPoint, EVP Exploration, explains: "These shafts and samples are extremely promising for the potential of the Randy trend and help us understand the orientation of the mineralized structures and accurately plan the first drill program."

In parallel, Sranan has commenced a trenching program to test the continuity of mineralization. The first trench, 150 meters south of Randy's Pit, returned an outstanding hit: three channel intersections totaling 5 meters averaging 36.7 g/t gold. This interval significantly extends the mineralized trend to the south, a zone that was apparently missed by historical drilling. The geology, a contact zone between sheared sediments and granite, is considered an excellent indicator of gold, similar to the neighboring Antino project. LaPoint emphasizes: "This first trench confirms the potential to extend the Randy trend – we are investigating a complex, multi-phase mineralization system with structural stress zones that favor high grades."

Overall, these results mark a dynamic start to the exploration phase at Tapanahony and lay the foundation for upcoming drilling. The stock is jubilant, with yesterday's rise above CAD 0.62 seemingly ending the brief consolidation phase. Speculative investors continue to buy in!

Hensoldt and RENK – The sector is in a sell-off

As we predicted, RENK and Hensoldt in particular have undergone consolidation in recent days. After impressive gains in recent months, the lofty valuations are coming back down again, but they have not yet reached a healthy level. Hensoldt has now fallen from its peak of EUR 108.80 in June to below EUR 79, while RENK's share price ranged from around EUR 86 to EUR 56.50 yesterday. Geopolitical signals have recently contributed to market volatility, as a possible de-escalation in the Middle East or a possible Ukrainian ceasefire are putting defense stocks under pressure in the short term. Things could still get exciting!

Nevertheless, the fundamental outlook remains solid. Hensoldt reported an 11% increase in revenue to EUR 944 million in H1 2025 and confirmed its revenue forecast of EUR 2.5 to 2.6 billion for the full year. At RENK, the defense segment is expected to grow gradually, with margins of over 21% on the cards. JP Morgan's upgrades show great confidence in both companies: the price target for RENK was raised to EUR 87.5 and for Hensoldt to a strong EUR 110. However, the current decline in the share prices of RENK and Hensoldt also shows that investors will eventually take profits and react to political risk signals. In addition, price-to-sales ratios of 4 are too high for Germany in a long-term comparison! There is therefore still room for correction.

The capital markets have many different influences to assess. A combination of defense stocks and gold in the portfolio offers a good opportunity in uncertain times. This is because both asset classes react differently to economic and political events, which reduces the overall risk. Currently, gold stocks like Sranan Gold are favored, while defense stocks are consolidating.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.