RHEINMETALL AG

Commented by Carsten Mainitz on October 16th, 2025 | 07:25 CEST

Europe is building a drone wall – Manufacturers like Volatus Aerospace set to benefit enormously!

The world is arming up. NATO has decided to invest 5% of its GDP annually in defense and security-related infrastructure from 2035 onwards! This means that more than EUR 300 billion per year will be spent. Large sums will flow into air defense, cyber defense, AI, and drone defense. The increasing number of airspace violations, presumably by Russian drones, is demanding action not only from the affected Eastern European countries but also from the entire NATO alliance. Which companies are on the winning side?

ReadCommented by Nico Popp on October 16th, 2025 | 07:10 CEST

Tungsten – Where the critical element is irreplaceable: Almonty, LAM Research, Rheinmetall

In recent days, the share price of tungsten producer Almonty Industries has known only one direction: upward. But why is there suddenly such hype surrounding a raw material that, only a few years ago, was known only to experts? The answer is clear: for decades, China lulled Western buyers into a false sense of security and drove foreign mine operators into bankruptcy through dumping prices. Today, Almonty remains the only major tungsten producer in the West, while numerous industries urgently depend on this critical element. We take a closer look at the demand structure of this unique high-tech and defense metal.

ReadCommented by André Will-Laudien on October 15th, 2025 | 07:05 CEST

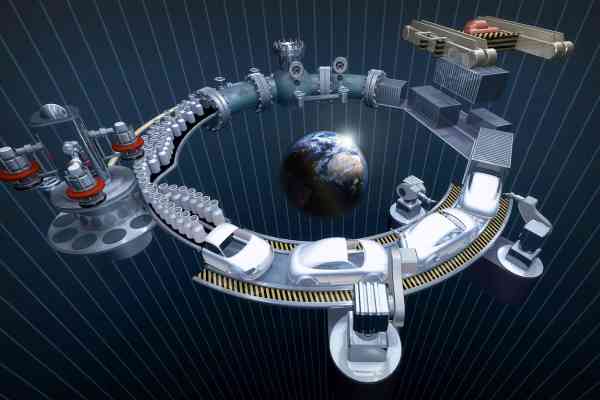

Supply chains on the NASDAQ! Critical metals sold out? What is next for Almonty - Caution advised with Rheinmetall, Deutz, and RENK

Snip-Snap! In and out of the markets! At the moment, all stock market wisdom applies, because there is nothing more unpredictable for investors than the current US president. And who would have thought that the critical metal supply chains would suddenly become a major driving force behind the NASDAQ rally? Just as Xi Jinping threw rare metals into the ring as a bargaining chip, Donald Trump blew a fuse. Punitive tariffs of up to 100% were suddenly on the table, and the markets went into a tailspin. Yet just one trading day later, everything is put into perspective, and the markets have to find their new valuation point – no easy task. Yesterday, nervousness returned, as reflected in a sharp rise in the volatility index. What should investors be keeping a close eye on now?

ReadCommented by Carsten Mainitz on October 14th, 2025 | 07:15 CEST

Momentum plays with a new wave: Almonty Industries and Rheinmetall – what is Gerresheimer doing?

The trade dispute between the US and China appears to be entering the next round. Late last week, US President Trump announced his intention to impose additional punitive tariffs of 100% on Chinese goods. The measures are expected to take effect by November at the latest. This follows China's decision to tighten export controls on certain technologies and raw materials. China holds many critical raw materials and is gradually restricting their export. While consumers face major challenges in view of the shortage of demand and rising prices, producers of these raw materials are among the stock market favorites.

ReadCommented by Nico Popp on October 13th, 2025 | 07:25 CEST

Drone stocks: Opportunities with Volatus Aerospace, DroneShield, and Rheinmetall

When drones appeared over several European airports in September and brought flight operations to a standstill, it came as a shock. The incidents revealed that Germany and many other Western countries are largely powerless against drones, as there are no defense mechanisms in place. Instead, representatives of the German Armed Forces and police are arguing over who is responsible for countering such threats – in Germany, there are even regulations governing who may defend against enemy threats and where. Meanwhile, the war in Ukraine continues – and with it, the drone war is evolving. It has long been clear that drones are essential as a deterrent and have become a core element of every modern army. We explain why Volatus Aerospace is well-positioned to benefit from the ongoing drone hype.

ReadCommented by Armin Schulz on October 9th, 2025 | 07:00 CEST

Almonty Industries' Raw material power brings Rheinmetall and Lockheed Martin into a new geopolitical era

Nations around the world are investing record sums in their defense capabilities. This defense boom is driving demand for critical raw materials to unprecedented heights. Suddenly, critical metals such as tungsten are at the center of global politics. They have become strategic commodities, with security of supply directly influencing military strength. This development is creating real momentum for companies covering the entire value chain, from mining to the defense industry to high-tech. Three stocks that perfectly embody this interplay between raw materials, production, and technology are Almonty Industries, Rheinmetall, and Lockheed Martin.

ReadCommented by André Will-Laudien on October 8th, 2025 | 06:55 CEST

Drone warfare and armament – Caution with Rheinmetall, Hensoldt, and thyssenkrupp, but 150% upside with Antimony Resources

Recent geopolitical events impressively highlight the critical need for strategic metals. While tungsten producer Almonty has surged by over 1,000%, risk-aware investors are now turning their attention to Antimony Resources. With properties that are indispensable for ammunition, electronics, and protection systems, antimony is emerging as a key strategic metal for modern defense and high-tech industries. The heavy reliance of Western nations on a few producing countries, such as China, is increasingly bringing security of supply into the focus of geopolitical debates. Without a stable supply chain, there is a risk of bottlenecks that threaten not only defense capabilities but also technological sovereignty. Investors and industry players are therefore increasingly seeking alternative sources and recycling solutions to meet rising demand in a sustainable manner. Meanwhile, defense stocks are currently consolidating at a high level. Is the rally now entering its final phase?

ReadCommented by André Will-Laudien on October 6th, 2025 | 07:00 CEST

Drone warfare with NATO Europe? DAX soon to reach 25,000 with defense stocks: DroneShield, Volatus Aerospace, thyssenkrupp, and Rheinmetall

Drone warfare in Europe is providing a massive boost to the defense sector, as demand for modern defense and attack systems is rapidly increasing. Companies such as Rheinmetall continue to benefit from public contracts for drone defense systems, including the Skyranger and new laser weapons. DroneShield is positioning itself as a leading provider of drone defense technologies and is currently experiencing an impressive growth phase. Volatus Aerospace is also involved as a service provider offering specialized solutions for drone surveillance and security services. Driven by EU-wide NATO investments in state-of-the-art defense technologies, analysts anticipate cyclical double-digit growth for the entire defense sector well beyond 2030. This historic wave of rearmament is transforming trillions in public debt into dream profits for shareholders, with our grandchildren and great-grandchildren footing the bill. Who are the current winners?

ReadCommented by Carsten Mainitz on September 30th, 2025 | 07:40 CEST

Antimony Resources, Rheinmetall, Novo Nordisk – Something is in the air!

Sufficient access to raw materials is crucial for any economy. The EU has compiled a list of 34 critical raw materials. How critical a raw material is classified depends on two parameters: "economic importance" and "supply risk." This list also includes a little-known but very important metalloid – antimony. The price of antimony skyrocketed at the end of 2024 in the wake of China's export ban. There are still exciting investment opportunities in this area.

ReadCommented by Armin Schulz on September 30th, 2025 | 07:00 CEST

What is happening at Gerresheimer? Almonty Industries and Rheinmetall are booming again!

In uncertain times, the focus shifts to companies that form the backbone of our critical infrastructure. Their ability to build resilient and transparent supply chains for essential goods determines our collective resilience to geopolitical and economic upheavals. Where the highest quality and safety standards prevail in areas such as pharmaceuticals, high tech, and defense, sustainable and ethical conduct becomes a decisive competitive advantage, while strict traceability along the value chain becomes the new benchmark. This development makes values such as those of Gerresheimer, Almonty Industries, and Rheinmetall particularly interesting.

Read